Tragedy in Paris

KEY TAKEAWAYS

· Our thoughts are with the victims of the November 13 terrorist attacks in Paris.

· Here we look back at history to assess potential market impacts of Friday’s tragedy.

· History suggests any potential negative stock market reaction to these events may be short-lived.

by Burt White, Chief Investment Officer, LPL Financial

[DOWNLOAD PDF]

Our thoughts are with the victims of Friday’s terrorist attacks in Paris. Events like this stir up many powerful emotions, including anger, fear, sadness, confusion, and regret, and these emotions are not easily suppressed. It is difficult to shift our attention away from this tragedy and toward the financial markets in times like this, but it is our responsibility to do so. Here we look at the potential stock market impact of Friday’s tragedy. As this commentary is being written, the S&P 500 is solidly higher in midday trading, with some speculating that terrorist threats mean the Federal Reserve (Fed) may not raise interest rates next month (though we still see a December hike as likely based on what we know now).

HISTORICAL PERSPECTIVE

Regardless of the circumstances when making market forecasts, looking back in history to find similar conditions or events is always part of our process. In this case, unfortunately, we have many terrorist attacks in recent history to look at for a sense of how stocks might react.

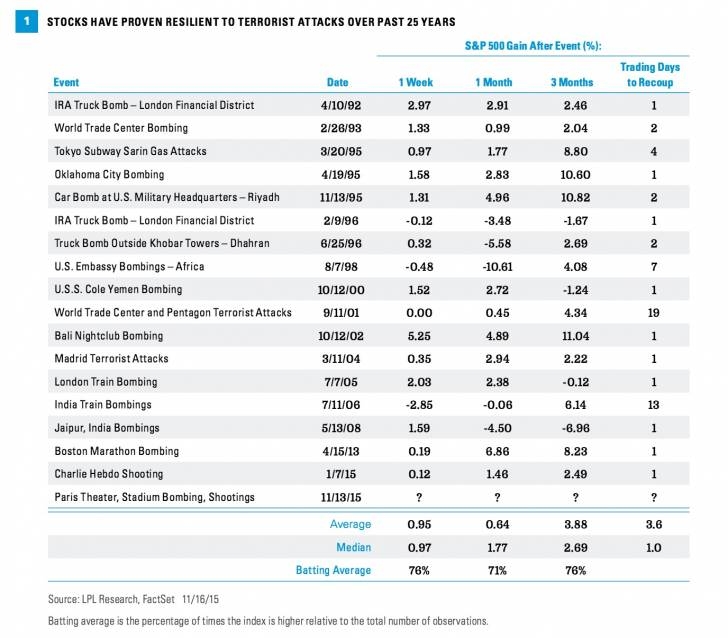

Below is a list of events going back to the early 1990s and how stocks performed after these events [Figure 1]. The data are encouraging, as stocks perhaps benefited from the wave of patriotism or, in some cases, possibly the spending associated with the military response. The limited economic disruption from most of these events — with 9/11 a clear exception — is consistent with the generally muted stock market reactions.

These events occurred at different points in market cycles, and certainly other factors influenced stock market movements during these periods; but nonetheless, the stock market’s performance after these 17 events over the past 23 years suggests any related weakness in stocks may be short-lived.

It is logical to think defense stocks would get a boost from these events, but the data are mixed. These stocks do no better, on average, than the market during the week and month following the events (they are largely flat). However, the group (represented by the S&P 500 Aerospace & Defense Industry Group) has done better than the S&P 500 over the subsequent three months, gaining an average of nearly 8% compared with the S&P 500 gain of about 4%. Correlation is possible, but the muted short-term reaction suggests these results may not be meaningful.

It is also possible that oil prices may get a bump from the heightened geopolitical risk in the Middle East (West Texas Intermediate Crude Oil is solidly higher in midday trading); although, given how well supplied the global oil markets are currently, we would expect the impact to be relatively limited.

Finally, as has occurred in previous attacks, travel- and leisure-related stocks that are most impacted by travel restrictions may experience additional weakness in the coming days and weeks. Some weakness in these segments is evident in European markets today.

POTENTIAL POLITICAL IMPACT

Here are some of our thoughts on potential political impacts from the intensifying global war on terror:

U.S. election. Voters recognize that the war on terror is a global fight, and just because the latest attack occurred in Europe does not mean terrorism is not a risk for U.S. citizens. Accordingly, immigration and national defense, which were already key issues for the Republican presidential candidates, are even bigger issues now and could easily sway Republican primary voters in February 2016. Generally, the Republican Party is considered stronger on defense, while likely Democratic candidate Hillary Clinton has foreign policy experience as former Secretary of State.

European elections. This event may also alter elections in Europe, with more hardline governments, with respect to immigration, having greater influence. Populist and Nationalist parties have been gaining support across Europe based on their stances on immigration and European integration. To the extent these issues impact — or even dominate — political conversations, additional uncertainty is created around economic policies that may heighten market volatility.

Defense spending. The military response has begun, with France bombing Islamic State targets in Syria over the weekend. The U.S. and most, if not all, G20 nations will provide support of some kind for this fight and, even though the war on terror was already well underway, the response will likely put additional upward pressure on defense spending. The G20 meetings over the weekend were dominated by discussions of a global coordinated response.

CONCLUSION

While we mourn those who lost their lives in Friday’s terrorist attacks, we also do our best to help you navigate a challenging investment landscape. In this case, a look back at history for perspective offers reassurance. Still, as always, we remain watchful for risks that may warrant a change in our asset allocations. We see further modest gains ahead for stocks in the months ahead as the U.S. economy and corporate profits improve, but we acknowledge that geopolitical risk may contribute to heightened near-term stock market volatility.