Riding Out Wild Equity Markets

by Equity Research, AllianceBernstein

The market convulsions of the past few weeks have many investors thinking twice about owning stocks. But there’s a way to stay the course in equities without abandoning comfort zones: consider strategies with built-in shock absorbers.

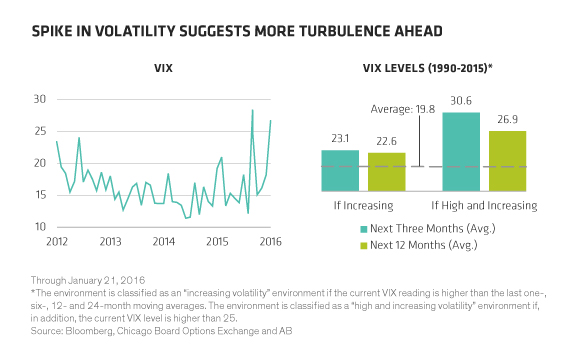

Markets have been growing more unruly since last fall (Display, left). Interlocking issues surrounding the collapse in oil prices, slowing growth in China and shifting US monetary policy have raised doubts about the vitality of the global economy and rattled nerves. And, as we wrote in September, spikes in volatility tend to presage future turbulence (Display, right). Four months later, and the ride has continued to be rocky.

Investors may be tempted to rush for the exits. But history teaches that such responses (and, indeed, most efforts at market timing) have proven costly. Investors risk locking in losses, and missing out on the market’s eventual recovery.

In our view, current conditions appear to be consistent with a transient midcycle correction, rather than a prolonged recession or credit crisis that will lead to an extended bear market as in 2008. We are unconvinced that China’s transition and the disruptions in the energy market will significantly erode global economic conditions. The US consumer appears strong, job growth is accelerating and conditions in Europe and Japan look steady if uninspiring. So, while we expect higher volatility to persist, we don’t think it’s time to reduce exposure to equities.

Time to Grab the Maalox?

Many equity investors tackle the risk issue by defaulting to traditional passive cap-weighted, index-tracking strategies and ETFs. But, while passive approaches may address concerns about relative risk, they can’t help investors mitigate absolute risk when markets decline.

An allocation to a less-volatile portfolio of stocks can help investors get the long-term upside potential of equities with less of the nasty side effects of gyrating markets along the way.

But purely passive approaches are not wholly without risk. Most passive strategies in this arena screen strictly for low beta, with no consideration of valuation or potential for return. This can leave investors overly exposed to pricier subsets of stocks, industries or countries.

Today, these types of strategies are particularly risky, in our view. After multiyear outperformance, for example, lower-beta stocks are trading at some of their highest valuations of the past 25 years (Display, right bar). Some would say the MSCI Minimum Volatility Index, the most commonly used proxy for low-beta stocks, has become the “safety at any price” benchmark. It currently trades at a 32% premium to the MSCI World Index based on 12-month forward earnings and a 26% premium based on free cash flow.

The index is also concentrated in many “bond proxy” sectors, such as utilities, which adds unintended interest-rate sensitivity. And going with the passive flow could mean forgoing any potential for future upside in returns when investors need it most—in an era when broad market performance is likely to be more subdued.

In fact, low volatility equities come in many shapes and sizes. Notably, many cash-generative companies, with good business models are still trading at reasonable valuations (Display, left bar). This is precisely why we believe a multifaceted, active approach is the way to go when investing in this space.

Active Can Finesse

An active strategy can adjust exposures depending on insights into current fundamental attractiveness and risk, even pivoting into sectors not typically associated with low volatility. For instance, we’ve found attractive opportunities in software companies with large installed bases and low capital needs. Within healthcare, even after the strong biotech-led outperformance last year, there are many large, diversified pharmaceutical companies with strong and stable cash flows that are still selling at discounts to the market.

Tag-Teaming Controls Valuation

As we’ve written before, our research suggests that combining built-in downside defenses with traits of high fundamental quality—such as high return on assets, strong cash generation, and disciplined balance-sheet management—can produce better risk-adjusted returns than focusing on low volatility alone. That’s because these two attributes offer complementary, tag-teaming features: high-quality stocks provide participation in bull markets, including during periods of rising interest rates (Display), while low-beta portfolios are much better at tempering losses in market slumps.

The equity market’s recent schizophrenia has been unnerving. It also comes with the territory. But, by actively trading off between quality and stability, and remaining sensitive to valuation, it is possible to build a portfolio that can weather future bouts of volatility through a variety of environments. That’s particularly important given where we are in the investment and rate cycle. A smoother journey that’s easier on the nerves can help keep equity investors on course when turbulence strikes and improve their odds of getting to their desired investment destination.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

Portfolio Manager—Strategic Core Equities

Kent Hargis is Portfolio Manager of Strategic Core Equities. He has been managing the Global, International and US portfolios since their inception in September 2011. Hargis was named Head of Quantitative Research for Equities in 2009, with responsibility for overseeing the research and application of risk and return models across the firm’s equity portfolios, and is currently Co-Head of Quantitative Research. He joined the firm in October 2003 as a senior quantitative strategist. Prior to that, Hargis was chief portfolio strategist for global emerging markets at Goldman Sachs. From 1995 through 1998, he was assistant professor of international finance in the graduate program at the University of South Carolina, where he published extensively on various international investment topics. Hargis holds a PhD in economics from the University of Illinois, where his research focused on international finance, econometrics, and emerging financial markets. Location: New York

Portfolio Manager—Strategic Core Equities

Sammy Suzuki is Portfolio Manager of Strategic Core Equities, and has managed the Emerging Markets Strategic Core portfolio since its inception in July 2012. He joined AB in 1994 as a research associate covering the capital equipment industry, and then became an analyst covering the technology industry. From 1998 to 2004 Suzuki served as senior research analyst for the global automotive industry. He then became director of research for Canadian Value Equities and served as leader of the global commodities team. From 2010 to 2012 Suzuki was director of Fundamental Value Research, managing a team of over 50 fundamental analysts globally. In addition, from 2008 to 2015 he was director of research for Emerging Markets Value Equities. Before joining the firm, he was a consultant at Bain & Company. Suzuki holds a BS in materials science and engineering and a BS in finance from the University of Pennsylvania. He is a CFA charterholder. Location: New York

Portfolio Manager—Equities

Christopher W. Marx is Portfolio Manager of Equities. He joined the firm in 1997 as a research analyst, covering a variety of industries both domestically and internationally, including chemicals, food, supermarkets, beverages and tobacco. Marx joined the portfolio management team in 2004. Prior to joining the firm, he spent six years as a consultant for Deloitte & Touche and the Boston Consulting Group. Marx holds a BA in economics from Harvard University and an MBA from the Stanford Graduate School of Business. Location: New York

Related Posts

Copyright © AllianceBernstein