by Don Vialoux, Timingthemarket.ca

StockTwits released yesterday

Crude oil soars despite multi-decade highs in the Days of Supply of the commodity.

Nice breakout by TSX Gold Index above $149.83 to complete a base building pattern.

U.S. Precious Metals ETFs breaking resistance today include $GDX and $WITE. Also, nice breakout by $PAAS

Editor’s Note: Silver stocks joined the gold stocks

Base Metal stocks also joined the parade.

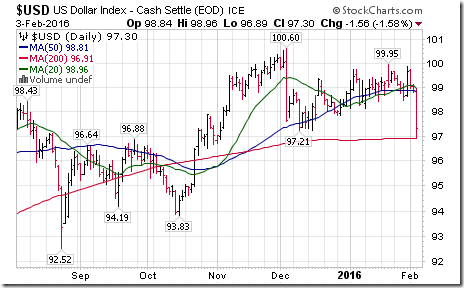

Commodity prices were helped by a plunge in the U.S. Dollar Index

Conversely, nice breakout by the Euro!

And a corresponding pop in the Canadian Dollar!

Technical action by S&P 500 stocks yesterday

Lots of volatility, but in the end, technical action remained quietly bullish. Breakouts: AES, CTL, EW, KMB, PXD. Breakdown: LOW.

Trader’s Corner

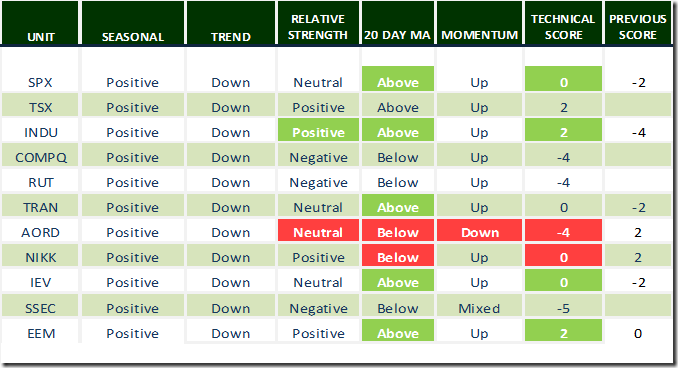

Technical scores generally moved higher yesterday when equity indices, commodities and sectors moved above their 20 day moving average.

Daily Seasonal/Technical Equity Trends for February 3rd 2016

Green: Increase from previous day

Red: Decrease from previous day

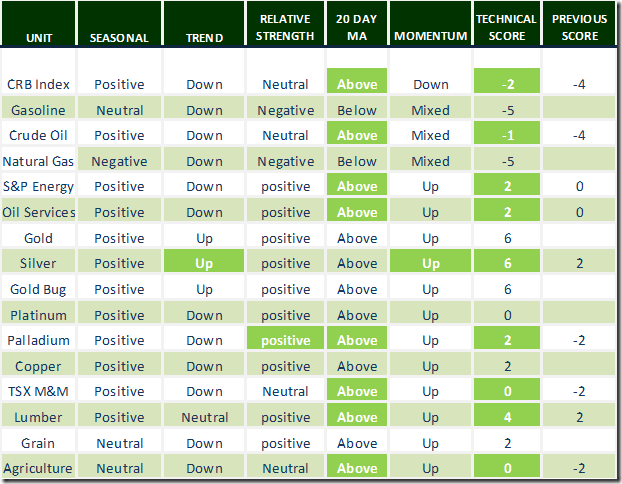

Daily Seasonal/Technical Commodities Trends for February 3rd 2016

Green: Increase from previous day

Red: Decrease from previous day

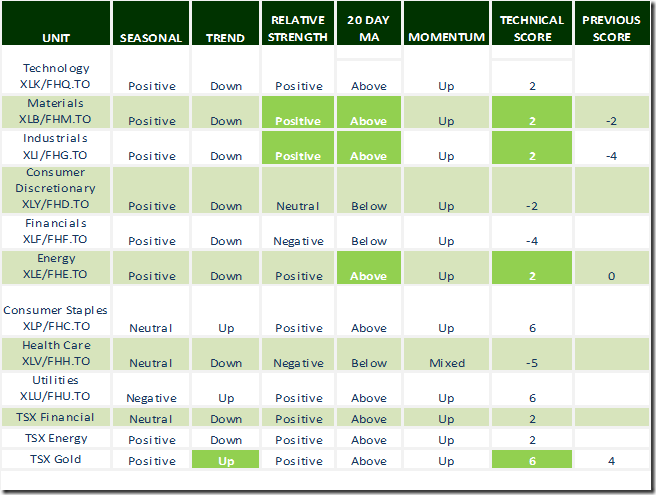

Daily Seasonal/Technical Sector Trends for February 3rd 2016

Green: Increase from previous day

Red: Decrease from previous day

Interesting Charts

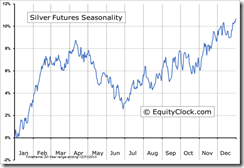

Nice breakout by Silver above $14.64!

‘Tis the season for silver to move higher until mid-April!

Technical score for the Materials sector increased to 2 from -4 when strength relative to the S&P 500 Index turned positive and the Index moved above its 20 day moving average.

‘Tis the season for strength in the Materials sector into May!

Strength in the Materials sector is related to strength in the Chemical sub-sector.

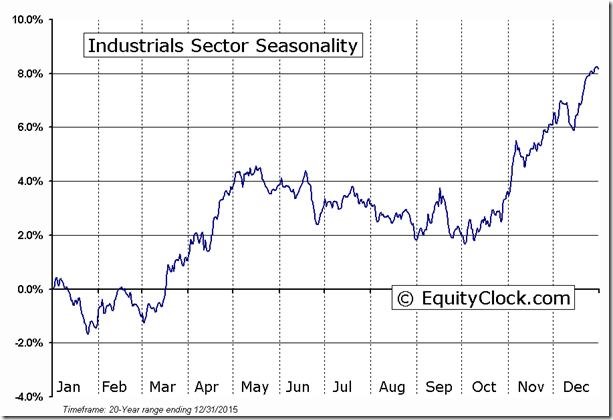

Technical score for the Industrial sector increased to 2 from -4 when strength relative to the S&P 500 Index turned positive and the Index moved above its 20 day moving average.

‘Tis the season for strength in the Industrial sector into May!

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca