Toppling Scales of Balance

by Guy Haselmann, Director, Capital Markets Strategy, Scotiabank GBM

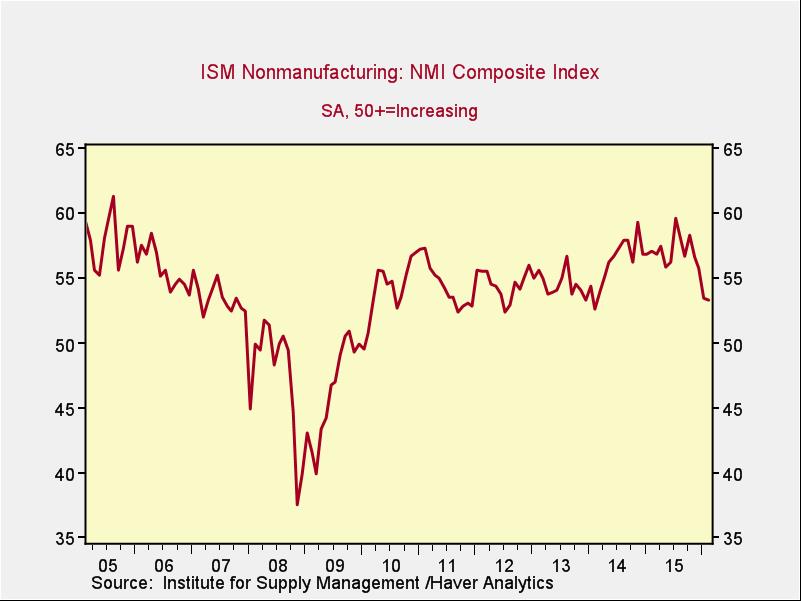

· Everything happening today is in some ways interconnected: popularity of ‘non-establishment’ political candidates; ineffectiveness of central bank policy in lifting inflation; economic pessimism; weak capital spending (from handcuffed capitalism); and angst due to perceptions of inequality. Let me explain.

· Business investment and capitalism are being held back by a lack of visibility on what a future return might generate from an investment in a capital project. Not only are future economic forecasts cloudy and highly-uncertain, but the rules governing business engagement are changing too frequently. Capitalism and entrepreneurship are simply being hand-cuffed by unclear and overly-burdensome regulation. Small businesses in particular do not have the economies of scale necessary to keep up under these conditions.

· Domestic and global uncertainties always exist, but most would agree that they are unusually elevated. The strange and unpredictable political environment - and uncertainties over who will be the next President and what his/her policies will be – further restrains capital investment. Understandably, determining the present value of a future cash flow is impossible when the tax code and health care costs are in flux.

· Stimulative monetary policies cannot offset these powerful forces. In the past, I have referred to this dynamic as “Great Aunt Addy Policy” in honor of my aunt who drove with one foot on the accelerator and a heavy foot on the brake. Restrictive regulatory and fiscal policies are one reason why massive amounts of global central bank stimuli have underwhelmed. In addition, artificially low official interest rates distort financial asset valuations, which further harm the ability to properly assess the value of a future stream of cash flows.

· Fed officials often cite Japan’s economic malaise as the basis for their own concerns and the basis for providing and maintaining highly accommodative policy. In my opinion, Japan’s quagmire should absolutely not be used as the prototype for Fed policy justifications. The reasons are beyond the scope of this note. However, Japan has had sustained 0% rates since 1999 (and conducted various QE programs). Yet, it has had more success over that period raising debt than lifting inflation. Why then do other central banks follow their lead?

· If there is a lesson from Japan, it is that low inflation is a function of high rates of savings, caused by low interest rates, rising VAT taxes, harmful economic and regulatory policies, poor demographics, and a falling population. Comparisons to Japan and associated deflationary fears are unfitting. By mis-diagnosing the reasons for subpar nominal GDP, and by taking the lead to offset its weakness, central banks have veered too far from their true capabilities without proper regard for the long run consequences and risks to financial stability.

· Profitability has become ever more challenged in a ‘new normal’ world of slow growth and tepid pricing power. In such an environment, worker anger cultivates as a ‘labor vs capital’ battle ignites. Worker resentment and blame targets both employers and government officials.

· Hence, the Fed is right to be concerned about stagnating wage growth, high levels of under-employed and rising inequality. Unfortunately, Fed officials have failed to fully comprehend that fixing those issues is beyond the scope of their policy tools. More importantly, they have not realized how their well-intentioned policies have actually contributed to those problems, helping to fuel the anger witnessed in voting polls.

· I will elaborate on this point in more detail, but first it would be helpful to review the past to see where we are now and where we might be headed. For several decades, economic prosperity was powered-forward by credit-based initiatives. The lower stair-stepping of official interest rates has allowed consumption, economic activity and debt to grow sufficiently to drive economic advancement and prosperity.

· I believe this cycle has reached a tipping point; basically, an end of the road. Due to fiscal and regulatory constraints and general indebtedness, economies may no longer be able to generate the growth rate necessary to sustain improvements in prosperity; or even to adequately service existing high debt levels.

· The proceeds from the massive amount of debt issuance during the last six years have gone mostly into financial market speculation, rather than into capital projects meant to generate future cash flows. Yield seeking is widely known, but is now ending. Debt has truly borrowed from the future mainly for today’s benefit.

· The ‘portfolio effect’ - or purposeful encouragement of risk-seeking behavior - was supposed to create a wealth effect that spilled into the broader economy. A main reason for the Fed’s ‘gradual’ retreat from stimulus is to try to prevent the reversal of this effect from occurring too quickly (after all, there is no free lunch).

· However, as central bank officials drop rates into negative territory, is it possible that the easing move actually has the actual net impact of a tightening through a negative wealth effect? After all, a bond with a negative yield has a guaranteed loss for the buyer who holds it to maturity.

· Some people ask why someone would buy a bond with a negative yield. Speculators buy them when they believe they can be sold back to the market or to the central bank (via QE) at a higher price. An investor might make money from a negative yielding bond if financing can be locked up for the life of the bond at a rate lower than the negative coupon. Lastly, some benchmark asset managers are forced to buy them by law.

· The intention of the negative rate move by the Bank of Japan was to influence banking behavior away from deposits and toward lending. Everyone should question why the markets had such an extreme and unexpected market reaction following the modest BoJ move. (Nikkei fell by 14%, and $/Y by 6% in the span of two weeks).

· Without fixing the root causes of economic ailments, risk-seeking behavior today is playing an ever more dangerous ‘game of chicken’. Investor behavior has shifted from ‘FOMU’ to ‘TINA’: from Fear Of Missing the Upside to There Is No Alternative.

· Multi-asset portfolio managers (and others) prefer an equity investment (with perceived upside) and with, say, a 5% or greater dividend, over a bond with minimal yield, or a ‘sticker-shock yield’ near zero (or negative). In other words, investors continue to chase the riskiest part of the capital structure; and do so, at potentially the worst possible time.

· Voter outrage has not risen simply because most feel they are not participating in higher financial asset prices. A great article explaining voter frustrations can be found here. In this note, author Peggy Noonan writes about the “unprotected American” who has “limited resources and negligible access to power”. I will let her article speak for itself, but will transition her same argument into how the effects of Fed policies are felt by voters.

· QE, money printing, and low (or negative) rates work against the “unprotected American” in a similar manner to something called “The Cantillon Effect” see here. Just like inflation is a tax on money, and negative rates are a tax to the lender, money printing and QE are a stealth tax on those who get the money last.

· If the government mailed a large tax bill to each household, there would be immediate outrage. By stealthily doing it through QE, money printing and inflationary policies, the government is doing that same thing in a different and more subtle manner. However, the average voter may not clearly see it, or be able to express their outrage in economic terms. Yet, it is quite obvious by watching the news that they are feeling it.

· In summary, monetary policy and credit-fueled growth may have reached the end of their practical limits. Evidence of such is percolating. Providing monetary accommodation is the easy part, but taking it away has historically been problematic. Not enough focus has been given to central bank exit strategies.

· When and if banks in countries with negative yields begin to pass negative rates onto their depositors, then a whole new Pandora’s box will open. I will save that for another note. In the meantime, watch Gold, buy long Treasuries, raise cash and move to capital preservation strategies.

· The best thing the Fed can do is to raise rates in March. You heard that right. To wait risks even bigger problems down the road. A Fed hike in March would help pull other central banks away from the abyss of negative rates. It should start with the Fed; the country behind the world’s reserve currency. If the FOMC were truly ‘data dependent’, then they would hike.

· “If you do not change direction, you may end up where you are heading” – Lao Tzu

NOTE: For some weekend reading, I have attached a note that I wrote in January 2014 called, “2014 and Beyond”, which still has many themes relevant today.

Have a nice weekend.

Guy

Guy Haselmann | Capital Markets Strategy

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

Scotiabank | Global Banking and Markets

250 Vesey Street | New York, NY 10281

T-212.225.6686 | C-917-325-5816

guy.haselmann[at]scotiabank.com

Scotiabank is a business name used by The Bank of Nova Scotia