POTENTIAL WINNERS OF LOW OIL: PART 1

by Anthony Valeri, Investment Strategist, LPL Financial

Oil prices have fallen nearly 70% from $107 per barrel in July 2014 to near $33 in February 2016. The reason is well known and summed up perfectly in a recent report from the International Energy Agency—the oil market is drowning in oversupply. The magnitude of the decline has surprised market participants and sparked a host of fears about domestic and global economic growth. In a market full of negative headlines, it is important to remember that while lower oil prices are a threat to energy companies and oil-exporting countries, there are other areas of the market that may benefit.

In part 1, we review potential sector and industry beneficiaries if oil prices remain low for the foreseeable future. In part 2, we will take a closer look at the consumer, as well as the countries and regions across the globe.

HOW TO POTENTIALLY BENEFIT FROM LOW OIL

Businesses can benefit from lower oil prices in two ways: through cost savings (for companies using oil as a production input) and through consumers, as they spend more of their energy savings. Both methods can lead to potentially higher profits.

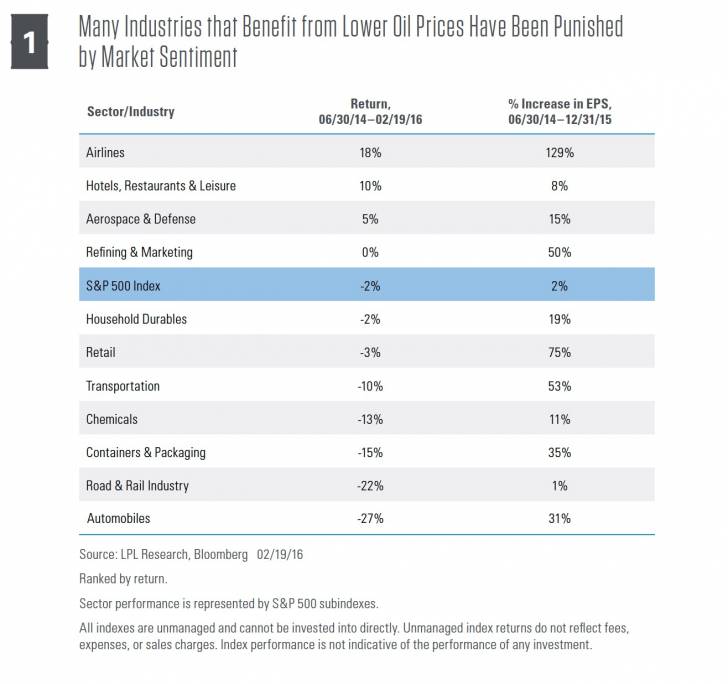

Low oil prices translate into lower fuel and energy costs for companies and more income for consumers, but not necessarily stock gains. Figure 1 shows stock returns and earnings growth from sectors that are expected to benefit from lower oil prices. A few sectors have managed gains in a difficult market environment and, perhaps more importantly, all have witnessed better financial results (as measured by earnings per share [EPS]). Some sectors have been punished, as market sentiment remains fragile due to concerns about future demand offsetting the benefit of lower energy costs. Still, if the U.S. avoids a recession and oil prices remain lower for longer, the valuations assigned to these industries may seem low in hindsight.

POTENTIAL SECTOR WINNERS

Airlines

Airlines stand to possibly benefit both from cost savings and increased consumer demand. As of the third quarter of 2014, prior to the steep drop in oil prices, fuel accounted for approximately 31% of costs, on average, for U.S. airlines.[1] As of the third quarter of 2015 (latest available data), that number had fallen to 18%, and may fall further given continued oil price declines. In 2015, U.S. carriers used 541 million more gallons of fuel than they did in 2014, as revenue passenger miles increased by almost 6% between October 2014 and October 2015.[2] However, even with the higher fuel usage, airlines saved almost $16 million (or 33%) compared with 2014 spending, as the average price paid per gallon fell from $2.86 to $1.86.

Fares decreased by approximately 5% and 3%, respectively, in 2014 and 2015, according to Consumer Price Index (CPI) data. Lower fares may increase demand and, along with lower costs, may boost airline profitability. Earnings results support this, with the S&P airlines industry seeing profit margins increase from 3% in the fourth quarter of 2014 to more than 15% in the fourth quarter of 2015. Trailing 12-month EPS more than doubled over the same time period, while revenue per share was also up more than 28%.

The improved financial results helped the S&P Airlines Index rise 18%, compared to a 2% decline for the broad market as measured by the S&P 500, from mid-2014 through February 19, 2016. Airlines may not have been able to take full advantage of lower oil, however, because many companies had hedged fuel costs. Although this was a positive during periods of rising fuel costs, it prevented many airlines from fully realizing the benefits of lower oil prices. Increased competition and a strong U.S. dollar have also hurt performance recently; but ultimately, the airlines industry is one beneficiary of lower oil prices.

Refiners

Refiners, who take crude oil and turn it into gasoline and other refined products, represent the only bright spot of the energy industry. The average price of gasoline, their main product, has also dropped—but not as much as oil prices, which has translated into improving profit margins. So while output prices have dropped, input prices have dropped even more, helping to explain why refiners have been able to boost earnings by a whopping 50% over the past 19 months.

Performance for the industry has been hurt recently, as markets fear that the lifting of the U.S. crude oil export ban may lead to increased costs for refiners. However, even when recent weakness is included, markets have been kinder to refiners than other areas of the energy sector, with the S&P Refining and Marketing Index showing flat performance between June 30, 2014 and February 19, 2016. Due to the improving earnings, valuations—as measured by price-to-earnings ratios (PE)—improved with the average PE cheapening to 7.8, below the overall S&P 500 average.

Hotels, Restaurants, and Leisure

All three of these segments have benefited from lower fuel prices as U.S. consumers take to the roads for vacation, leisure activities, and dining. The combination of more disposable income and lower fuel costs helps drive greater consumption of each, illustrated by the 12-month moving average of total distance traveled by Americans increasing by 3.4% between September 2014 and September 2015,[3] a difference of more than 100 billion miles.

OTHERS MAY BENEFIT…BUT HAVEN’T YET

Transports

For the trucking industry, fuel costs have rivaled labor costs recently—typically a company’s largest expense. At an average of 34%, fuel and oil costs were one of the largest expenses for the trucking industry in 2014, topped only by driver wages and benefits at 35%.[4] Low oil prices have resulted in improved profitability metrics over the past 18 months, with EPS increasing by 53%.

However, the market has not rewarded these improvements, with the S&P 500 Transportation Industry Index falling a cumulative 10% from June 30, 2014 to February 19, 2016, slightly worse than the S&P 500 Index. China’s economic slowdown, the strong U.S. dollar’s impact on trade, and a reduced need for transportation equipment domestically, as the shale oil industry and other commodity producers curtail activity, have caused investors to avoid transports. In addition, market fears of a continued economic slowdown in the U.S. and around the globe have pressured the sector. On a positive note, the trailing 12-month PE for the industry has fallen from 18.8 ( a premium versus the S&P 500) in June 2014, to 11.1 (a significant discount).

The rail industry is one subsector of the transportation industry that has particularly lagged. Lower fuel costs are a plus, but not nearly enough to offset decreased traffic as a result of lower commodity prices broadly, which is reflected in the sector’s relatively weak earnings growth.

Chemicals and Containers and Packaging

These sectors both use oil and natural gas as key inputs to production, but macroeconomic concerns have overshadowed financial benefits. Despite good earnings growth over the past 18 months, forward-looking markets have expressed more concern over future business prospects.

Automobiles and Household Durables

The stock prices of automobiles and household durables also reflect investors’ economic fears, despite each sector benefiting from consumers’ increased disposable income. The average household may save over $1,200 annually just due to lower gas prices[5] (not to mention cost savings from lower heating oil or natural gas), savings they may choose to spend elsewhere. For example, autos have benefited from consecutive years of record sales, with total sales at or near all-time highs since 2013, and miles traveled reached a new record in 2015. These two categories of big ticket items have historically been economically sensitive, and rising recession concerns have begun to impact both, despite improving financial results from both sectors. One headwind thus far has been that consumers have increased savings, with the estimate of personal savings rising from 4.8% in the second quarter of 2014 to 5.5% in the fourth quarter of 2015. It is always possible, however, that this increase in savings may push spending forward and lead to benefits for these sectors in the long run.

MIXED RESULTS

Retail

Energy cost savings point to retail as a beneficiary of low oil prices, but results are mixed. Forward-looking investors have punished some companies in anticipation of a slower economy while rewarding those showing greater resilience. However, financial results, on average, have been strong, with earnings growth for retailers over the period rising by 72%.[6]

Retail stocks overall have fared slightly worse than the broad market during the past 19 months, declining by 3% (S&P 500 Retail Select Index) compared to a 2% decline for the S&P 500, but these results hide a disparity. Stocks of the 30 largest retailers, based on market capitalization, are up 31% (S&P 500 Retail Index) during that period. The retail group contains a broad range of companies from online retailers, home improvement stores, and traditional stores.

TECHNOLOGY DEALS A BLOW TO PEAK OIL THEORY

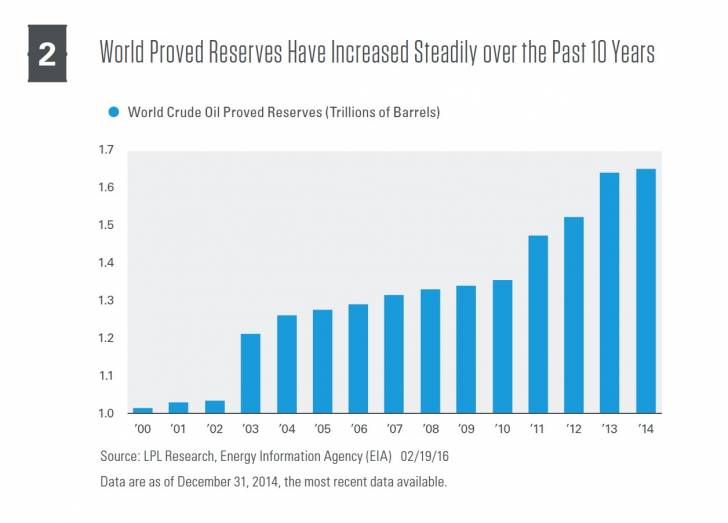

The oil supply glut can best be illustrated by showing the rapid growth of reserves in recent years. The U.S. Energy Information Administration (EIA) tracks two important metrics related to oil reserves: proved reserves and technically recoverable resources. Proved reserves refer to the amount of oil that is able to be recovered economically at current prices and with current technology [Figure 2]. Unproved technically recoverable resources are broader, and include “tight oil,” commonly refered to as shale oil, and other types of unconventional resources.

Proved reserves have increased steadily over the past few years, partly due to increased oil prices, which make it economically feasible to extract oil that may have been too expensive to recover previously. However, the EIA’s estimate of unproved technically recoverable resources related to tight oil increased at a much faster rate. Though the EIA is continuing to assess tight oil resources across the world, estimates increased from 32 billion barrels in 2011 to 345 billion in 2013, and have since been updated to nearly 419 billion barrels. To put this in perspective, the 313 billion barrel increase between 2011 and 2013 is larger than the entire proved reserves of Saudi Arabia (280 billion barrels). As technology continues to evolve, access to previously unknown reserves is likely to develop, meaning the world isn’t likely to run out of oil anytime soon.

WHAT IS THE CASE FOR OIL STAYING LOWER FOR LONGER?

Although higher oil prices remain in our memory, a number of factors suggest oil prices may remain low relative to what we have experienced in recent years.

Short term:

1) U.S. production has proven resilient in the face of lower prices and supply is down only modestly. Though this may change in the near future, the resiliency of U.S. oil producers has surprised markets.

2) OPEC has shown reluctance to cut supply, driven by fear over losing market share.

3) Russia and other nations more dependent on oil revenue continue to pump to maintain cash flow for national budgets.

4) Iran may add more than 1 million barrels a day of oil in the absence of sanctions.

Long term:

1) Improving technology and higher fuel efficiency mandates may reduce demand.

2) Environmental concerns continue to increase demand for alternative energy.

3) Continued improvements to battery technology and electric car capabilities may expand the use of electric vehicles.

The persistence of low oil prices may give the sectors discussed above a tailwind, assuming a fairly steady path for the broad economy. Outside of a major shift in policy from OPEC, or a surprise pickup in economic growth that pushes demand higher quickly, the case for a spike in oil prices over the short term appears unlikely. While we believe that current low oil prices may not be sustainable, they may remain subdued over the intermediate term given that supply and demand are not projected to equalize until sometime after late 2016; in addition, technology improvements and environmental concerns may keep a lid on oil prices in the long term. Even the steep decline in 2015 wasn’t able to stop the momentum of renewable energy, with petroleum-based power generation losing ground to renewables such as wind and solar, though natural gas also saw gains [Figure 3].

Figure 3: Lower Oil Prices Didn’t Stop the Momentum of Renewable Energy in 2015

CONCLUSION

Outside of a surprise production cut from OPEC or an acceleration in global growth, low oil prices may linger. Long-term factors may keep oil prices low relative to recent years, which may mean that $100 oil is the anomaly in the future. This would be a headwind for the energy industry and countries exporting large amounts of oil, but consumers overall are likely to benefit from lower prices, as are the sectors and industries of the market exposed to lower energy input costs or increasing consumer disposable income.

Read/Download the complete report below:

TL Potential Winners of Low Oil Part1

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance reference is historical and is no guarantee of future results. All indexes are unmanaged and cannot be invested into directly.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk including loss of principal.

Because of their narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets, as well as weather, geopolitical events, and regulatory developments.

INDEX DESCRIPTIONS

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

DEFINITIONS

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

Earnings per share (EPS) is the portion of a company’s profit allocated to each outstanding share of common stock. EPS serves as an indicator of a company’s profitability. Earnings per share is generally considered to be the single most important variable in determining a share’s price. It is also a major component used to calculate the price-to-earnings valuation ratio.

The PE ratio (price-to-earnings ratio) is a measure of the price paid for a share relative to the annual net income or profit earned by the firm per share. It is a financial ratio used for valuation: a higher PE ratio means that investors are paying more for each unit of net income, so the stock is more expensive compared to one with lower PE ratio.

[1] According to Bloomberg data.

[2] According to the Bureau of Transportation Statistics.

[3] According to Federal Highway Administration data.

[4] According to The American Transportation Research Institute.

[5] According to the Bureau of Economic Analysis (BEA).

[6] According to Bloomberg Data.