by Don Vialoux, Timingthemarket.ca

StockTwits Released Yesterday @equityclock

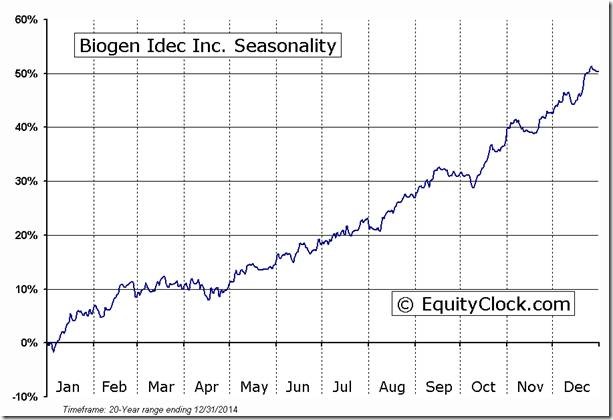

Nice breakout by Biogen $BIIB above resistance at $304.37 to complete a base building pattern!

‘Tis the season for Biogen $BIIB to move higher until at least the end of February!

Trader’s Corner

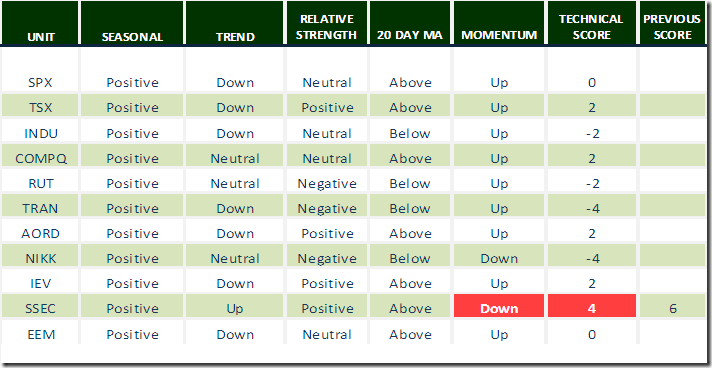

Daily Seasonal/Technical Equity Trends for December 28th 2015

Green: Increase from previous day

Red: Decrease from previous day

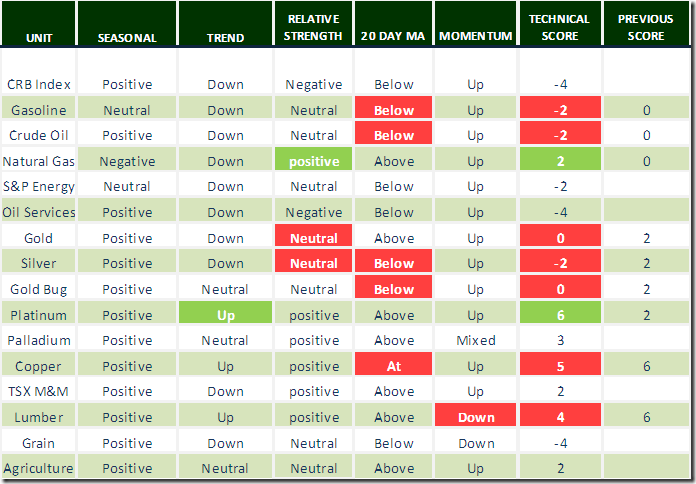

Daily Seasonal/Technical Commodities Trends for December 28th 2015

Green: Increase from previous day

Red: Decrease from previous day

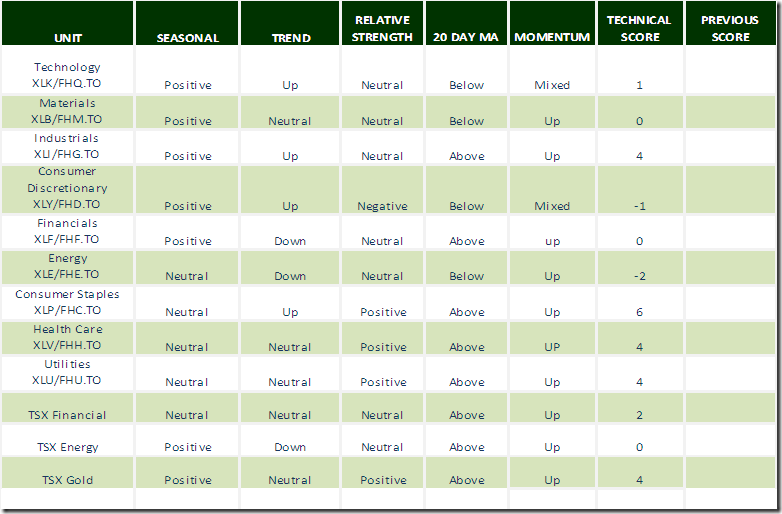

Daily Seasonal/Technical Sector Trends for December 28th 2015

Green: Increase from previous day

Red: Decrease from previous day

Interesting Charts

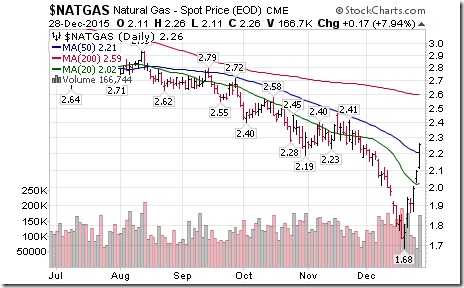

Natural Gas prices soared as colder than average rolled into eastern U.S. and Canada

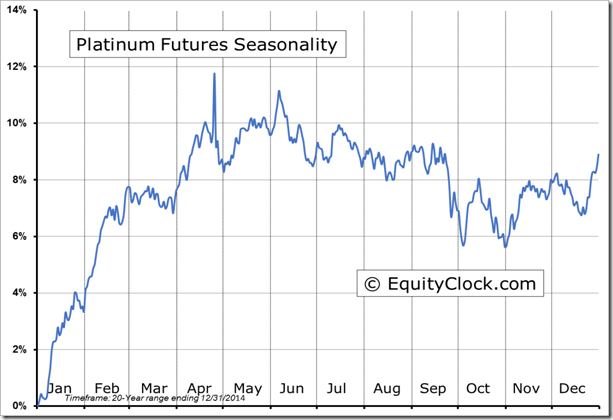

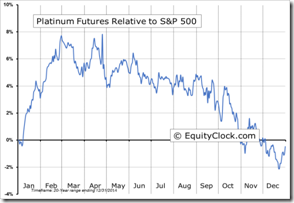

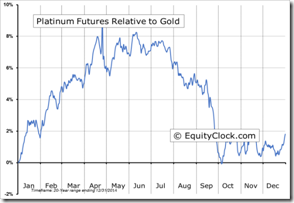

Platinum prices briefly broke above resistance at $888.20 to complete a base building pattern, but subsequently eased in late trading. Strength relative to the S&P 500 Index is positive. ‘Tis the season for Platinum and its related ETN (PPLT) to move higher!

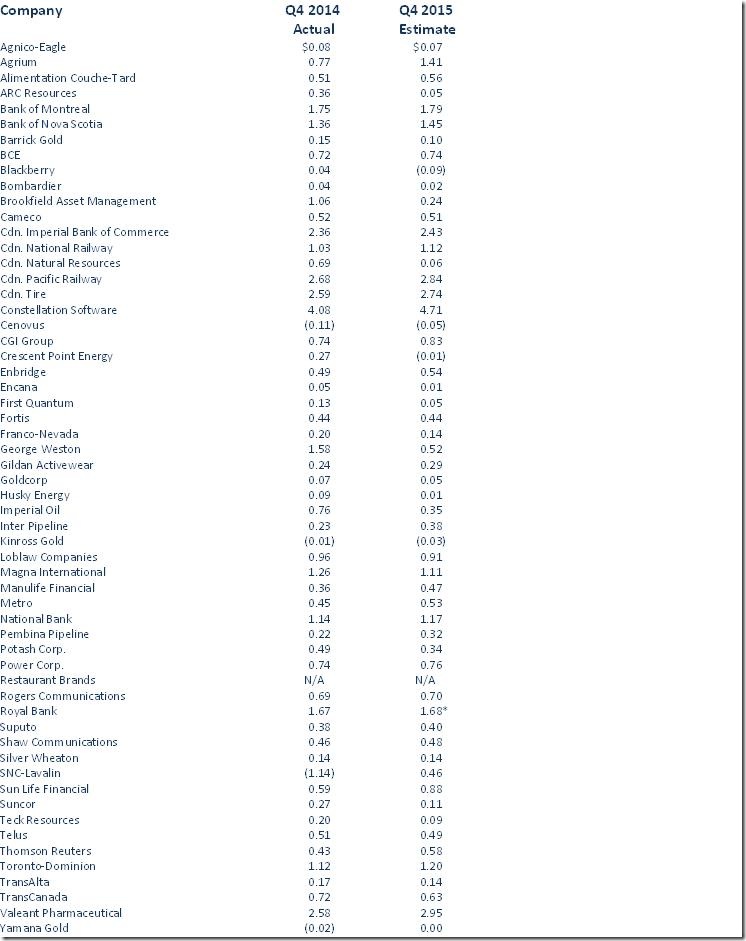

Consensus Fourth Quarter Earnings Per Share for S&P/TSX 60 Companies

The fourth quarter earnings picture for Canada’s top 60 companies is mixed. Consensus estimates show an average (median) gain on a year-over-year basis of 0.6%. Twenty seven companies are expected to report lower earnings, thirty companies are expected to report higher earnings, two companies are expected to report no change and comparable data for one company was not available. Not surprising, energy and mining stocks are expected to report the largest year-over-year declines related to lower commodity prices. Companies expected top percentage gains include Constellation Software, CGI Group, Inter Pipeline, Manulife Financial, Pembina Pipeline and Sun Life Financial. Following is the data:

*Median

Source: www.globeinvestor.com

Special Free Services available through www.equityclock.com

Equityclock.com is offering free access to a data base showing seasonal studies on individual stocks and sectors. The data base holds seasonality studies on over 1000 big and moderate cap securities and indices. To login, simply go to http://www.equityclock.com/charts/ Following is an example:

Disclaimer: Seasonality and technical ratings offered in this report by www.timingthemarket.ca and www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

Copyright © DV Tech Talk, Timingthemarket.ca