Hot prices, cold earnings

by Macro Man

"We may well at present be seeing the first stirrings of an increase in the inflation rate- something that we would like to happen."

So spake Stanley Fischer yesterday. It wasn't exactly an admission that he has his finger on the trigger, but as Fed commentary goes it beat the hell out of moaning about forward breakevens. Small wonder that the Fischer has noticed a potential percolation in inflation- not only have core measures ticked up recently, but as discussed even commodities are finally showing signs of life. To be sure, crude oil is still down on the year (though only modestly so), but iron ore has continued its ascent and has now nearly doubled in price over the last couple of months.

In trying to explain this price action it's hard not to point the finger at some combination of short covering and speculative silliness out of China. In some ways, recently it seems that the worse your fundamentals are, the better your price performance has been. That is a classic, if not the classic, symptom of short covering, which is naturally the reason for scepticism in some quarters, especially as prices ascend into the relative stratosphere.

Of course, it would be dangerous to forget that in some instances price precedes fundamentals; it was seven years ago that the SPX put in its bottom and started to rally, before Fed Treasury purchases or even Bernanke's (in)famous green shoots. Then again, sometimes a painful bear market rally is just a bear market rally, and not indicative of a future fundamental improvement at all. The trick, as readers are no doubt aware, is to be able to distinguish between the two- or to play on such modest time frames that the difference is irrelevant.

It's probably fair to say that if this is just a short-covering rally, it's probably getting long in the tooth. Copper has reacted just as you'd want following last week's break of the inverted head-and-shoulders neckline, but is already some 2/3 of the way to the target of 2.33 or so.

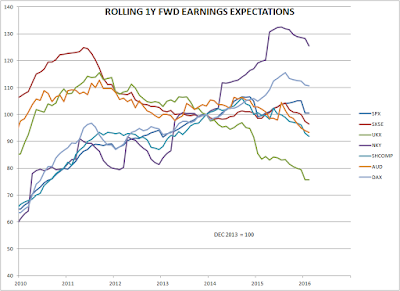

Given where we are in the developed market equity cycle, however, it difficult to get enthused about buying for anything other than a punt...and even there, we've just had a nice rally already, so how much upside is left. Macro Man noted a week or two ago that he was agnostic about the next 3-5% in US equities; a big reason is that one of his favourite indicators, rolling 12m forward earnings expectations, is showing no signs of life on a structural basis. Indeed, in many markets, it's moving the wrong way altogether.

That earnings expectations for the SPX have been largely unchanged for the last two years offers a pretty good explanation for why the price has, as well. If these indices had been beaten up to the extent of commodities/EM over the last year or two, or everything in 2008-09, it would be a lot easier to countenance a value-based purchase even without an earnings tailwind.

Perhaps that's why EM and some of the commodity producers have done so well recently. After all, Macro Man got bulled up on GDX largely because of nice base-forming pattern, though admittedly he waited until gold had started rallying before actually pulling the trigger. Still, he had the luxury of waiting, which isn't the case for all professional money managers. Perhaps what we're seeing is actually a rational asset rotation; after all, if you're forced to buy something with lousy earnings prospects, you might as well buy the thing that's already adjusted in price!