A Meridian Market Update

by Erik Swarts, Market Anthropology

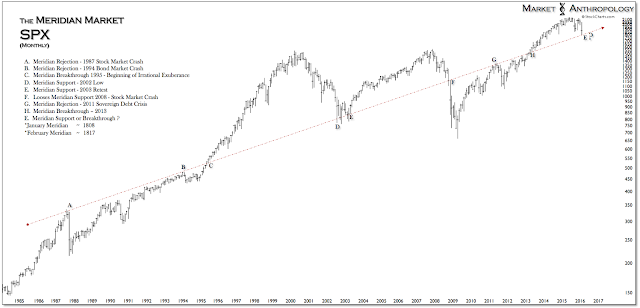

With trading for January coming to a close this week, US equities remain skittish - after breaking through intermediate support last Wednesday around 1860 on the SPX and quickly testing long-term support just above the Meridian at 1808. Although the subsequent rally was sharp and recaptured intermediate support, considering the proximity and significance of the Meridian - the bounce isn't all that surprising or telling just yet.

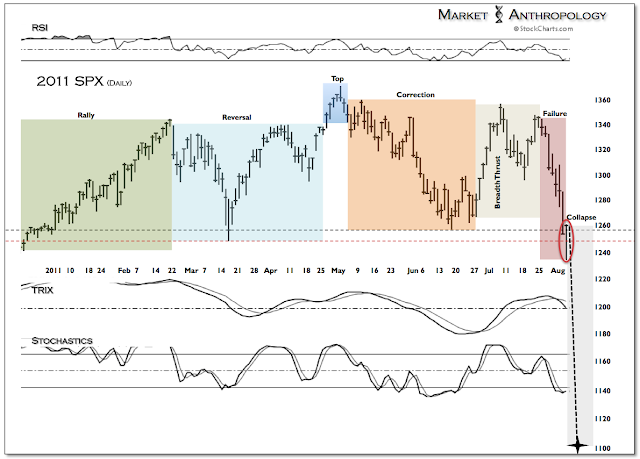

That said, the SPX did fulfill the basic technical condition of testing the Meridian, that our more bullish (but less probable) equity scenarios (see Here) from a few weeks back were looking for. With sentiment eroded from January's steep decline, elevated pessimism likely sparked the sharp short-covering move. Nevertheless, the buoyancy quickly dissipated yesterday as the Fed statement largely upset, in part, by not unequivocally ruling out another rate hike at their next meeting in March. Although we find that outcome extremely unlikely and misread, the volatile breakdown in equities does speak to the fragile nature they continue to demonstrate. As a cautious reminder heading into next week and February, we wanted to again stress that equities technically remain precariously situated, with intermediate support just below and with the Meridian rising to ~1817 next month. Naturally, with the market so close to pivotal support, the longer it remains in limbo, the more likely a more significant breakdown becomes. Moreover, the break and recapture dynamic seen over the past week was quite similar to another reaction period with the Meridian: the broader breakdown pattern in the SPX in early August 2011, directly before the markets took another leg lower (see Here).

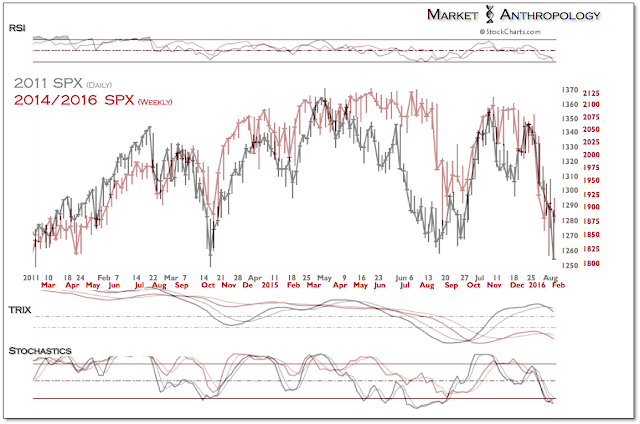

While expressed on a longer timeframe with a much larger move, the potential top in the SPX has mimicked the same market reflexes of the 2011 breakdown following the end of QE2. Although we don’t foresee a market decline proportional to the full retracement of QE2 in 2011, the broader technical structure, as well as the underlying policy mechanisms that helped drive and prick the rally – are alike. All things considered, the bulls need to gain breathing room and quickly, by replicating another large short-covering rally that manifests into a larger move.

From a big picture perspective - and as described in our previous equity note (see Here), we hold as our base-case scenario that a cyclical decline is underway. Of course how pronounced a potential downturn becomes is largely an educated guesstimate, but we'd argue it's chiefly dependent on how well the Fed and markets handle and react to this atypical period of policy normalization, as well as the underlying health of the US and global economy.

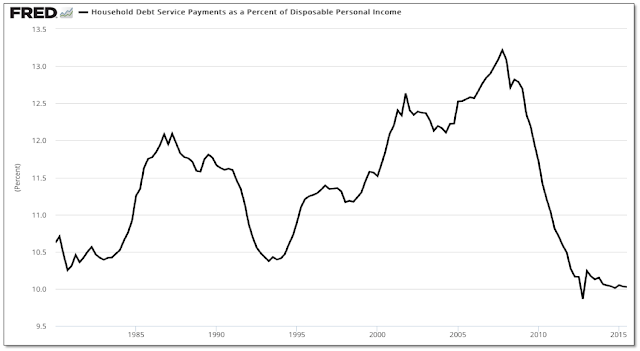

Domestically, although we certainly see a clear causal connection in equities from the extraordinary measures taken by the Fed to support the markets - and believe an extended period of recalibrating expectations and valuations is warranted; we also recognize the significant deleveraging that's been accomplished during this period for US households, who still very much drive the economy through their respective consumption habits. Fundamentally, this is one reason to suspect a milder bear is in store, rather than the two most recent cyclical downturns that were effectively borne-out of pronounced excesses in the economy in 2000 and 2007.

Domestically, although we certainly see a clear causal connection in equities from the extraordinary measures taken by the Fed to support the markets - and believe an extended period of recalibrating expectations and valuations is warranted; we also recognize the significant deleveraging that's been accomplished during this period for US households, who still very much drive the economy through their respective consumption habits. Fundamentally, this is one reason to suspect a milder bear is in store, rather than the two most recent cyclical downturns that were effectively borne-out of pronounced excesses in the economy in 2000 and 2007.

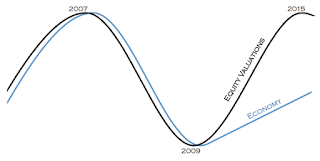

A key difference and one that frames our broader outlook, is that we view the economy slowly catching up with extended - but receding valuations, rather than valuations sinking with the economy. For worst or for better, it is this distinction that has largely kept us out of the more bearish deflationary camps; as we view these dynamics as primarily massive market displacements greatly steered and volleyed by the worlds largest central banks - rather than the more pernicious symptoms of underlying economic decay that some participants may try to conflate. This doesn't imply that we believe the effects from these policies are benign or without significant impact to the US or global economy - they certainly are not. We simply recognize them as our market reality in the wake of the financial crisis and within the trough of the long-term yield cycle, where central banks extraordinary actions largely diverged markets from the fundamental underpinnings that investors had relied on to navigate and appraise economic conditions. Consequently, the playbook and experiences that many money managers had followed and passed down over the course of their careers have gradually stopped working.

A key difference and one that frames our broader outlook, is that we view the economy slowly catching up with extended - but receding valuations, rather than valuations sinking with the economy. For worst or for better, it is this distinction that has largely kept us out of the more bearish deflationary camps; as we view these dynamics as primarily massive market displacements greatly steered and volleyed by the worlds largest central banks - rather than the more pernicious symptoms of underlying economic decay that some participants may try to conflate. This doesn't imply that we believe the effects from these policies are benign or without significant impact to the US or global economy - they certainly are not. We simply recognize them as our market reality in the wake of the financial crisis and within the trough of the long-term yield cycle, where central banks extraordinary actions largely diverged markets from the fundamental underpinnings that investors had relied on to navigate and appraise economic conditions. Consequently, the playbook and experiences that many money managers had followed and passed down over the course of their careers have gradually stopped working.

For example, while we certainly have experienced significant disinflationary conditions over the past several years, we primarily view it as a consequence of the currency markets, rather than symptoms of underlying economic malaise that could manifest into investors worse fears of deflation. Generally speaking, the US dollar has exerted the most influence worldwide, not from endogenous deflationary pressures, but primarily from reflexive market behavior reacting to the world’s largest and most influential central banks. From our perspective, the danger for participants is viewing and conflating the market effects - such as the collapse in the price of oil, as primarily a consequence of diminishing demand or an economic downturn. The same is true for the equity markets, where participants and pundits would typically expect a recession to follow a market decline, or conversely, that an exuberant market indicates a strong economy. It's a different paradigm completely, but we've been here before.

Copyright © Market Anthropology