High-Yield: Flows over Fundamentals

by Anthony Valeri, Investment Strategist, LPL Financial

KEY TAKEAWAYS

- The origin of high-yield weakness has come from the lowest-rated tiers of the high-yield market but has infected the broader market.

- The average yield advantage, or spread, of high-yield bonds to comparable Treasuries increased to the highest level since the summer of 2011 and the peak of European debt concerns

- We believe the high-yield bond market offers good value at current prices for suitable long-term investors but the near-term still looks challenging as an illiquid trading environment persists.

[DOWNLOAD FULL PDF]

High-yield bond selling, or the threat of selling, has sparked one of the worst sell-offs in the high-yield bond market since the summer of 2011 and the peak of European debt fears. The origin of high-yield weakness has come from the lowest-rated tiers of the high-yield market but has infected the broader market. Last week’s redemption freeze by an $800 million high-yield strategy, and news of a similar halt by a smaller fund over the weekend of December 12–13, 2015, intensified pressure on the high-yield bond market. Underlying financial fundamentals do not change so quickly, but the sharp change in market prices shows what lopsided selling and fears of contagion can do.

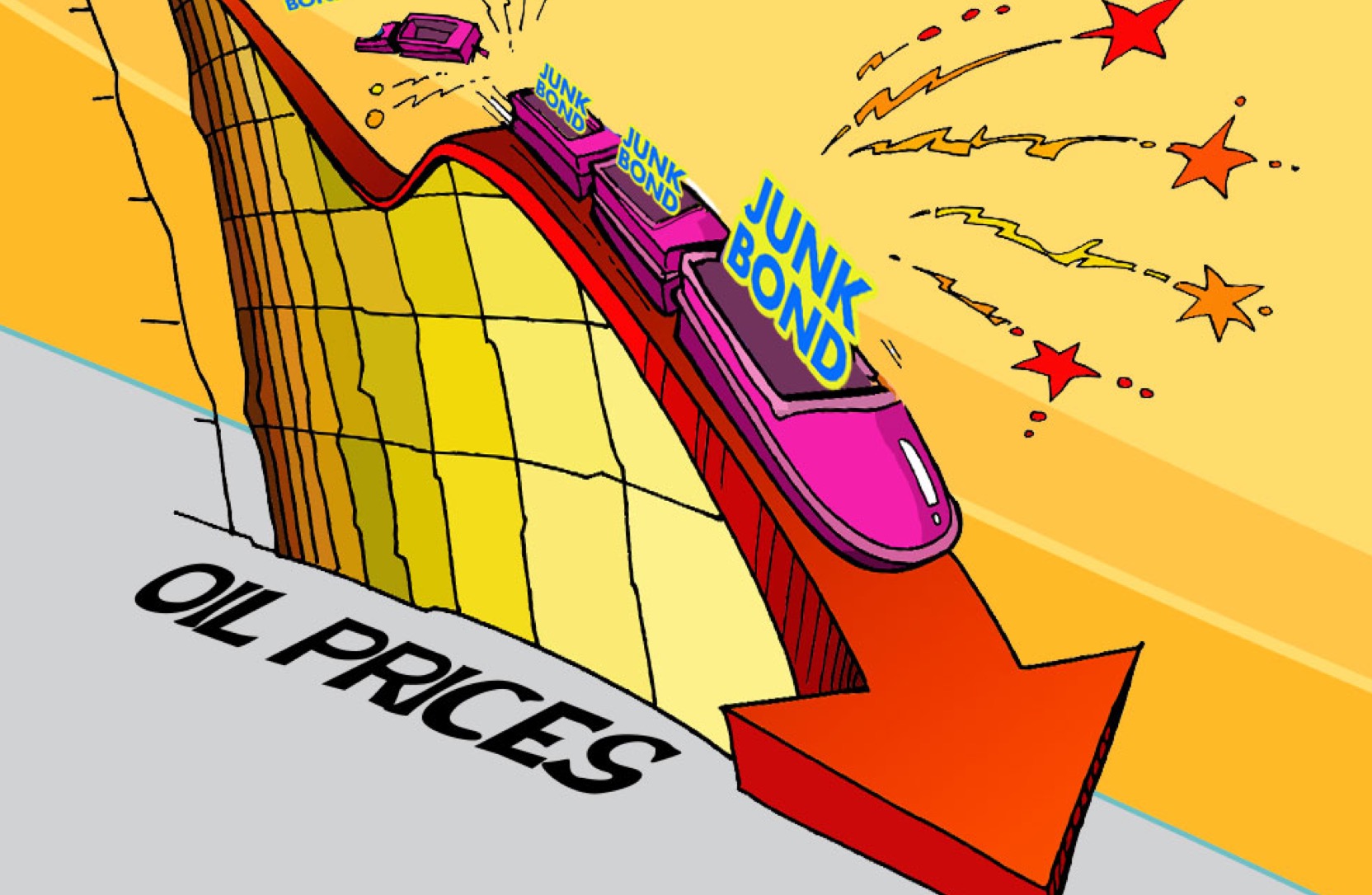

The lowest-rated segments of the high-yield bond market, bonds rated CCC or lower, began to deteriorate quickly starting mid-November 2015. The yield differential between the lowest-quality and higher-quality tiers of the high-yield bond market increased sharply [Figure 1] and grew to the widest margin since the financial crisis of 2007–09. The widening yield gap reflects the growing risk premium required by investors to own the least credit worthy borrowers within the high-yield market. Issuers rated CCC or lower comprised the vast bulk of the funds that were forced to initiate a redemption freeze to avoid selling bonds at fire sale prices.

High-yield/junk bonds are not investment-grade securities, involve substantial risks, and generally should be part of the diversified portfolio of sophisticated investors.

UNIQUE SECTOR

Investors and strategies that concentrate on bottom rung CCC- and lower-rated, or distressed, issuers are a unique and niche bunch. When things go wrong, there are few buyers of such debt, especially in a post-2008 world where risk appetites among the largest market making financial firms are greatly reduced (due to Dodd-Frank regulation and the Volcker Rule). Distressed investors have had a very difficult 2015 and even a small amount of selling pressure can go a long way to move prices, which helps explain the sudden and sharp change in yields since late November 2015.

News of forced sellers, even if confined to a small market subsection, can spread and lead to broader weakness. Volatile markets often force institutional investors to “sell what you can” and include higher-quality issues within the high-yield market. Through December 14, 2015, the Barclays Very Liquid High Yield Index (an index comprised of larger, higher-rated issuers) is down nearly 1% more than the broad Barclays High Yield Bond Index for the month.

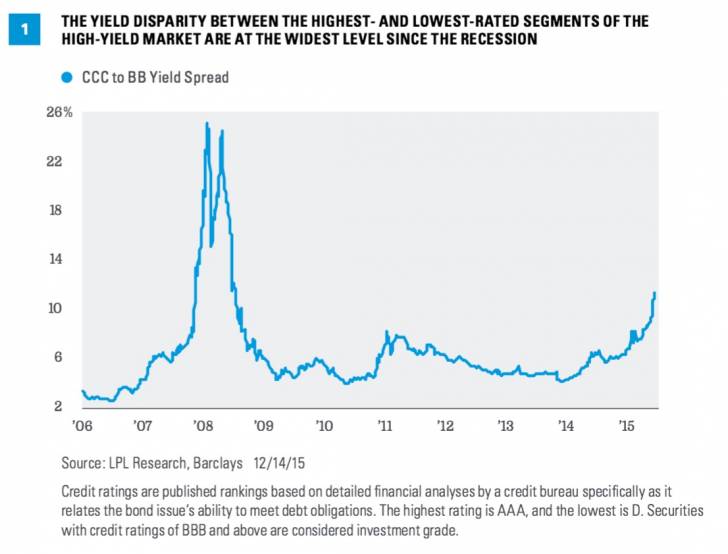

In response, the average yield advantage, or spread, of high-yield bonds to comparable Treasuries increased to the highest level since the summer of 2011 and the peak of European debt concerns [Figure 2]. The wider the yield spread, the cheaper high-yield bonds are, and vice versa. Monday’s (December 14, 2015) closing yield spread of 7.4% is well above the long-term average of 5.8% and more than compensates for the modest increase in defaults witnessed so far in 2015 (also illustrated in Figure 2).

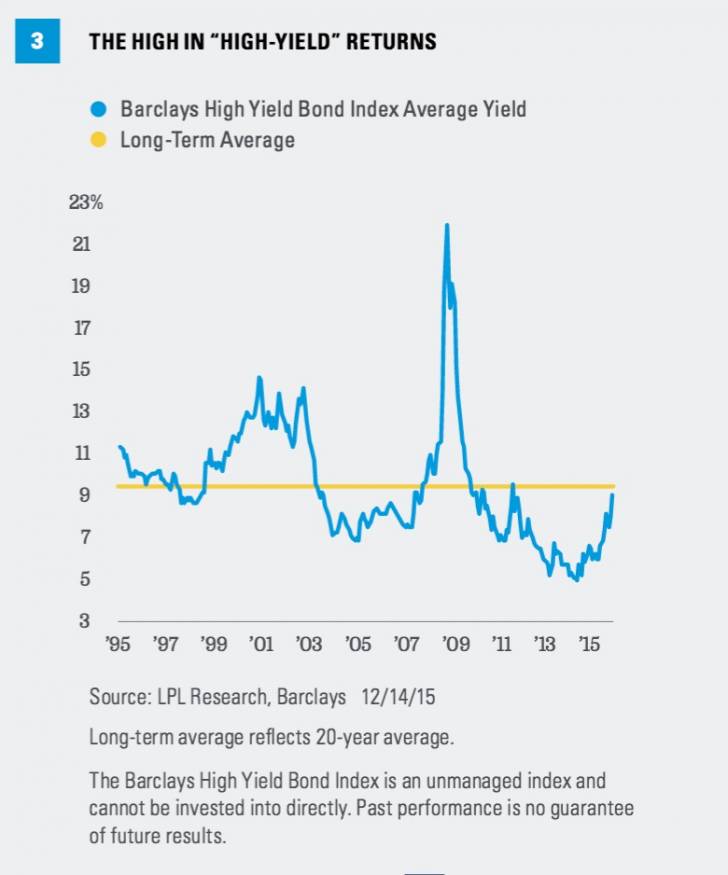

The average yield-to-maturity of high-yield bonds closed Monday, December 14, 2015, at 9%, near the long-term average of 9.4% [Figure 3].

NOT ALL ENERGY & DEFAULTS

The drop in oil prices to new post-recession lows has been a factor in recent weakness but not the primary detractor. Since mid-2015, the decline in oil prices and the energy sector’s 15% composition (now 12%) of the high-yield bond market was, and still is, a key driver.

Rising defaults, historically a key driver of high-yield bond spreads, have also taken a back seat. Energy companies comprise roughly one-third of defaults in 2015 (according to Moody’s data), but that only pushed up the 12-month trailing U.S. default rate to 3.0% as of the end of November 2015. Including energy, defaults are expected to increase to 3.9% over the coming 12 months according to Moody’s, which remains below the long-term historic average of 4.5%.

IS THIS A REPEAT OF SUBPRIME AND 2008?

Events of the past week are not indicative of leveraged[1] investors with linkages to the banking system—a key difference between now and events leading up to the financial crisis. In the lead-up to 2008, strategies using borrowed funds suffered amplified losses. The portfolios that froze redemptions are not leveraged and are attempting to restrain disorderly sales at fire sale prices due to an extremely illiquid market. The same financial regulation that has contributed to less liquid trading markets has restricted the big banks and financial institutions from making leveraged investments in the riskiest segments of the high-yield bond market. Leveraged entities such as special purpose vehicles (SPV) or special investment vehicles (SIV) that provided leverage in the lead-up to the financial crisis simply do not exist today. Therefore, we do not see current events as the same as those leading up to the financial crisis.

CURRENT VOLATILITY MAY PERSIST

We expect volatile trading conditions to persist; reasons that argue against a quick recovery include:

· Thinly traded year-end markets. As the holidays approach and 2015 winds down, trading becomes more limited and market makers are less likely to support trading, potentially leading to still weaker prices. Therefore, the timing of high-yield weakness has exacerbated weakness.

· Focus on quality. Related to the above, year-end leads to conservatism by market making firms. Compounded by financial regulation that incentivizes firms to avoid lower-quality assets, market making firms are unlikely to hold lower-rated positions over year-end, removing a potential source of price support.

· Another seller. Questions over the presence of another forced seller will likely keep investors conservative until the new year arrives at a minimum. In an uncertain environment, investors are unlikely to sustain a move higher in prices.

· Federal Reserve (Fed) rate hike uncertainty. As this publication goes to print, a Fed rate hike is priced with an 80% probability according to futures, but not a certainty. The Fed’s decision is accompanied by forecasts of future rate changes as well as a press conference—multiple moving parts for investors to assess. (For more on this, see the Weekly Economic Commentary, “FOMC FAQs.”)

CONCLUSION

We believe the high-yield bond market offers good value at current prices for suitable long-term investors but the near-term still looks challenging. Current default expectations in both the overall high-yield market and in the energy sector, 9% and 16%, respectively,[2] are overly pessimistic, but they take a backseat to trading flow dynamics, which can overpower fundamental drivers in the short-run.