by Don Vialoux, Timingthemarket.ca

Editor’s Note: Mr. Vialoux is scheduled to appear on BNN at 7:45 AM EST tomorrow.

StockTwits Released Yesterday @equityclock

Technical action by S&P 500 stocks to 10:00: Bullish. Breakouts: $MKC, $EQR, $KIM, $MAC, $MHFI, $NDAQ, $PLD, $HSIC, $PKI, $VAR, $WAT, $SNA, $SYMC, $AEE, $EQIX

Editor’s Note: Another 14 S&P 500 stocks broke intermediate resistance after 10:00 AM EST. Notable were Amazon.com, Pepsico and Alphabet (GOOG)

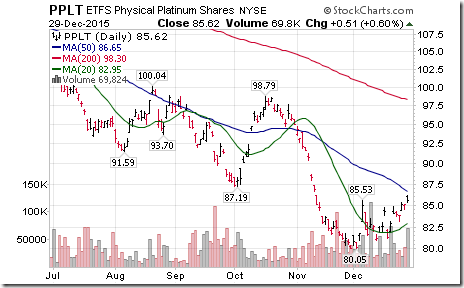

Nice breakout by the Platinum ETN $PPLT above resistance at $85.53 to complete a base building pattern!

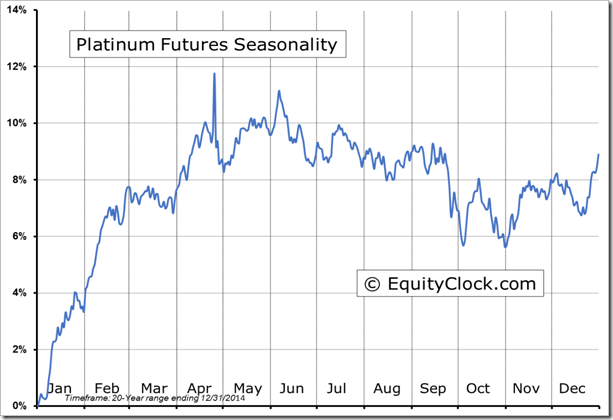

‘Tis the season for Platinum and PPLT to move higher until late April!

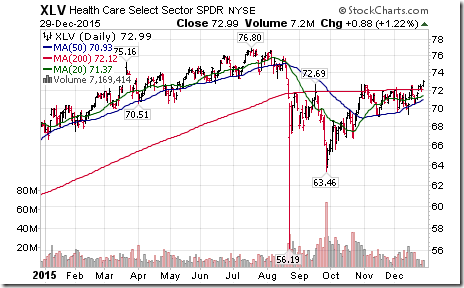

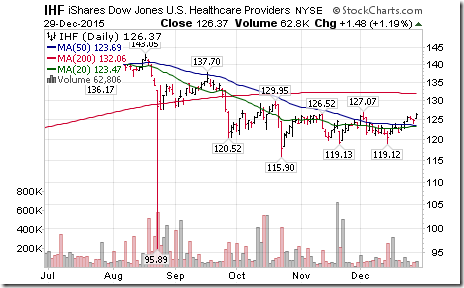

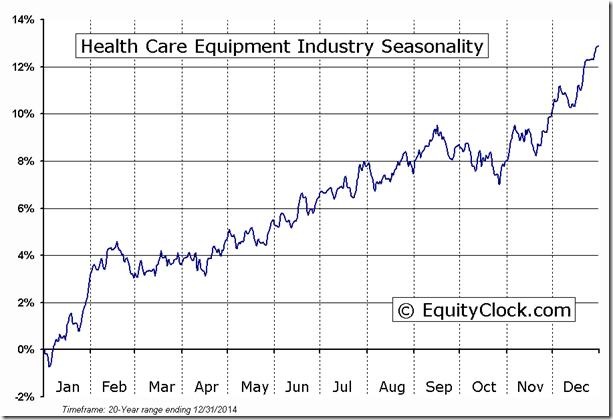

Nice breakout by Healthcare SPDRs $XLV above $72.69 to complete a base building pattern!

Healthcare SPDRs were helped by seasonal strength in IBB, IHI and IHF

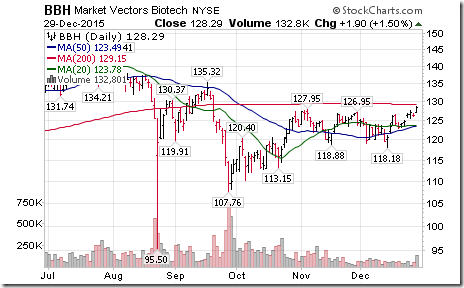

Nice breakout by $BBH above resistance at $127.95 to complete a base building pattern!

Editor’s Note: Subsequently, IBB completed a similar pattern on a breakout above $342.86.

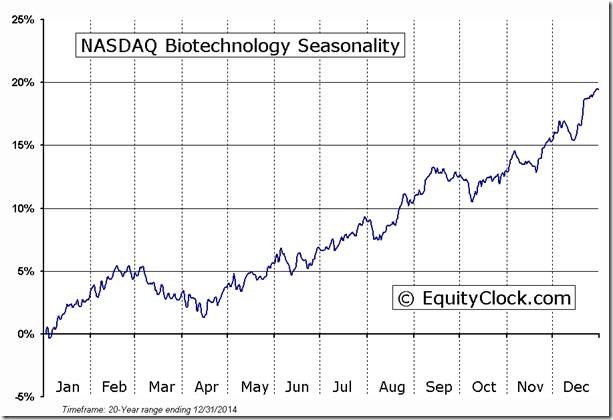

‘Tis the season for strength in Biotech until mid-February! $IBB, $BBH

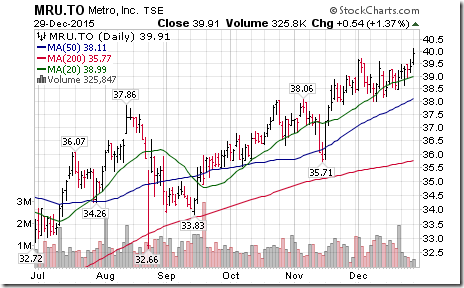

Nice breakout by Metro above resistance at $39.72 to extend an intermediate uptrend!

Stronger than expected U.S. Sales this Christmas season prompted a break by $AMZN above $684.82 to an all-time high.

Trader’s Corner

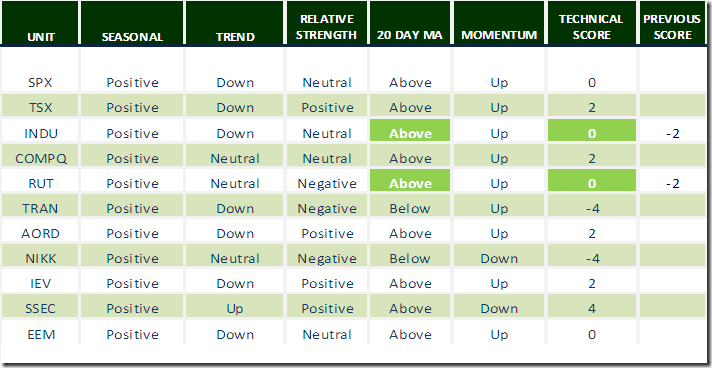

Editor’s Note: Technical scores generally moved higher yesterday thanks mainly to markets moving above their 20 day moving average.

Daily Seasonal/Technical Equity Trends for December 29th 2015

Green: Increase from previous day

Red: Decrease from previous day

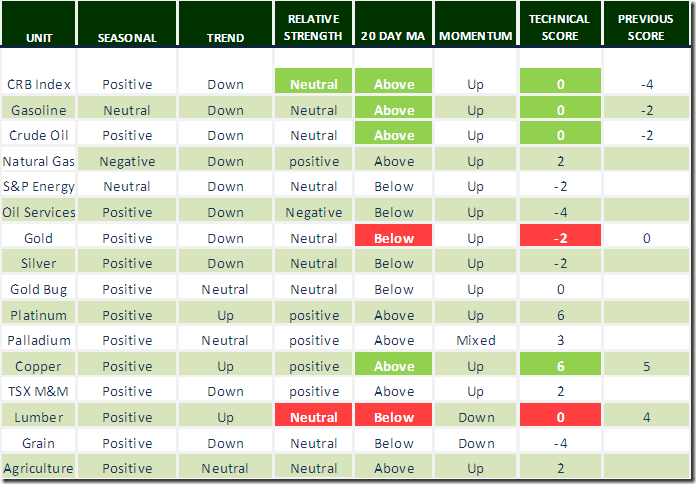

Daily Seasonal/Technical Commodities Trends for December 29th 2015

Green: Increase from previous day

Red: Decrease from previous day

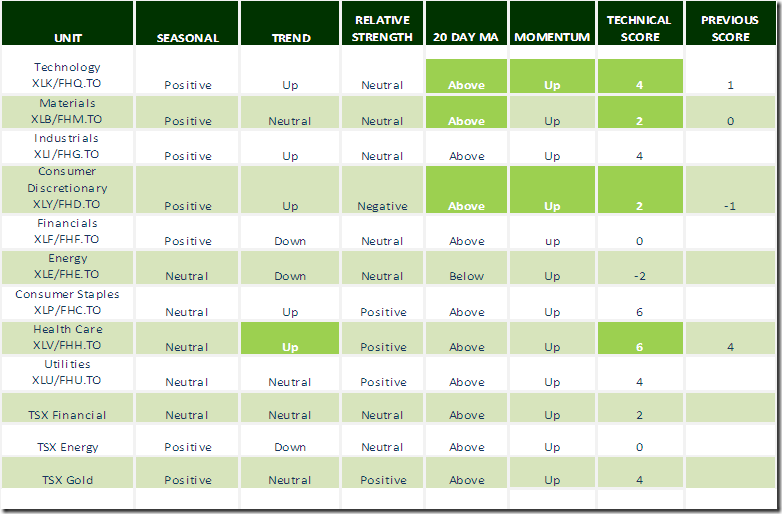

Daily Seasonal/Technical Sector Trends for December 29th 2015

Green: Increase from previous day

Red: Decrease from previous day

FP Trading Desk Headlines

FP Trading Desk headline reads, “TSX to outperform S&P 500 in2016”. Following is a link:

http://business.financialpost.com/investing/trading-desk/tsx-to-outperform-sp-500-in-2016-bmo

FP Trading Desk headline reads, “Loonie is just two cents shy of 1986 when oil was $10 a barrel. Time to buy both says David Rosenberg”. Following is a link:

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca