by Don Vialoux, Timingthemarket.ca

Jon Vialoux on BNN’s Market Call Tonight

Following are links:

Opening segment giving market outlook:

http://www.bnn.ca/Video/player.aspx?vid=784449

Segments on individual equities

http://www.bnn.ca/Video/player.aspx?vid=784452

http://www.bnn.ca/Video/player.aspx?vid=784474

http://www.bnn.ca/Video/player.aspx?vid=784479

http://www.bnn.ca/Video/player.aspx?vid=784491

http://www.bnn.ca/Video/player.aspx?vid=784494

http://www.bnn.ca/Video/player.aspx?vid=784497

Top Picks

http://www.bnn.ca/Video/player.aspx?vid=784498

Economic News This Week

Weekly Initial Jobless Claims to be released at 8:30 AM EST on Thursday are expected to slip to 275,000 from 277,000 last week.

December Retail Sales to be released at 8:30 AM EST on Friday are expected to increase 0.1% versus a gain of 0.2% in November. Excluding auto sales, December Retail Sales are expected to increase 0.3% versus a gain of 0.4% in November.

December Producer Prices to be released at 8:30 AM EST on Friday are expected to decline 0.1% versus a gain of 0.3% in November. Excluding food and energy, December Producer Prices are expected to increase 0.1% versus a gain of 0.3% in November.

January Empire Manufacturing Index to be released at 8:30 AM EST on Friday is expected to improve to -3.5 from -4.6 in December

December Industrial Production to be released at 9:15 AM EST on Friday is expected to slip 0.2% versus a decline of 0.6% in November. December Capacity Utilization is expected to slip to 76.9% from 77.0% in November

January Michigan Sentiment Index to be released at 10:00 AM EST on Friday is expected to remain unchanged from December at 92.6

November Business Inventories to be released at 10:00 AM EST on Friday are expected to be unchanged versus unchanged in October

Earnings News This Week

Monday: Alcoa

Thursday: Intel, JP Morgan Chase

Friday: Citigroup, US Bancorp, Wells Fargo

The Bottom Line

Weakness in equity prices around the world came as a shock and clearly was not anticipated by Tech Talk. The blow up created by growing political tensions in the Middle East followed by serious questions about China’s monetary policy triggered a shock in equity markets that led to substantial technical selling. A small saving grace occurred when selected sectors and subsectors with favourable seasonality at this time of year continued to outperform the S&P 500 Index (e.g. Medical Devices, Healthcare Providers, Aerospace & Defense, Silver, Platinum). Their prices dropped slightly last week. However, positive relative performance does not create a profit. The only sector that created a significant profit last week was gold. As noted in Jon Vialoux’s comments on BNN on Friday, significant technical damage has occurred in most equity markets and sectors and technical signs of a bottom have yet to surface despite momentum indicators that are deeply oversold. Investors will watch closely to responses to “ugly” fourth quarter earnings reports by S&P 500 companies that start to appear this week. Equity markets will need a period of base building before they once again move higher. Preferred strategy for now is to “wait until the dust settles” following last week’s unexpected shock events.

Equity Indices

Daily Seasonal/Technical Equity Trends for January 8th 2016

Green: Increase from previous day

Red: Decrease from previous day

Calculating Technical Scores

Technical scores are calculated as follows:

Intermediate Uptrend based on at least 20 trading days: Score 2

Higher highs and higher lows

Intermediate Neutral trend: Score 0

Not up or down

Intermediate Downtrend: Score -2

Lower highs and lower lows

Outperformance relative to the S&P 500 Index: Score: 2

Neutral Performance relative to the S&P 500 Index: 0

Underperformance relative to the S&P 500 Index: Score –2

Above 20 day moving average: Score 1

At 20 day moving average: Score: 0

Below 20 day moving average: –1

Up trending momentum indicators (Daily Stochastics, RSI and MACD): 1

Mixed momentum indicators: 0

Down trending momentum indicators: –1

Technical scores range from -6 to +6. Technical buy signals based on the above guidelines start when a security advances to at least 0.0, but preferably 2.0 or higher. Technical sell/short signals start when a security descends to 0, but preferably -2.0 or lower.

Long positions require maintaining a technical score of 0.0 or higher. Conversely, a short position requires maintaining a technical score of 0.0 or lower.

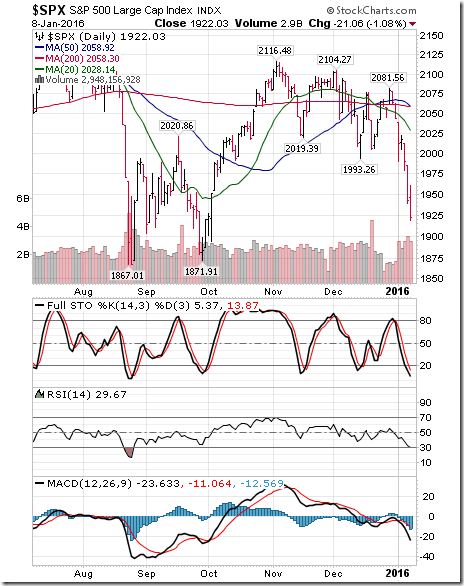

The S&P 500 Index plunged 121.91 points (5.96%) last week. Intermediate trend remains down. Short term momentum indicators continue to trend down and are oversold, but have yet to show signs of bottoming.

Percent of S&P 500 stocks trading above their 50 day moving average plunged last week to 12.80% from 50.6%. Percent is deeply oversold, but has yet to show signs of bottoming. Historically, a recovery from below the 25% level has triggered an intermediate uptrend.

Percent of S&P 500 stocks trading above their 200 day moving average plunge last week to 25.40% from 48.80%. Percent is deeply oversold, but has yet to show signs of bottoming.

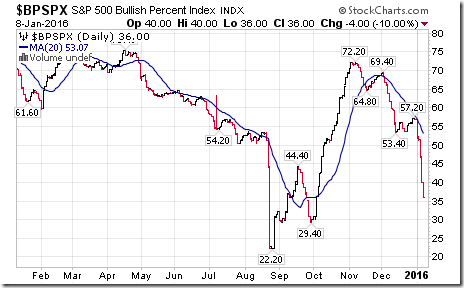

Bullish Percent Index for S&P 500 stocks plunged last week to 36.00% from 56.80% and remained below its 20 day moving average. The Index continues to trend down.

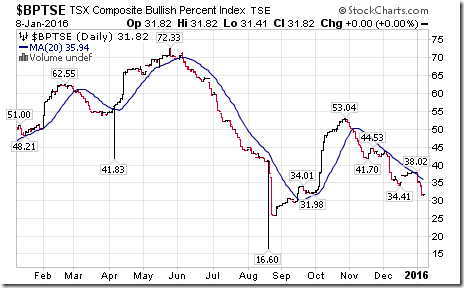

Bullish Percent Index for TSX stocks dropped to 31.82% from 38.02% and remained below its 20 day moving average. The Index continues to trend down.

The TSX Composite Index plunged 564.50 points (4.34%) last week. Intermediate downtrend was extended on a move below 12,617.66 (Score:-2). Strength relative to the S&P 500 Index turned positive from neutral on Friday (Score: 2). The Index remains below its 20 day moving average (Score: -1). Short term momentum indicators are trending down and are deeply oversold (Score: -1). Technical score improved last week to -2 from -4.

Percent of TSX stocks trading above their 50 day moving average dropped last week to 20.66% from 38.84%. Percent has returned to an intermediate oversold level, but has yet to show signs of bottoming.

Percent of TSX stocks trading above their 200 day moving average dropped last week to 20.25% from 30.17%. Percent has returned to an intermediate oversold level, but has yet to show signs of bottoming.

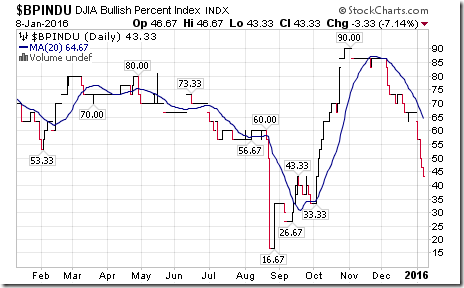

The Dow Jones Industrial Average plunged 1,078.58 points (6.19%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index turned negative from neutral. The Average remained below its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped last week.to -6 from -2.

Bullish Percent Index for Dow Jones Industrial Average stocks plunged last week to 43.33% from 66.67% and remained below its 20 day moving average.

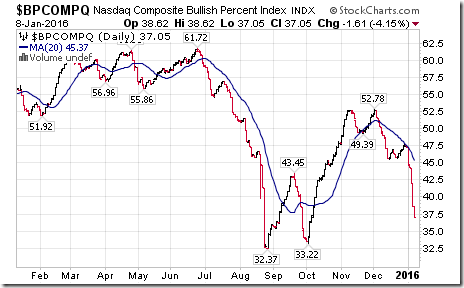

Bullish Percent Index for NASDAQ Composite stocks plunged last week to 37.05% from 47.30% and remained below its 20 day moving average.

The NASDAQ Composite Index plunged 363.78 points (7.26%) last week. Intermediate trend changed to down from neutral on a move below 4871.59. Strength relative to the S&P 500 Index changed to negative from neutral. The Index remains below its 20 day moving average. Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming. Technical score last week dropped to -6 from 0.

The Russell 2000 Index plunged 89.69 points (7.90%) last week. Intermediate trend changed to down from neutral on a move below 1,108.76. Strength relative to the S&P 500 turned negative. The Index remains below its 20 day moving average. Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming. Technical score dropped last week to -6 from -2.

The Dow Jones Transportation Average plunged 562.35 points (7.49%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Average remains below its 20 day moving average. Short term momentum indicators are trending downs and are oversold, but have yet to show signs of bottoming. Technical score dropped last week to -6 from -4

The Australia All Ordinaries Composite Index fell 295.20 points (5.52%) last week. Intermediate trend remained neutral. Strength relative to the S&P 500 Index remains positive. The Index fell below its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped to 0 from 4.

The Nikkei Average plunged 1,335.75 points (7.02%) last week. Intermediate trend remains neutral. Strength relative to the S&P 500 Index remains negative. The Average remained below its 20 day moving average. Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming.

Europe 350 iShares dropped $2.59 (6.46%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed to negative from neutral. Units remain below their 20 day moving average. Short term momentum indicators are trending down are deeply oversold, but have yet to show signs of bottoming. Technical score slipped last week to -6 from -4.

The Shanghai Composite Index plunged 353.07 points (9.98%) last week. Intermediate trend changed to neutral from up on a move below 3,327.81. Strength relative to the S&P 500 Index changed to negative from positive. The Index remained below its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped last week to -4 from 2.

Emerging Markets iShares fell $2.68 (8.33%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index turned negative from neutral. Units remained below their 20 day moving average. Short term momentum indicators are trending down and are oversold, but have yet to show signs of bottoming.

Currencies

The U.S. Dollar Index slipped 0.25 (0.25%) last week. Intermediate trend remains up. However, evidence of an intermediate peak at 100.60 has become apparent. The Index remains above its 20 day moving average. Short term momentum indicators are mixed.

The Euro added 0.61 (0.56%) last week. Intermediate trend remains down. The Euro moved back above its 20 day moving average. Short term momentum indicators are trending up.

The Canadian Dollar dropped another US 1.28 cents (1.78%) last week. Intermediate trend remains down. The Canuck Buck remains below its 20 day moving average. Short term momentum indicators are trending down.

The Japanese Yen gained 1.94 (2.33%) last week. Intermediate trend changed to neutral from down on a move above 84.64. The Yen remains above its 20 day moving average. Short term momentum indicators are trending up and are overbought.

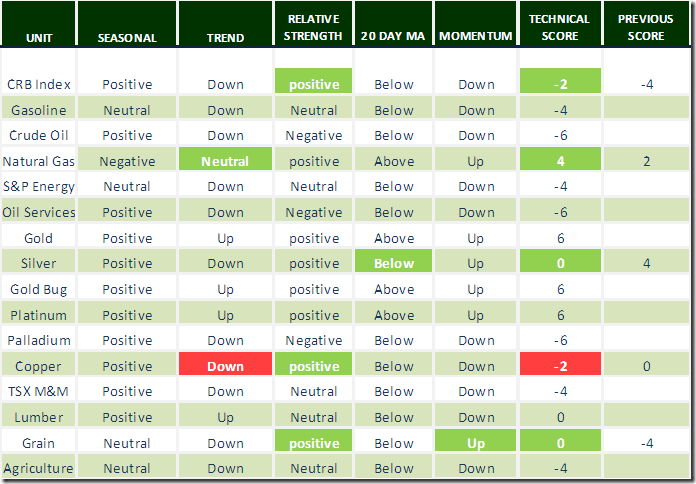

Commodities

Green: Increase from previous day

Red: Decrease from previous day

The CRB Index dropped 7.69 points (4.36%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index turned positive from neutral. The Index remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score dipped last week to -2 from 0.

Gasoline dropped $0.14 per gallon (11.02%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains neutral. Gas remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score slipped to -4 from -2

Crude Oil dropped $3.91 per barrel (10.55%) last week. Intermediate downtrend was extended on a move below $34.53. Strength relative to the S&P 500 Index turned negative from neutral. Crude remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped last week to -6 from 2.

Natural Gas added $0.12 per MBtu (5.11%) last week. Intermediate trend changed on Friday to neutral from down on a move above $2.46. Strength relative to the S&P 500 Index remains positive. “Natty” remains above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 4 from 2.

The S&P Energy Index plunged 30.67 points (6.84%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains neutral. The Index remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score slipped last week to -4 from -2.

The Philadelphia Oil Services Index plunged15.53 points (9.85%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index remains negative. The Index remains below its 20 day moving average. Short term momentum indicators are trending down. Technical score last week slipped to -6 from -5.

Gold gained $37.40 per ounce (3.53%) last week. Intermediate trend changed to up from down on a move above $1,088.30 per ounce. Strength relative to the S&P 500 Index turned positive. Gold moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score increased last week to 6 from -3.

Silver gained $0.10 per ounce (0.72%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed to positive from neutral. Silver slipped back below its 20 day moving average on Friday. Short term momentum indicators are trending up. Technical score improved last week to 0 from -3. Strength relative to Gold is negative.

The AMEX Gold Bug Index added 7.36 points (6.62%) last week. Intermediate trend changed to up from down on a move above 121.51. Strength relative to the S&P 500 Index changed to positive from neutral. The Index moved above its 20 day moving average. Short term momentum indicators are trending up. Technical score improved last week to 6 from -1. Strength relative to Gold turned positive.

Platinum dropped $14.20 per ounce (1.59%) last week. Trend remains up. Strength relative to S&P 500: positive. Strength relative to Gold: neutral. Trades above its 20 day moving average.

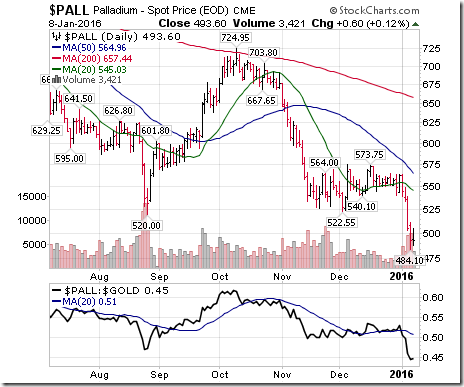

Palladium dropped $68.40 per ounce (12.17%) last week. Intermediate trend remains down. Strength relative to the S&P 500 and Gold is negative. PALL moved below its 20 day moving average. Short term momentum indicators are trending down. Technical score fell to -6.

Copper dropped $0.11 per lb. (5.16%) last week. Intermediate trend changed to down from up on a move below $2.00 per lb. Strength relative to the S&P 500 Index remains positive. Copper dropped below its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped to -2 from 6.

The TSX Metals & Mining Index plunged 50.50 points (14.42%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index changed to neutral from positive. The Index fell below its 20 day moving average. Short term momentum indicators are trending down. Technical score dropped last week to -4 from 1.

Lumber dropped $10.80 (4.19%) last week. Intermediate trend remains up. Strength relative to the S&P 500 remains neutral. Lumber fell below its 20 day moving average.

The Grain ETN added $0.06 (0.20%) last week. Intermediate trend remains down. Strength relative to the S&P 500 Index has turned positive. Units remain below their 20 day moving average. Short term momentum indicators are trending up. Technical score: 0.

The Agriculture ETF dropped $2.71 (5.83%) last week. Intermediate trend changed to down from neutral on a move below $45.58. Strength relative to the S&P 500 Index remains neutral. Units remain below their 20 day moving average. Short term momentum indicators are trending down. Technical score dropped last week to -4 from 0.

Interest Rates

The yield on 10 year Treasuries dropped 12.9 basis points (5.71%) last week. Intermediate trend remains up. Yield remains below its 20 day moving average. Short term momentum indicators are trending down.

Conversely, price of the long term Treasury ETF added $2.78 (2.31%) last week. Units moved above their 20 day moving average.

Other Issues

The VIX spiked 8.04 (44.15%) last week. Intermediate trend remains up. The Index remains above its 20 day moving average.

Short and intermediate term technical indicators are oversold for most equity indices and primary sectors, but have yet to show signs of bottoming.

Technical action by individual S&P 500 equities remains bearish. Last week 237 S&P 500 stocks broke support and only 6 stocks broke resistance

Fourth quarter earnings report start to appear this week. Alcoa traditionally is the first major company to report. Money center banks start reporting on Thursday and Friday. .

Analysts reduced fourth quarter earnings and revenues estimates again last week for S&P 500 companies. According to FactSet consensus earnings estimates for S&P 500 companies show a 5.3% decline on a year-over-year basis versus a decline of 4.7% reported last week. Most of the further reduction came from a lowering of estimates for Financial and Energy companies. Fourth quarter revenues are expected to drop 3.3% on a year-over-year basis. 83 companies have issued negative fourth quarter guidance and 28 companies have issued positive fourth quarter guidance. Earnings and revenues turn positive in the first quarter of 2016. Consensus for first quarter earnings on a year-over- year basis is a gain of 0.5% and consensus for first quarter revenues is a gain of 2.3%. Consensus for 2016 is a gain in earnings of 7.4% and an increase in revenues of 4.2%. The implication is that many S&P 500 companies will release lousy fourth quarter results, but with positive guidance.

Fourth quarter earnings prospects for TSX 60 companies are more encouraging than consensus estimates for S&P 500 companies. Consensus estimates for TSX 60 companies show that approximately half report higher earnings on a year-over-year basis and the other half will report lower earnings. Weakness in the Canadian Dollar relative to the U.S.Dollar will help.

The El Nino effect on equity markets is expected to be positive until at least the end of February

International events are a focus. China’s handling of monetary policy remains uncertain. Negotiations to reform Greece’s pension plans are an issue. Efforts to restrain North Korea’s intransigence on nuclear bomb production remain a concern.

Economic news this week is expected to show a modest decline in U.S. economic growth rate.

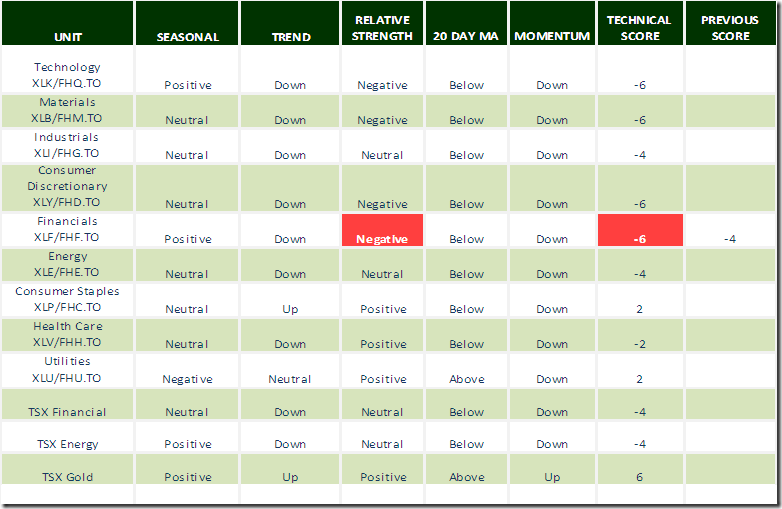

Sectors

Daily Seasonal/Technical Sector Trends for January 8th 2016

Green: Increase from previous day

Red: Decrease from previous day

Interesting Chart

Nice breakout by Gold in Canadian Dollars on Friday! Since its low in early December, Gold in Canadian Dollars has gained over 12%. Positive for Canadian gold producers!

StockTwits Released on Friday @EquityClock

Risk of a substantial topping pattern for equity markets has increased exponentially with Thursday’s breakdown.

Technical action by S&P 500 stocks to 10:00 AM: Quiet. Breakdowns: $KORS, $STX. No breakouts.

Editor’s Note: After 10:00 AM, technical deterioration by S&P 500 stocks was significant. Another 13 stocks broke support and none broke resistance

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca