Value Investing Requires Patience ... a LOT of Patience – Ask Cliff Asness

by Welsey Gray, Ph.D., Alpha Architect

Value investing was a lot easier in 2012 and 2013 when our value approach beat the market by a substantial margin and we had a reasonable edge on other active value players. But now that we have lived through 2014 and 2015, most value approaches (simple, complex, quant, human, small, large, etc.) have some degree of “suckiness.” If you don’t believe us, check our post on “The Value Pain Train.”

We are continually trying to educate investors on the need for discipline and patience when implementing highly active value exposures that have a fighting chance of beating the gloriously cheap and tax-efficient Vanguard S&P 500 fund. As we often say, active investing is simple, but not easy. One needs to be wired differently and their capital needs to have the long duration to match the long duration of active value strategies. Matching short duration capital with long duration strategies doesn’t work out well. (Read the literature on bank runs to find out more).

And while we spend an inordinate amount of time sharing research and our ideas to get investors to internalize discipline and patience, sometimes a great anecdote can go a long way. Hearing about the adversity others have suffered while trying to maintain discipline to a value strategy can sometimes provide valuable perspective for those who are struggling today.

To facilitate this effort I went looking for interesting case studies and I ran across an outstanding presentation by Cliff Asness at the 2014 Grant’s Interest Rate Observer Conference (an event I used to attend when I wanted to feel bad about the future and find bearish investment calls that never make money).

Digging into the Asness Talk

Cliff’s talk covers a lot of ground, but I’ll focus on the elements related to value investing.

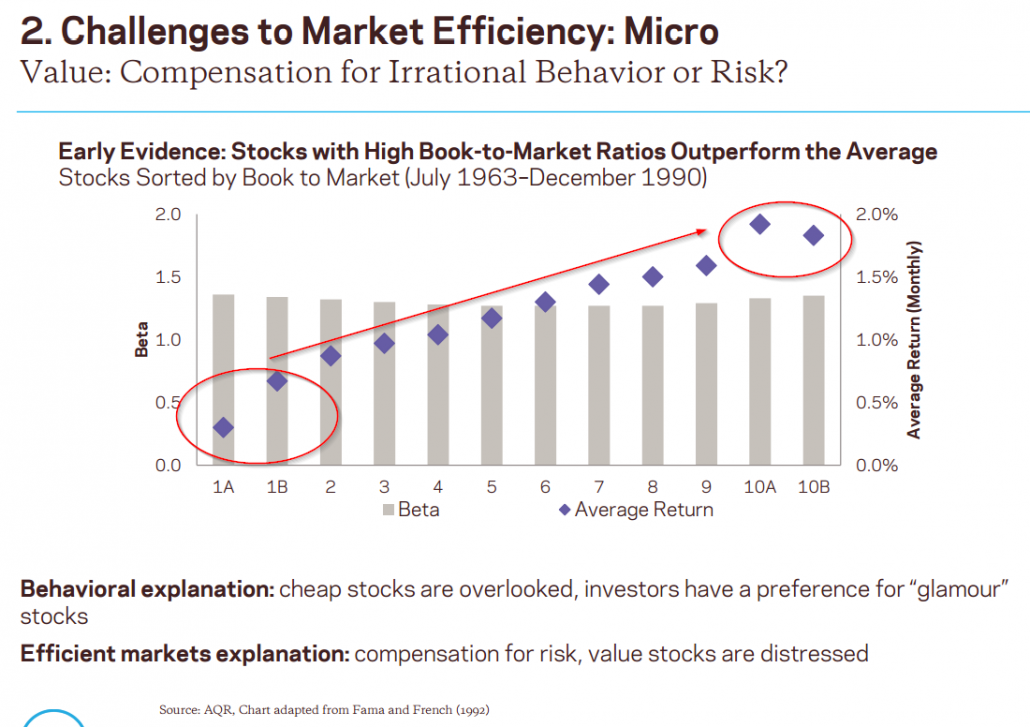

First, he highlights the baseline evidence related to “cheap” stock investing:

The academic evidence highlights that over long periods cheap stocks beat expensive stocks. Great! Looks good so far.

What about the real-world?

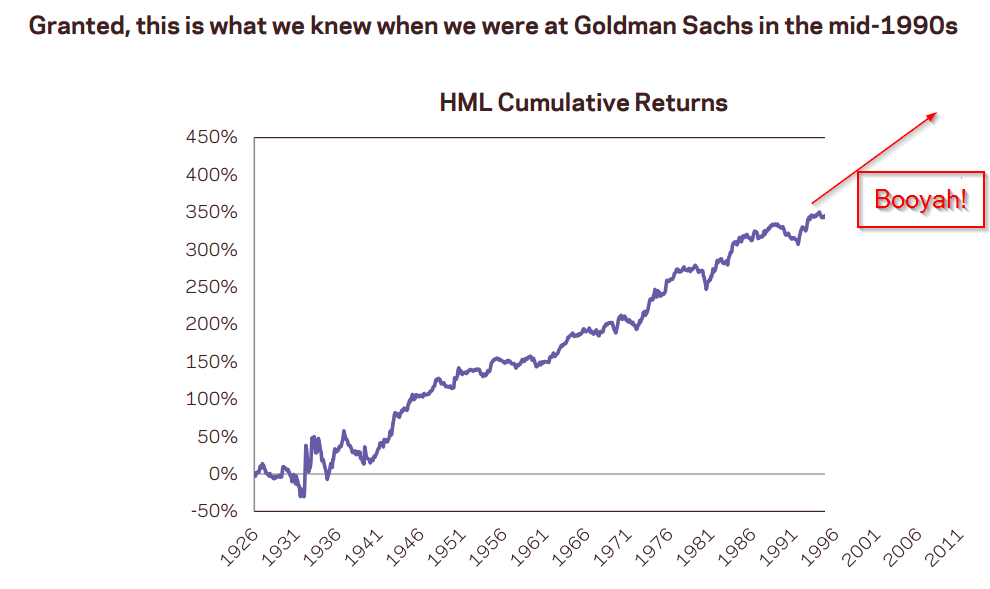

Cliff highlights the pretty chart of a long/short portfolio (cheap minus expensive) through the 1990’s. Wow, even better! This strategy looks pretty bullet-proof. What a good looking backtest!

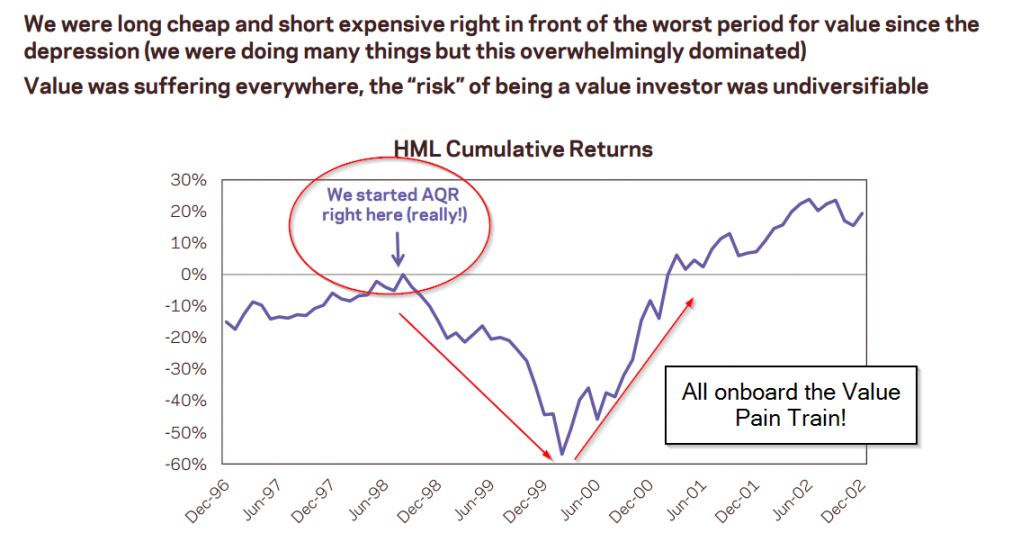

And then, as Cliff put his plan into motion, Murphy’s law asserted itself…

Ay, caramba! Launching into a 50%+ drawdown is always a challenge! Can you imagine the conversations with investors Cliff had in December ’98, “well, value has underperformed, but let’s stay the course,” and then in June ’99, “I know this is bad, but I still believe in our process,” and then in December ’99, “Wow, this is the worst stretch of value underformance since the depression, and by the way, don’t mind the beads of sweat on my upper lip.”

Conclusion

Value investing can work, but one needs to expect an occasional pain train of epic proportions. It’s just inevitable. And pain is a great thing. As the Marines say, pain is weakness leaving the body. Pain is cleansing. The same goes in financial markets. Market pain –especially relative performance pain — shakes out the weak hands and sets patient investors up for higher expected success. If active value was an easy strategy to manage and career risk was limited–everyone would do it. And if a lot of capital is chasing the same idea, the strategy will be priced efficiently. Fortunately, markets aren’t perfectly efficient, but unfortunately, they are extremely competitive. And most of the competitive capital is focused on picking off low hanging fruit that is easy to arbitrage and doesn’t require career suicide.

This post, authored by Wesley Gray, Ph.D., originally appeared on Alpha Architect.

Copyright © Alpha Architect