2015 and 2016, U.S. Equity Bubble Update, and Yet More on Oil [excerpted]

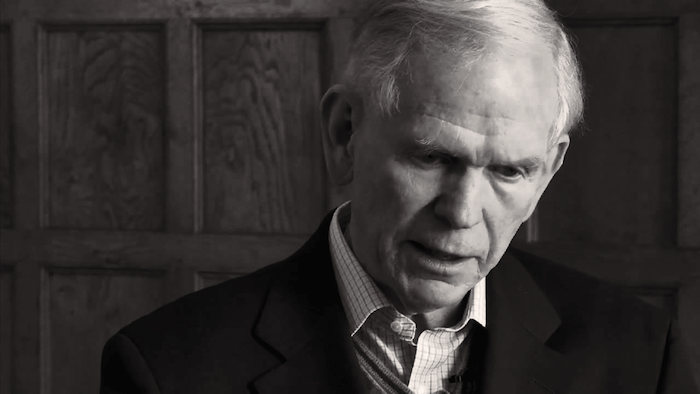

by Jeremy Grantham, GMO LLC

Summary

■ The positive effects of low resource prices are underestimated. The U.S. and global economies are likely to do significantly better this year than recent opinions predict. The U.S. has plenty of spare capacity to grow above its longer-term limits. The biggest risk would be China’s GDP becoming much more disappointing.

■ The U.S. and global markets do not look like they are in bubble territory. They can always suffer a regular bear market (and are almost in one now). But I still believe we will have to wait longer for the BIG ONE and that global equity markets will regroup once more.

■ Currently ultra-low resource prices are not sustainable, particularly those of grains and oil. Oil producers need $65/barrel and rising to finance new oil exploration. Resource prices will inevitably rise and as they do they will reduce once again the growth rates of the global economy.

A quick look at 2015 and 2016

2015

Looking back to last year we could simplify it by saying that the big positive was, as usual, support from the Fed and its allies, as they continued to maintain lower than market rates. You know my view: These lower rates have surprisingly little effect on the economy but a big effect on pushing up asset prices. Historically – well for 25 years anyway – the lack of reasonable values has often not impeded the Fed’s ability to push equity prices higher. Indeed, by any traditional measure we have spent over 80% of the last 25 years overpriced. The big negative in 2015, of course, was China slowing down, especially in areas requiring raw materials. This helped to broadly lower global GDP growth. Loosely speaking, the closer investments were to China – say, miners, countries supplying raw materials, and emerging markets with heavy Chinese trade – then the relatively worse they did. And the closer to the Fed, as the U.S. is, the less badly they did.

The global bear market bias of 2015 was also helped along everywhere by the plunging oil price, which caused layoffs, reductions in capital spending, and, probably more importantly for equities, increased global uncertainties both at the company financial level and the country political level.

Right behind that as a negative, particularly in the U.S., was a decline in profit margins. Finally! But the drop was from levels so far above the old trend that even after recent declines they remain handsome.

Looking at the U.S. equity market I think we might agree on how powerful the Fed is in the market equation. It approximately offset these three very large negatives: China, oil, and declining margins, which together caused disappointing global growth. But in addition, it had to neutralize the justifiable nervousness caused by increased terrorism, immigrant problems, Russia’s sharp elbows, and an apparently disheveled Europe. Not bad!

2016

Looking to 2016, we can agree that uncertainties are above average. But I think the global economy and the U.S. in particular will do better than the bears believe it will because they appear to underestimate the slow-burning but huge positive of much-reduced resource prices in the U.S. and the availability of capacity both in labor and machinery. So even though I believe our trend line growth capability is only 1.5%, our spare capacity and lower input prices make 2.5% quite attainable for this year. And growth at this level would make a major market break unlikely. As discussed elsewhere, this situation feels at worst like an ordinary bear market lasting a few months and not like a major collapse. That, I think, will come later after the final ingredients of a major bubble fall into place.

As always, though, prudent investors should ignore historical niceties like these and invest according to GMO’s rather depressing 7-year forecast. The U.S. equity market, although not in bubble territory, is very overpriced (+50% to 60%) and the outlook for fixed income is dismal. At current asset prices no pension fund requirements can be met. Thus, we should welcome a major market break that will leave us with more reasonable investment growth potential for the longer term, but I suspect that we will have to wait patiently for such a major decline. The ability of the market to hurt eager bears some more is probably not exhausted. I still believe that, with the help of the Fed and its allies, the U.S. market will rally once again to become a fully-fledged bubble before it breaks. That is, after all, the logical outcome of a Fed policy that stimulates and overestimates some more until, finally, some strut in the complicated economic structure snaps. Good luck in 2016.

[Download the complete GMO Letter]

U.S. equity bubble update

On the evaluation front, the market is not quite expensive enough to deserve the bubble title. We at GMO have defined a bubble as a 2-standard-deviation event (2-sigma). We believe that all great investment bubbles reached that level and market events that fell short of 2-sigma did not feel like the real thing. (In our view, 2008 was preceded by an unprecedented U.S. housing bubble – a 3-sigma event.)

Today a 2-sigma U.S. equity market would be at or around 2300 on the S&P, requiring a rally of over 20%; even from the previous record daily high it would have required an 8% rally. The impressive bubble peaks of 1929 and 2008 also featured broad international overpricing of equities, measured at over 1-sigma, and this, too, was completely lacking this time. Emerging market equities were just ordinarily overpriced last year and full of investor concerns totally unlike normal bubble conditions. Europe and other developed markets were more overpriced but nowhere near bubble levels, and were also characterized by extreme nervousness.

On the more touchy-feely level of psychological and technical measures, the U.S. market came closer to bubble status but, still, I think, no cigar. I had pointed out two years ago1 that nearly all major bubbles are immediately preceded by a period when the safer blue chips outperform the riskier, higher-beta stocks on the upside. At other times this would be considered very unusual. Two years ago there was not a hint of that, but last year was a classically narrow market – i.e., led by a handful of the very largest and, on average, higher-quality companies. So the bears can claim this one, although

I think with an asterisk because the market was not really going up last year and outperformance of bigger stocks in a flat market is not particularly remarkable. Also mitigating the bear argument is that this market effect was not caused by defensive buying of blue chips but, I would say, offensive buying into the spectacularly superior earnings of this small group. So, not convincing. I had also written that

I did not see much chance that this market would end before records would be set for corporate deals done, encouraged by the extremely low rates and reluctance to invest in new plants and equipment. This test, I must admit, was passed with flying colors, for all deal records were broken in the second half of last year. Much more convincing.

A third less elegant but historically effective test further improves the odds of a bear market this year: the infamous January rule. Applied GMO-style, it goes that the first five trading days predict the balance of the year, especially if the average number is negative. (As does the whole month with about the same – and quite significant – statistical weight.) When the two signals oppose each other, on the other hand, we have had very normal years. Needless to say, the first five days and January were both record-ugly this year. Since 1925, a down five-day and down January have more than doubled the probability of a down market for the remaining 11 months.

So I must admit to feeling nervous for this year’s equity outlook in the U.S. But I am not entirely convinced. Sure, we can have a regular bear market. That is always the case. But the BIG ONE? I doubt it. And here is my admittedly reduced case.

The most important missing ingredient is a fully-fledged blow-off. This should come complete with crazy speculative anecdotes for your grandchildren, massive enthusiasm from individual investors, an overwrought, overcapacity economy, and, at minimum, a 2-sigma S&P 500 at 2300. Lacking all of this, I still believe it is “likely” that we will reach Election Day more or less intact. I will, though, admit to my definition of “likely” being beaten down by the negative factors listed earlier to something just over 50%. The wild card, as usual these days, is China. The market is discounting lower growth. (I believe 4% a year for the next 10 years would be a reasonable target.) But a deep entry into negative GDP numbers might ruin my relatively positive case for global growth.

To rub in how ordinary our present market negatives are compared to the impending doom bubble of 2007 when a crash seemed inevitable – like “watching a slow motion train wreck”2 – let’s compare today with 2007.

Back then the banks looked very vulnerable. Indeed, I predicted in July 2007, “at least one major bank... will fail.” This time oil debt may hurt, but our moderately strengthened banks will surely withstand this much smaller hit easily. In 2007, resource prices, historically a terrible drag on economies, were at cosmic highs – oil alone was over $150/barrel. Today they are at cosmic and unsustainable lows. So a major, major negative is this time a major positive. The U.S. housing market back then was at a 3-sigma high (never before approached) and represented a potential and realized

$6 trillion write-down of perceived wealth. This time the U.S. housing market is merely moderately overpriced. Last time the economy was cranking out 1.25 million extra houses and the whole economy was running flat out. This time we are building at least 300,000 houses below normal levels and there is spare capacity in the broad economy. Clearly, this current situation has no material similarity to that which impressed us as so irresistibly negative in 2007. In short, the economic outlook for the immediate future is less bad than recent commentaries would have you believe. Especially in the U.S.

Read/Download the complete report below:

Copyright © GMO LLC