What is the Fed Supposed to to with 0.2% CPI?

by Eddy Elfenbein, Crossing Wall Street

The government reported today that consumer prices rose 0.2% last month. This is important because it’s more argument for the Federal Reserve to start raising interest rates next month. Some people thought that the terrible events in Paris might serve as convenient cover for the Fed to delay some more.

The “core rate,” which excludes volatile food and energy prices, also rose by 0.2%. Food and energy prices have significantly weighted on inflation in the past year. Consider that over the last 12 months, headline inflation is up by a mere 0.17%. But core inflation is up by 1.91%.

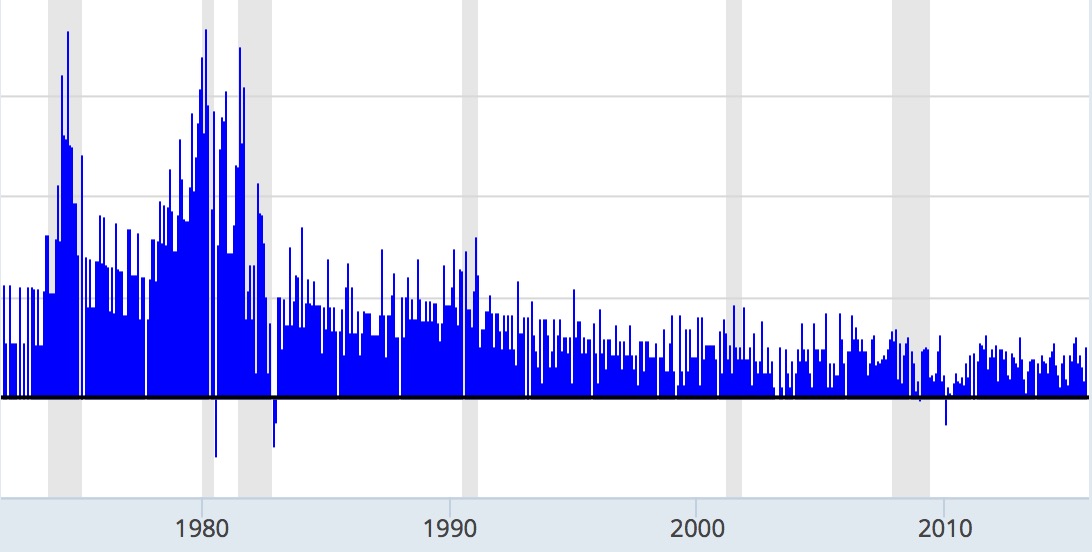

Here’s a look at the monthly core rate in annualized terms:

The odds of a rate hike next month are now up to 73.6%. The next big test will be the November jobs report.

Posted by Eddy Elfenbein on November 17th, 2015 at 10:24 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.