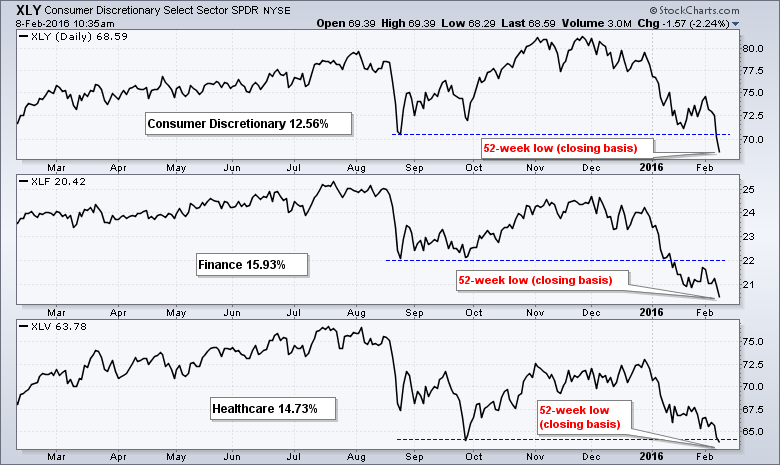

Three Big Sectors Hit New Lows for the Year

by Arthur Hill, CMT, StockCharts.com

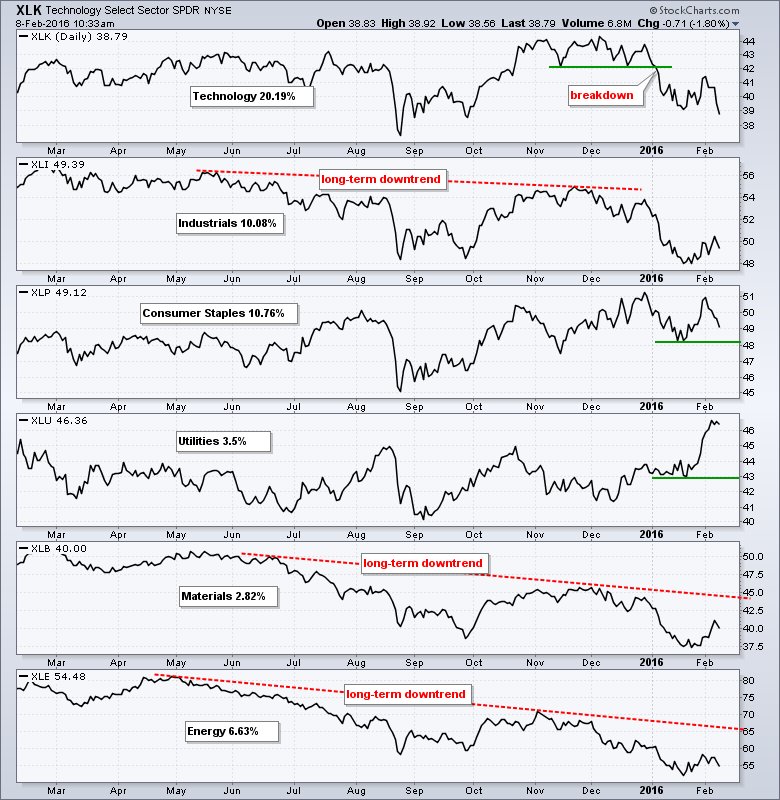

There are nine sectors in the S&P 500 SPDR (SPY) and their weights range from 2.82% (materials) to 20.17% (technology). The technology sector is around seven times bigger than the materials sector and this means that not all sectors affect the S&P 500 the same. Looking at the charts today, I noticed that three of the nine sector SPDRs were trading at new lows for 2016. These are the Consumer Discretionary SPDR (XLY), the Finance SPDR (XLF) and the HealthCare SPDR (XLV). Together, these three account for 43% of the S&P 500. On the close-only chart below, these three are also trading at 52-week lows. The fact that these three are the first to record new lows for the year shows relative "chart" weakness. In other words, these three are leading on the downside. The finance sector represents the banking system and the consumer discretionary sector represents the most economically sensitive sector. It is not good to see these two sectors leading the market lower. There is a chart with the other six sectors after the jump.

****************************************

****************************************

Thanks for tuning in and have a good day!

--Arthur Hill CMT

Plan your Trade and Trade your Plan

*****************************************

This post was originally published by Arthur Hill, CMT at StockCharts.com

Copyright © StockCharts.com

The Don't Ignore This Chart blog contains daily articles with intriguing or unusual charts selected by one of our Senior Technical Analysts, along with a short explanation of what exactly caught their attention and why they believe the chart is worth noting.