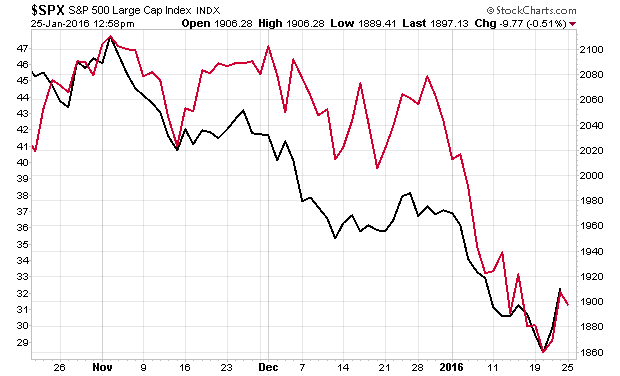

Stocks and Oil are Correlated

by Eddy Elfenbein, Crossing Wall Street

The WSJ notes that stocks and oil are 97% correlated this year. That’s the highest in 26 years.

The unusually strong link between the two markets partly reflects a common theme driving both: fears that a slowing Chinese economy could tip the global economy into recession. But as traders and investors in each market look at the other for clues as to how bad things are, they have exacerbated the overall bearish mood.

The recent pattern marks a shift in the dynamics of oil’s 19-month collapse. Traders who long worried that the oil market was suffering from oversupply are now growing increasingly concerned that demand may be weakening as well.

“There is a vicious-cycle mentality among investors,” said François Savary, Chief Investment Officer at Prime Partners, a Swiss investment firm managing $2.6 billion of assets. “It is become self-sustaining.”

In the chart above, red is the S&P 500 and black is oil.

It seems that we’ve turned a corner where lower oil went from being a net a benefit for the economy (lower gas prices, more consumer spending) to being a net negative for the economy (defaults, etc).