by Don Vialoux, Timingthemarket.ca

StockTwits released yesterday @equityclock

Technical action by S&P 500 stocks to 10:15: Bearish. 31 stocks broke support (including 9 Financials and 7 Industrials). No break outs.

Editor’s Note: Another 27 S&P 500 stocks broke support after 10:15 AM. No break outs.

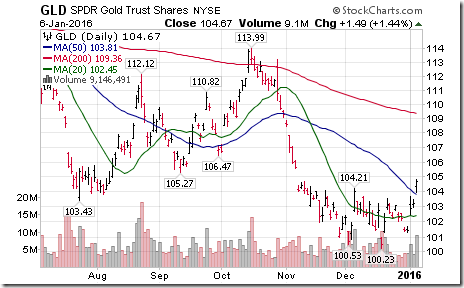

Nice breakout by $GLD above resistance at $104.21 to complete a base building pattern!

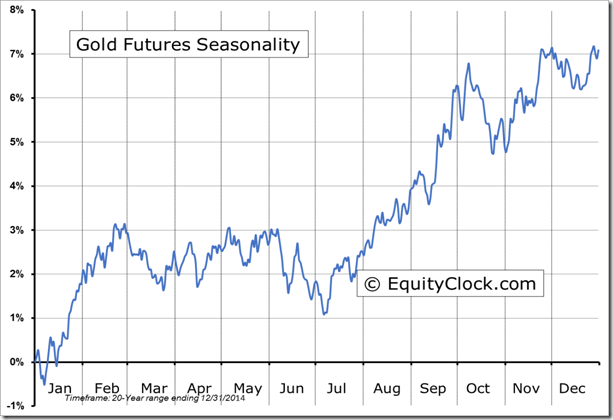

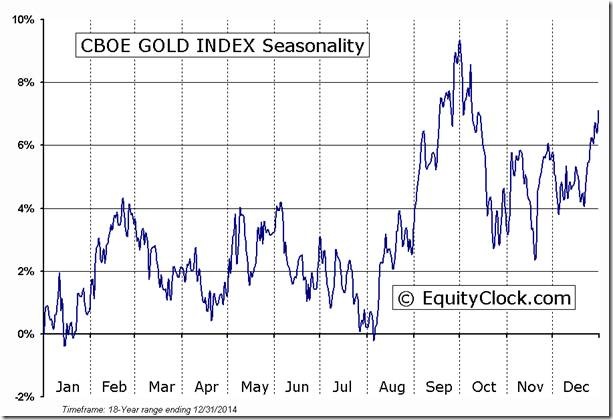

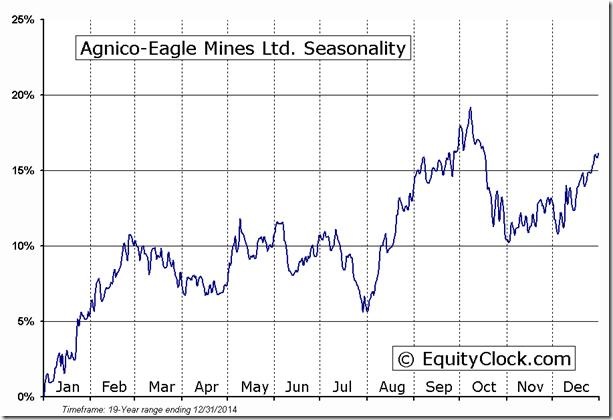

‘Tis the season for strength in Gold until the end of February! $GLD

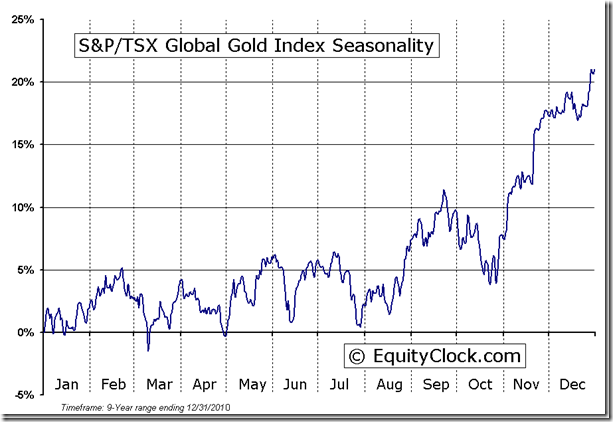

Cdn. Gold equities and related ETF breakouts this morning: $XGD.CA, $ABX.CA, $AEM.CA

‘Tis the season for strength in TSX Gold Index to the end of February!

Notably weaker this morning were S&P 500 Financials. Break below 312.06 extends downtrend $XLF

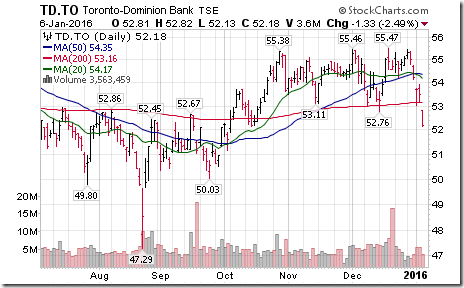

$TD.CA joined weakness in U.S. Financials by breaking support at $52.76.

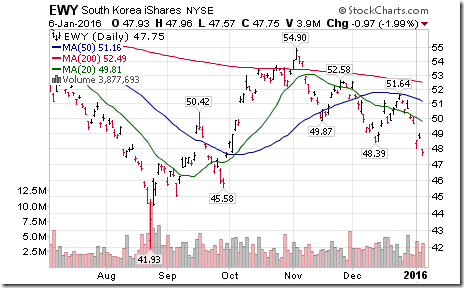

South Korean ETF $EWY broke below support at $48.39 to extend downtrend in response to North Korea nuclear test.

Cdn. Pacific $CP.CA broke support at $168.25 to extend a downtrend.

Nice breakout by the junior Gold ETF $GDXJ above $20.09 to complete a base building pattern.

‘Tis the season for U.S. Gold equity indices to move higher until the end of February!

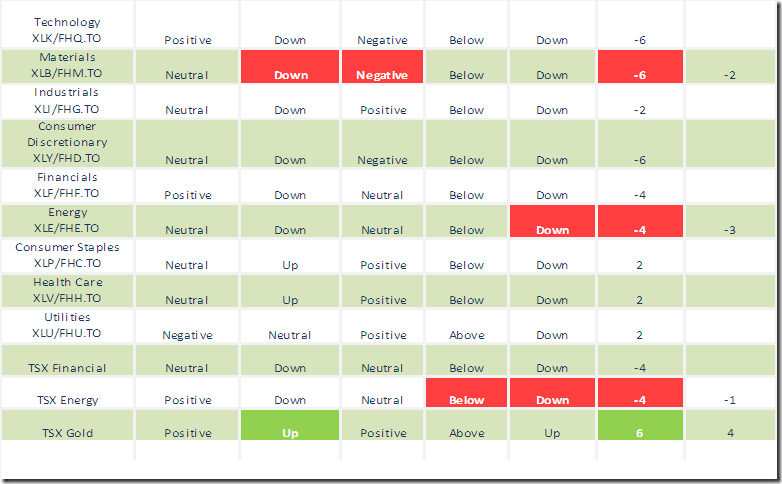

Trader’s Corner

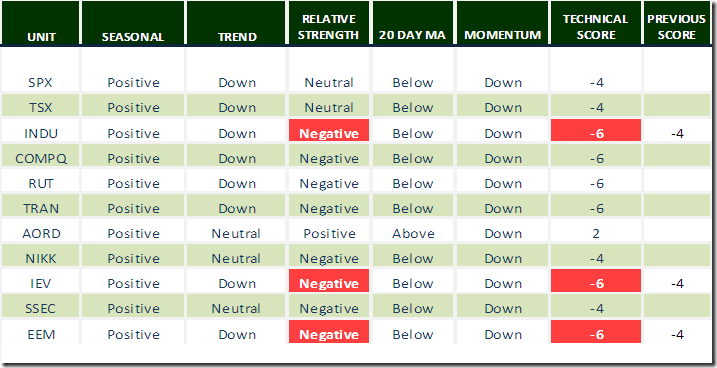

Daily Seasonal/Technical Equity Trends for January 6th 2016

Green: Increase from previous day

Red: Decrease from previous day

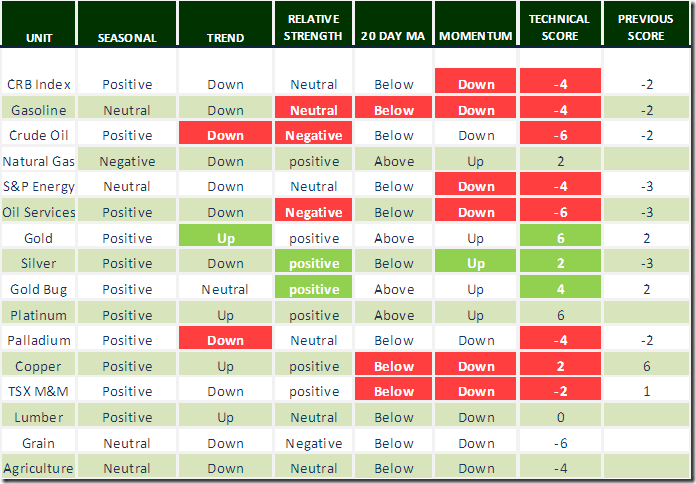

Daily Seasonal/Technical Commodities Trends for January 6th 2016

Green: Increase from previous day

Red: Decrease from previous day

Daily Seasonal/Technical Sector Trends for January 6th 2016

Green: Increase from previous day

Red: Decrease from previous day

Interesting Charts

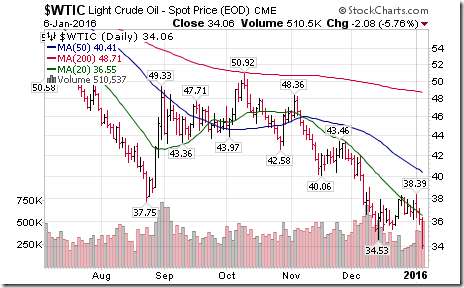

Weakest sector yesterday was energy following a breakdown to new lows by crude oil and gasoline prices.

Strange action in Palladium given strength in other precious metals!

Percent of S&P 500 stocks trading above their 50 day moving average already has moved down to 25% and is deeply oversold. However, evidence of a bottom has yet to appear.

The Canadian Dollar fell to a 12 year low.

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

A Note from Michael Campbell

Editor’s Note: Michael’s annual conference in Vancouver is one of the best in Canada and is well worth attending. Below is information about the conference.

P.S. Mr. Vialoux is scheduled to appear on Michael’s radio show (CKND) at approximately Noon Toronto time on Saturday January 16th

Did you know…

· There are $3,744,000,000,000 worth of negative yield government bonds in circulation in Europe. That represents 40% of the total.

· The US hasn’t created a single manufacturing job in 2015. Actually they’ve lost 6,600 manufacturing jobs.

· At $21,000 per person, ($294 billion total), Ontario has the highest debt per capita in the world of any non-sovereign entity.

· 23 stock markets crashed in 2015.

· In China, $1.2 trillion US dollars were borrowed in 2015 to pay interest on existing debt. China’s total debt is estimated at $30 trillion.

· The S&P 500 is still at the same level it was in August 2014 – 502 days and counting.

Hi ,

This is just part of the context that we’re dealing with as investors. Throw in facts like there are more people without jobs in the US, France, Spain and Greece than at any time in history and the fact that markets are still within shouting distance of all time highs in the US and parts of Europe, and it’s not tough to see why people are confused.

As legendary investor Jim Rogers recently stated – thanks to central bank action, "we are all floating around on a sea of artificial liquidity right now.” The question is – how and when is it going to end?

In China the answer may well be – it already has. As this week has demonstrated, despite unprecedented intervention by the Chinese government and central bank the market turmoil continues. It’s already started in Japan where the central bank now owns over 53% of all Exchange Traded Funds and has been forced to buy hundreds of billions worth of stocks in its government pension plan in order to support the Nikkei Index. It is already ending in Venezuela and Brazil.

But what about Europe and North America? When does the music of excessive debt, especially at the state and provincial level, combined with unaffordable entitlement promises stop? And more importantly what are the repercussions for every financial market?

This is where we can help

What I love about the markets is the scorecard. In the end there is no BS, no stories, no excuses – just results. And the results of recommendations at the World Outlook Financial Conference are crystal clear.

We nailed the top in oil and the subsequent decline to the $34 level thanks to energy analyst Josef Schachter. This year Josef will talk about why he thinks a bottom is forming.

At the Conference, and on MoneyTalks, we called the dramatic fall in the Canadian dollar when it was still above par. This year John Johnston, the man who shocked audiences three years ago in predicting that the loonie could hit 70 cents is back. And wait til you hear what he sees coming now.

The Outlook Conference’s track record on real estate is exceptional thanks to the work of Ozzie Jurock. As early as 2011 Ozzie told audiences to get into the Phoenix area and now with the appreciation of the US dollar and the recovery in prices, investors who followed the advice have done incredibly well.

This year Keystone’s Ryan Irvine will reveal the 2016 World Outlook Small Cap Portfolio. While past performance is not a guarantee of future results, it is impressive that the Outlook Small Cap portfolio has achieved double digit returns every single year.

Arguably, the most incredible forecast at any World Outlook Conference was Martin Armstrong’s prediction in 2013 that Russia would invade Ukraine in late February the following year immediately after the close of the Olympics. That’s not the first time Martin has wowed audiences with incredibly accurate predictions – and thankfully Martin will be back this year. And there are no shortage of issues to talk about.

These results have not been achieved by accident. Our analysts have been chosen precisely because they do have strong track records. No, they are not right every time but their uncanny ability to read the various investment markets while employing proven risk management techniques has clearly raised their probability of success dramatically. Which, by the way, explains why if you were to personally book a single hour with any of them the cost would start at $3,700. Yet at the World Outlook Financial Conference you can get access to them and get your individual questions answered for as little as $129.

I’m Really Excited About This Change

This year for the first time, we’re featuring a special Real Estate Investing section beginning at 1:00 pm on Friday, January 29, hosted by Ozzie and featuring one of my favourites – Vision Capital’s Jeff Olin. Jeff is one of my favourites not only because he is a nice guy but because he also told us specifically on MoneyTalks two years ago how to play the commercial real estate market downturn in Calgary. And that’s been a big winner.

Jeff’s insights and recommendations will be worth the price of admission alone.

Finally

The bottom line is that we take your time and money seriously. With that in mind we have put together our best Conference ever in the hope of making you a significant amount of money and just as importantly, saving you money in the chaos that’s to come.

I promise it will be worth the time for anyone concerned about their personal finances and investment returns.

Sincerely,

Michael Campbell,

Host of MoneyTalks

Conference Details

Where: Westin Bayshore, Downtown Vancouver

When: Friday, January 29th beginning at 1:00pm with the Real Estate Outlook, and all day Saturday, January 30, 2016

Agenda: http://moneytalks.net/agenda.html

Cost: $129 for a full access General Admission pass.

To book Your Ticket: CLICK HERE

or Call # 604.926.6848 – email info@moneytalks.net

P.S. As you may know I am hugely interested in educating our younger generation. And thanks to the sponsorship of the Online Investment Club service at myvoleo.com we are able to offer a complimentary ticket for young people/students when you purchase a ticket for yourself. And I might add that in the past those that took advantage of the offer really enjoyed the Conference. It is a great way to share/create a common interest with your children – no matter what their age.

P.P.S. Can’t make it in person? No worries, we will have the archive video – shot in HD this year with a four camera crew – available for viewing within 48 hours of the event. It is a great way to access all these speakers and more on an unlimited basis for a year. CLICK HERE to order

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed.

Copyright © DV Tech Talk, Timingthemarket.ca