We don’t know as much as we think we do

We, all of us, tend to be overconfident and make too many assumptions. Consider this case: a few years ago, it seemed the TA landscape was swept with the idea of trading failed patterns. There was a lot of hype about trading patterns in which traders were trapped and had to panic out of positions, and you can still hear people talk about how reliable failed patterns (especially failed breakouts) are. But patterns are just patterns, failed or not. All we have, all we can possibly have, is a slight tilt in the probabilities, a suggestion that there may be a slight departure from randomness over the lifetime of any trade we put on.

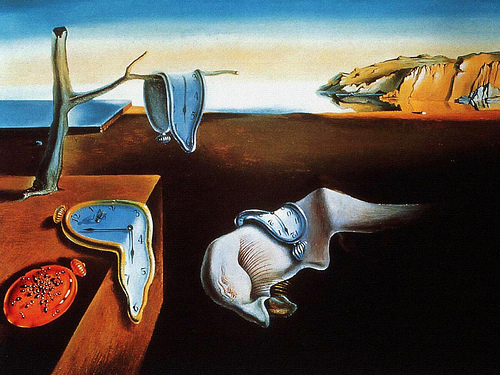

I think one of the biggest mistakes we make is to assume that everyone sees the market like we do. Technicians are perhaps worse than most groups at this, and you can find many examples where people go through charts bar by bar explaining the presumed thought process of “traders” at each point. I’m not so sure. I’ve thought about this a long time, and I think we may all be half crazy.

First, people execute trades for many reasons, and we can’t possibly understand what motivates many of those trades. A good example is the options services that point out “unusual activity” in options–yes, perhaps there is value there rarely, but we are encouraged to draw overly simplistic conclusions. “Someone just bought a bazillion puts in AAPL. This is extremely bearish for the stock because it shows smart money is bearish.” Well, maybe or maybe someone bought two bazillion shares and that’s actually a very bullish position. Consider also if you see “someone” selling a lot of stock. Is that bearish? I dunno, and neither do you. Maybe someone is shorting, maybe they are taking profits, or maybe someone is just rebalancing a large portfolio. Oh, they are an insider you say? Perhaps that insider needs to buy a boat and so is raising cash. Who knows?

All of this leads to the market being much more random than we think. The crowd looking at patterns and making decisions based on patterns is probably a pretty small segment of the market (at most times and in most markets). The levels you see on many of your charts are questionable. How are your charts back-adjusted (or are they)? Should they be? Is everyone making decisions around this tick looking at the same chart? Do they have the same motivations, limitations, and timeframe that you do? Even if they were looking at the same chart, would they make the same decisions or extract the same meaning? Of course not.

The height of this absurdity is the idea that “someone has to take the other side of your trade.” A very basic understanding of market microstructure (read this book) would tell you that’s not true. When you push the button because a 5 minute flag breaks out on your YM chart, the fact you are able to buy absolutely does not mean that someone is betting that flag is going to fail so they are shorting against you. The market is much bigger and much noisier than we expect.

The height of this absurdity is the idea that “someone has to take the other side of your trade.” A very basic understanding of market microstructure (read this book) would tell you that’s not true. When you push the button because a 5 minute flag breaks out on your YM chart, the fact you are able to buy absolutely does not mean that someone is betting that flag is going to fail so they are shorting against you. The market is much bigger and much noisier than we expect.

I guess the point of this is a gentle reminder to respect both the randomness of markets and the limits of our knowledge. To me, those questions about knowledge (epistemological questions) are fascinating–what do we truly know about financial markets and human behavior? How do we know we know it? How do we know that knowledge is valid? Assumptions are dangerous because they lead to overconfidence, hubris (and, perhaps, going on television and proclaiming that we know what is going to happen in the future.) Managing risk in financial markets takes flexibility, adaptability, and, above all, humility and respect.

Copyright © Adam H. Grimes