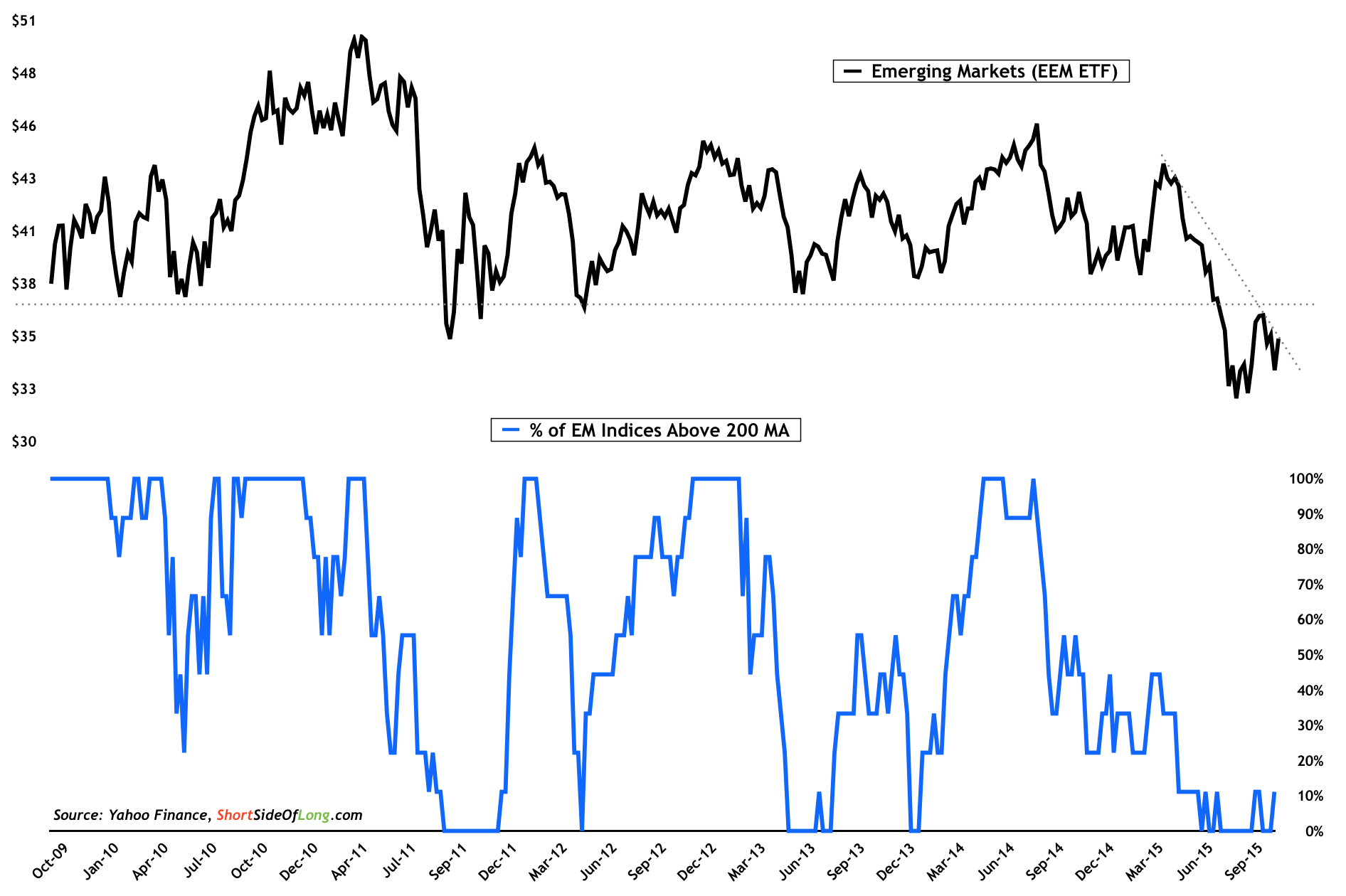

Could Emerging Markets Rebound?

Emerging Markets breadth remains very weak and oversold

Just a quick update today. Emerging Market equities remain in a downtrend on a technical basis, while the majority of the individual EM index components are still trading below their respective 200 day moving averages. The rebound from the August 25th low hasn’t been as strong as the Developed Markets, especially US equities. However, it is prudent to remind investors that some of these stock markets, in particular Russia and Brazil, are trading at ridiculously low valuations and if some positive surprises occur in 2016, upside could be very strong.

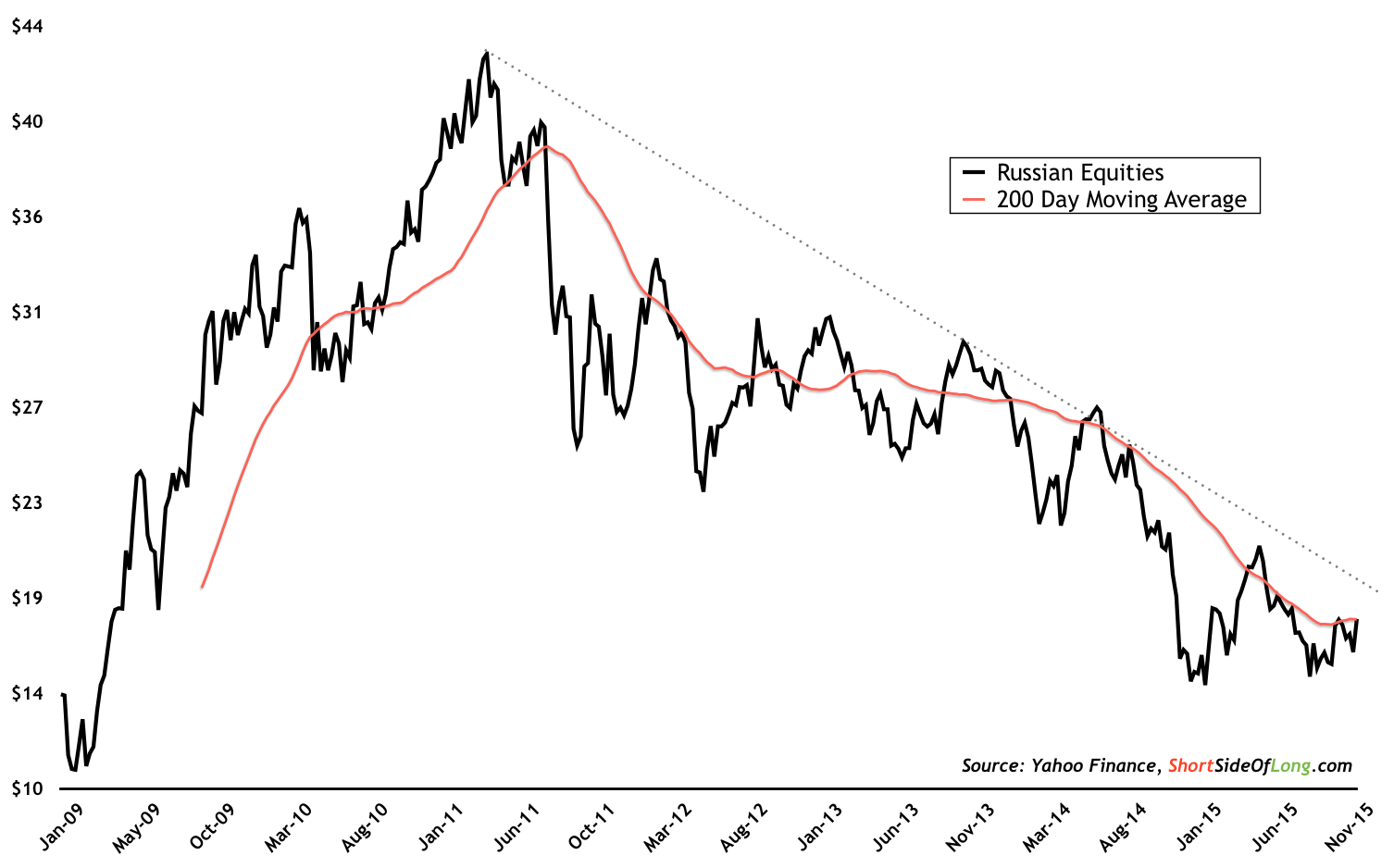

Surprisingly, out of all the EM indices, MSCI Russia is the one that has broken above its 200 day moving average first. Being contrarian investors, what we at Short Side of Long have been contemplating recently is whether or not some of these laggards could become leaders in 2016? Moreover, Indonesian stocks have also underperformed rather dramatically and have become very oversold. There is a possibility of a breakout from the current downtrend and at least a bit of an upside for this beaten down market, as investors are currently pricing in a total disaster.

Russian market is extremely depressed, but remains in a downtrend

Could the Indonesian stocks breakout from a strong downtrend?

Finally, MSCI Brazil has been doing pretty well recently, despite all the negativity and fundamental data deterioration. Regular readers of our blog will remember that we were lucky to call an intermediate bottom in the Brazilian Real on the 24th of September, which has obviously helped the Brazilian equities when priced in US Dollars. Despite certain positive steps being displayed from the technical perspective, this Latin American index has yet to reverse its downtrend. We will be watching some of these markets closely and could even consider them for a trade in coming days or weeks ahead.

Brazil performance is awful, but could be showing signs of a bottom…