Seven Years Ago

by Eddy Elfenbein, Crossing Wall Street

This time of year has been fairly popular for major stock market turns. In 2000, the Nasdaq reached its nosebleed peak on March 10. Sixteen years later, we’re still below that level.

On March 11, 2003, the S&P 500 reached its closing low ahead of an impressive rally sparked by the opening of the Iraq War.

But the most impressive turn came seven years ago when the market reached one of the best buying opportunities in market history.

On Friday, March 6, 2009, the S&P 500 reached an intra-day low of 666.79. Like last Friday, that was also Jobs Day. That morning, the government reported that the economy had lost an astounding 651,000 jobs in February. The number for January was revised to a loss of 655,000, and December to minus 681,000. The unemployment rate rose to 8.1%, which was a 25-year high. So you can see why everyone was so bummed out.

That morning, The Wall Street Journal ran a piece from Michael Bostin, “Obama’s Radicalism is Killing the Dow.”

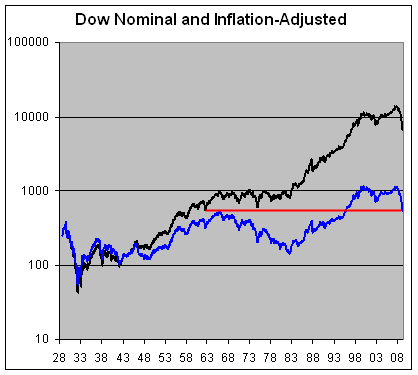

That day I posted a chart showing that the Dow, adjusted for inflation, was where it was 43 years before.

Then on Monday March 9, 2009, the S&P 500 reached its low close of 676.53, although it never dipped below the intra-day close from the previous Friday. The market hadn’t been this low in over 12 years.

To give you an idea of how nervous people were, the Volatility Index was near 50, and the TED Spread was over 1%. Yet this was a great time to buy. Or rather, I should say “because of this,” it was a great time to buy.

On Thursday, March 12, 2009, Bernie Madoff pled guilty to charges around his Ponzi scheme. In Forbes, Nouriel Roubini said the S&P 500 “could fall to 600.”

This was also the time when comedian Jon Stewart was criticizing CNBC and Jim Cramer. Stewart first mocked CNBC on March 5. That led to some public back-and-forth between him and Cramer. On the evening of March 12, Cramer came on The Daily Show for their famous matchup.

From its closing low on March 9, 2009, the S&P 500 would triple by November 6, 2014.

Copyright © Crossing Wall Street