In a Bull Market All Tactical Strategies are Going to Look Bad

by Michael Harris, Price Action Lab

Central bank policies have allowed a revenge of the “lazy investor” after a loss of confidence due to the crash of 2008. Many active strategies that invest in stock index tracking products underperform buy and hold after 2009 but this may be a temporary effect that will end after interest rates start increasing.

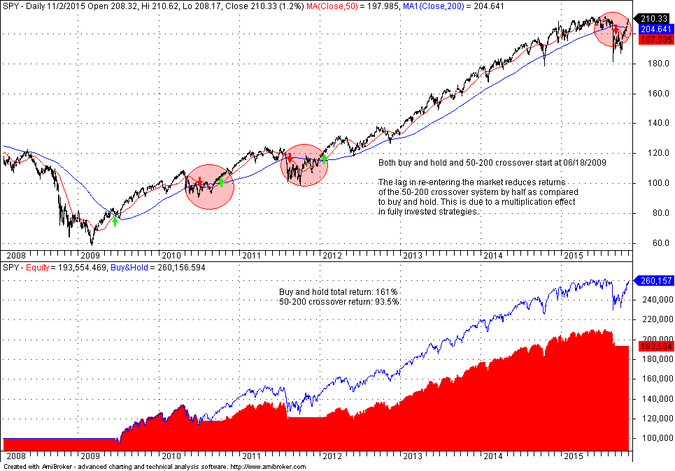

Technical traders and active investors feel the heat from a long period of low interest rates and stimulus that has caused failures of important patterns. There are many such failures since central banks decided to provide stimulus to the markets. The most recent one is a quick reversal immediately after a death cross in S&P 500. This reversal has caused significant underperformance of long-only strategies that implement a 50-200 moving average crossover filter as a timing signal. On the chart below it is shown that due to this crossover failure, the difference in year-to-date performance between buy and hold and a 50-200 crossover long-only strategy is more than 700 basis points, +3.39% for buy and hold versus -3.87% for the active timing strategy.

Since the first buy signal from the 50-200 moving average crossover that occurred on June 18, 2009, after the financial crisis plunge, the buy and hold total return is 161% while the timing strategy is up only 93.5%.

From the above chart it is not immediately evident why the buy and hold outperforms the active strategy by more than 65% because there are only two signals that cause an exit. However, due to the geometric nature of returns of fully invested capital, the small lags in reentering the market cause the underperformance of the active strategy.

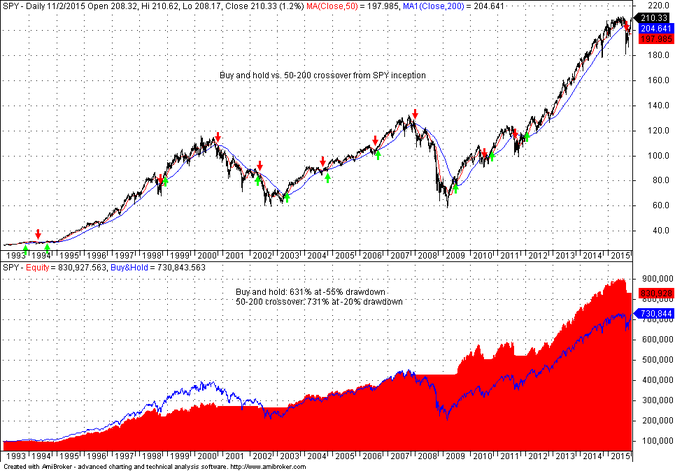

Note that since SPY inception, the active strategy still outperforms buy and hold by about 100% on a total return basis, as shown on the chart below:

The risk-adjusted underperformance of buy and hold is significant due to a -55% drawdown during the financial crisis. This fact can be used against arguments in favor of buy and hold that take taxation advantages into account. It is quite likely that many buy and hold investors exited the market near the bottom of the financial crisis due to fear of losing more. Passive investing is actually a trivial timing strategy of end points because one must decide when to initially enter and finally exit the market. The timing of the entry and exit points impacts performance but that is not reflected in buy and hold returns often presented to the public. In simpler words, some “lazy investors” may invest at the top of the market and not realize the same returns with other investors that enter at the bottom of a correction. These differences are important and make certain arguments in favor of passive investing sort of dubious at times.

The “lazy investor” revenge in recent years is only due to support received directly from central banks. This will change at some point and passive investors should be prepared to face the realities of mean-reverting markets. In mean-reverting markets, the probability of large corrections is high even in the absence of a trigger. However, this is a different subject, maybe for another article.

You can subscribe here to notifications of new posts by email.