You’re Fired!

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

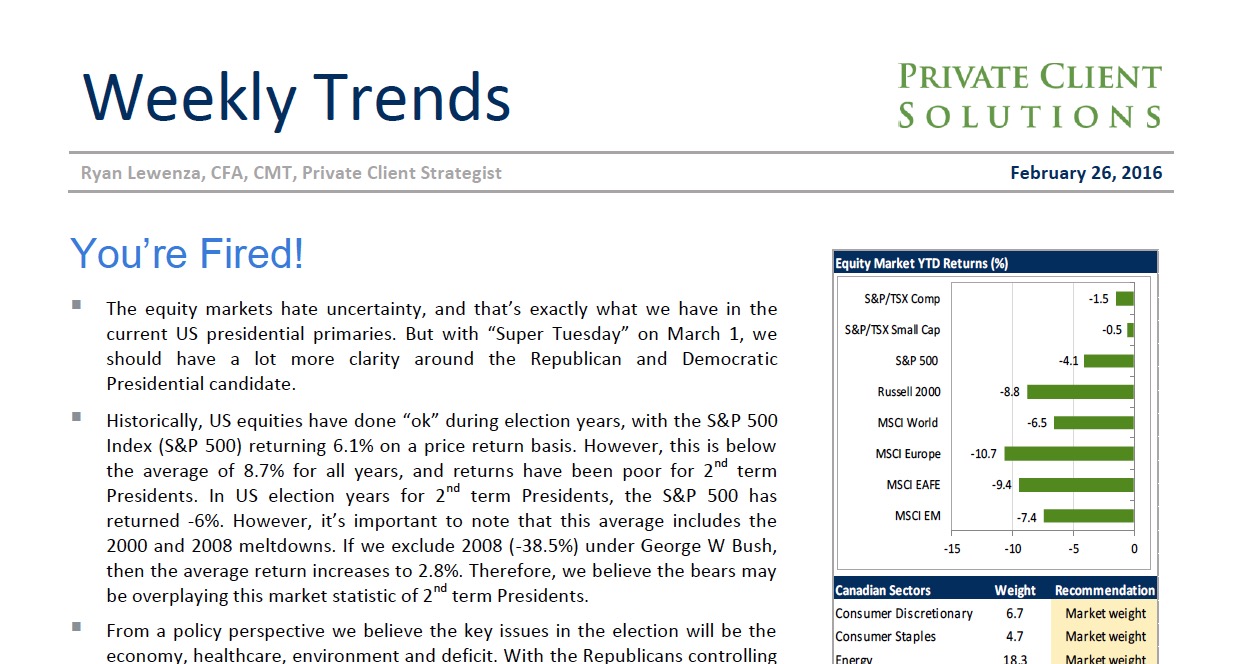

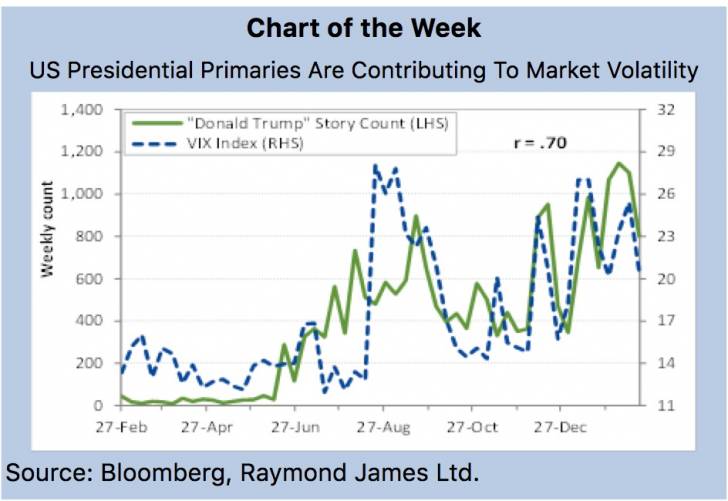

• The equity markets hate uncertainty, and that’s exactly what we have in the current US presidential primaries. But with “Super Tuesday” on March 1, we should have a lot more clarity around the Republican and Democratic Presidential candidate.

• Historically, US equities have done “ok” during election years, with the S&P 500 Index (S&P 500) returning 6.1% on a price return basis. However, this is below the average of 8.7% for all years, and returns have been poor for 2nd term Presidents. In US election years for 2nd term Presidents, the S&P 500 has returned -6%. However, it’s important to note that this average includes the 2000 and 2008 meltdowns. If we exclude 2008 (-38.5%) under George W Bush, then the average return increases to 2.8%. Therefore, we believe the bears may be overplaying this market statistic of 2nd term Presidents.

• From a policy perspective we believe the key issues in the election will be the economy, healthcare, environment and deficit. With the Republicans controlling both the House and Senate, a Republican Presidential win would be huge for the right, and likely result in dramatic policy changes following two terms of a Democratic President.

• There is a lot at stake for both the markets and policy in this election. We expect market volatility to remain elevated until we get greater clarity on the party leaders. However, as the frontrunner and possible winner of the US Presidential election emerges, we expect the equity markets to stabilize and begin to move higher.

Read/Download the complete report below: