ETF Spotlight on LMBS

by ETF Research, iSectors

Posted on: 02/24/2016

Let’s take a look at another ETF Spotlight on a fund owned by iSectors. This time we’re going to take a look at the fixed income space instead of the equity space as we covered in our last installment.

In an effort to diversify the risk in the iSectors Capital Preservation Allocation away from a heavy weighting towards credit risk, the iSectors investment team had been looking into increasing the allocation to Mortgage-Backed Securities ETFs.

Our decision, however, was not as simple as choosing between the handful of popular broad MBS ETFs that exist in the marketplace including: the iShares MBS ETF (MBB), the Vanguard Mortgage-Backed Securities ETF (VMBS), and the SPDR Barclays Mortgage Backed Bond ETF (MBG).

Each of these funds are competitively priced (VMBS being the least expensive of course) and each of them trade well with good liquidity, but there was a major problem. The iSectors Capital Preservation Allocation has a target duration of 3 or less, while optimally keeping the total portfolio duration as close to 1.0 as possible during this period of rising interest rates. The broad mortgage funds have durations too long to fit comfortably in the portfolio. So until that point, we had only kept a very small allocation to MBB in the portfolio because we didn’t want the duration to skyrocket.

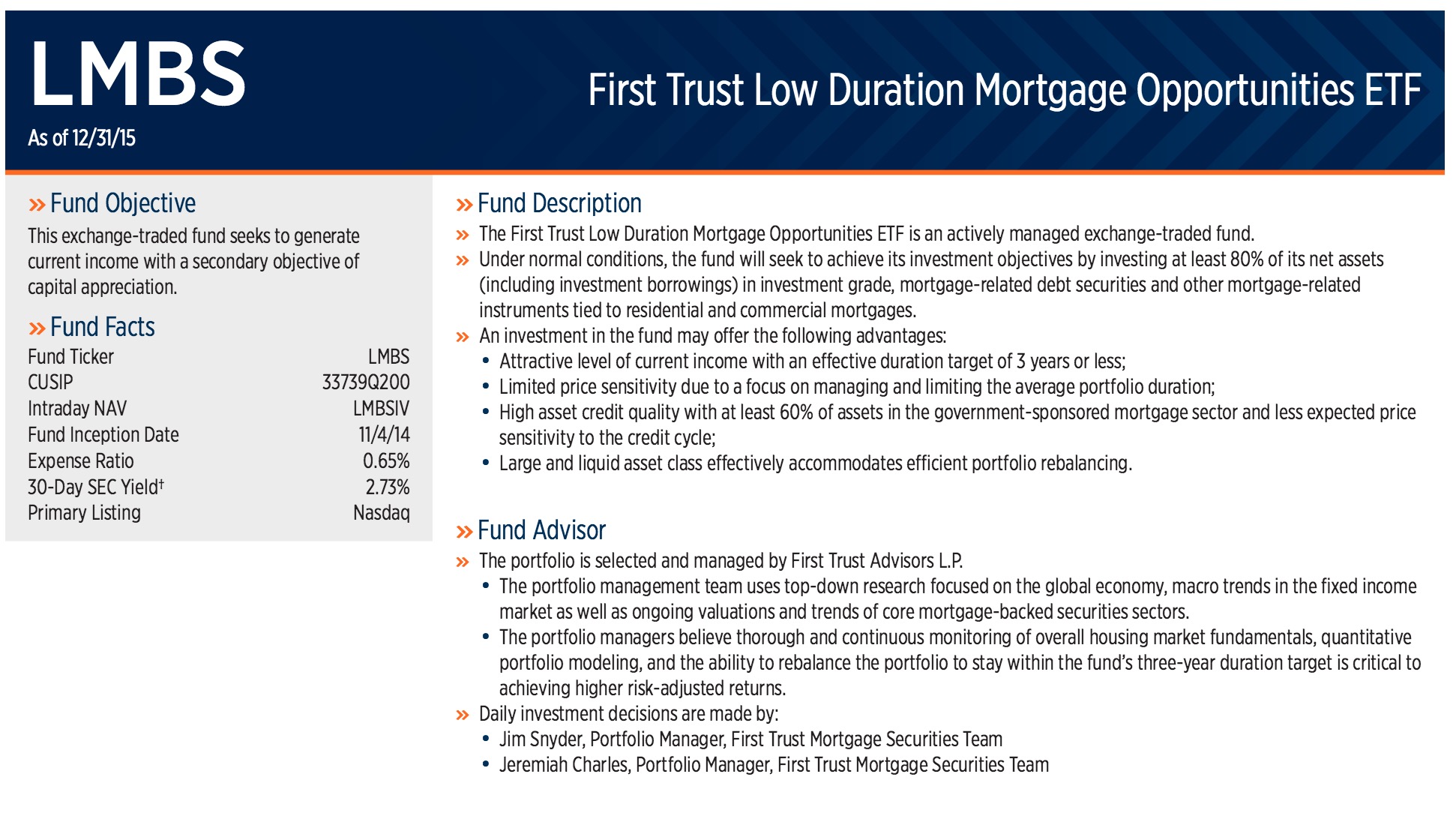

After doing a little more research, we came across the First Trust Low Duration Mortgage Opportunities ETF (LMBS). This is an actively managed ETF. Although we prefer index-based ETFs in the equity space, we are much more comfortable using them in the fixed income market because of the inherent problems with using indexes in the bond market, such as:

- These indexes will give a higher weighting to companies that are issuing larger amounts of debt. This is counterintuitive to good performance.

- Usually it is difficult to track an index of bonds because of liquidity/timing/maturity issues.

The target duration of LMBS is less than 3 years, which fits in line perfectly with the iSectors Capital Preservation Allocation. In order to maintain the targeted duration, the fund has higher credit risk than the pure mortgage-backed funds mentioned earlier because it can include non-agency and commercial MBS, not just agency-backed.

The resulting higher credit risk is still much less than any of the other low duration options available in the marketplace and utilized in the model. The 65 bps management fee is a little higher than we usually want to pay, but since this active fund is truly one of a kind in our eyes we think the fee is in line.

Copyright © iSectors