How to Help Women Investors Gain Comfort with Risk

by Commonwealth Financial Network

In The Hour Between Dog and Wolf, John Coats, former trader turned neuroscientist, says that testosterone and cortisol may be the reasons why men seem to be riskier traders. Testosterone boosts competitiveness and can result in a willingness to take risks. And in times of crisis, cortisol helps deal with stress. This combination—overconfidence, competitiveness, and reactive behavior—may lead to more frequent trading and higher trading costs compared with that of women investors.

In The Hour Between Dog and Wolf, John Coats, former trader turned neuroscientist, says that testosterone and cortisol may be the reasons why men seem to be riskier traders. Testosterone boosts competitiveness and can result in a willingness to take risks. And in times of crisis, cortisol helps deal with stress. This combination—overconfidence, competitiveness, and reactive behavior—may lead to more frequent trading and higher trading costs compared with that of women investors.

But are women really that risk averse and thus more conservative investors? Maybe not. Research suggests that women simply have a different genetic makeup. By understanding this difference, you can help women investors gain comfort with risk.

To start, let’s explore the role of women in decision making and how to help this group achieve their financial goals.

Statistically, there’s no doubt that women have their hand in the household finances and decision-making process. They are the primary caregivers—educated, working professionals who often outlive their husbands and need to support themselves throughout retirement. Just take a look at the numbers:

- For 2014, on an average day, 83 percent of women and 65 percent of men spent some time doing household activities (e.g., financial and other household management, cooking, lawn care).

- For 2013, on an average day, 30 percent of women and 21 percent of men spent time helping and caring for members of their household. On these days, women spent an average of 2.3 hours on these activities, while men spent 1.8 hours.

- For 2014, women working full-time earned 78.6 percent of what men earned.

- In 2013, women accounted for 51 percent of all workers employed in management, professional, and related occupations, somewhat more than their share of total employment (47 percent).

So, how can you bridge the gap between what is known about women’s behavior and their ability to achieve their financial goals?

Identify goals. Women want the big picture. They need to understand why certain investments fit their financial needs. To understand those needs, your first step is identifying goals by asking the following questions:

- What stage of life is she in?

- What’s the time horizon for her portfolio?

- What is she passionate about?

- What major events are happening or may happen in her life (e.g., buying a house, paying off college debt, paying for a child’s education)?

- Is she financially comfortable and more concerned with legacy planning?

Once the goals have been established, it’s time to figure out what your client can do to achieve them. What’s an acceptable target return, and how much risk does she need to take?

Define risk comfort level. Risk comfort levels vary from person to person. It’s not so much about gender but about the person’s investment experience, goals, time horizon, investment objective, and comfort with market volatility. A woman’s personality, lifestyle, and behavior are major factors in how she perceives risk. What are her views about money in general? How does she feel about market volatility? What is the absolute lowest level the market can reach before she’d want to pull her money out?

Whatever your client’s risk comfort level, it’s important for her to understand that risk and reward go hand in hand and that an overly conservative portfolio can be just as risky as an overly aggressive one.

Nurture confidence. Next, help your client become a more confident investor. Comfort with risk and confidence in investing are correlated, and women need to feel confident that they are making the right investment decisions. The more you can educate and guide your women clients, the more trust they will have in you and your recommendations.

Remember, a little coaching may go a long way in getting the desired result. That is, don’t tell a woman what to do; show her and help her draw the appropriate conclusion. Discussing alternative solutions and paying attention to your clients’ behavior, values, and needs will help them connect with and support what you’re saying.

So, which types of investments and strategies might introduce a level of risk that a female investor would be comfortable adding to her portfolio? Let’s consider a couple of options.

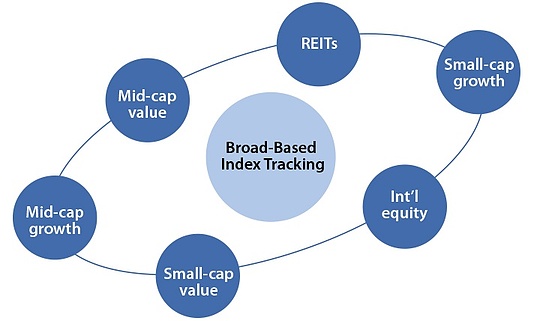

The core and satellite approach strives to outperform the broader market in the long term by combining passive and active, or even strategic and tactical, investment styles (see chart below). The core is invested in broad stocks and passive investments. It can allot for up to 90 percent of total assets in the portfolio and is typically spread across different sectors and uses traditional asset types. The satellite (the "riskier" component of this portfolio management approach), on the other hand, can represent up to 40 percent of assets and seeks to take advantage of growth opportunities or hedge the core allocation. It may incorporate actively managed investments or separately managed accounts and invest in emerging markets, small-cap equity, real estate, commodities, or individual stocks.

This approach is beneficial for clients more comfortable having the bulk of their allocation in passively managed investments. These investments seek to capture overall market returns at a lower cost. The intention is to follow the index, rather than beat it. Higher risk can be introduced with the satellite allocation, and the percentage of assets allotted to this portion can be adjusted as your client becomes more comfortable taking on investment risk.

The bucket strategy divides assets into multiple portfolios that have different goals, time horizons, income needs, and objectives. It’s often used as clients are preparing for retirement but can be used at other times as well.

For example, this approach is beneficial for those looking to link specific goals or needs to specific, projected returns. It helps manage risk, market volatility, income needs and liquidity, and legacy planning. Here’s how it could work:

- One bucket can provide income a few years before or after retirement. It may be invested in a cash-alternative* portfolio for liquidity purposes.

- The next bucket, for the following three to nine years, can be invested in an income-generating model.

- Buckets for longer-term goals (perhaps a child’s education) can be invested more aggressively.

With these buckets, a client whose current portfolio may be invested too conservatively to achieve all of her financial goals can systematically take on more risk in a way that may be more comfortable for her.

After deciding on the best approach, consider various platforms (insourcing/outsourcing), managers, and investments. Keep in mind that many women like to invest with a higher purpose. For example, they may be drawn to an ESG (environmental, social, and governance) portfolio, may be passionate about companies that want to reduce their carbon footprint, or may want to avoid alcohol or tobacco investments.

Helping your female prospects and clients starts with knowing how to communicate with them, whatever their investment interests. Women aren’t necessarily risk averse; they do need to understand why taking on more risk can be beneficial. And if you pay attention to their needs and values, you may find that your women clients are especially loyal and will stay with you for the long run.

Do you find that women investors, in general, are more risk averse? Are certain investment strategies more popular with your female clients? Please share your thoughts with us below.

*May not be insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other governmental agency. Non-bank deposit investments are not FDIC- or NCUA-insured, are not guaranteed by the bank/financial institution, and are subject to risk, including loss of principal invested.

Investments are subject to risk, including the loss of principal. Because investment return and principal value fluctuate, shares may be worth more or less than their original value. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.

Commonwealth Financial Network is the nation’s largest privately held independent broker/dealer-RIA. This post originally appeared on Commonwealth Independent Advisor, the firm’s corporate blog.

Copyright © Commonwealth Financial Network