How long will profit margins continue to defy the skeptics?

KEY TAKEAWAYS

· We expect corporate America to generate strong profit margins for at least the next several quarters, as the primary margin drivers remain largely intact.

· The S&P 500’s operating margin remains near multi-decade highs on limited wage pressure, corporate efficiency, and low input costs.

· We expect strong profitability to support earnings growth acceleration in late 2015 and early 2016.

by Burt White, CIO, LPL Financial

Profit margins may continue to defy the skeptics and remain elevated. The primary drivers of robust corporate profit margins remain largely intact, including limited wage pressure, corporate efficiency, and low input costs, and support our view that earnings growth may be poised to accelerate through year-end and into 2016. Despite a lack of revenue growth, the operating margin for the S&P 500 remains near multi-decade highs; we expect corporate America to continue to defy the skeptics and potentially generate strong profit margins over the next several quarters and likely beyond.

NEAR RECORD HIGHS

The S&P 500’s operating margin remains near multi-decade highs despite several challenges. The business cycle is now more than six years old, a bit on the long side relative to history, which has led some to predict profit margin contraction. The economy has produced several years of steady job growth and the unemployment rate (5.1% in September 2015) is low, which would normally bring some upward pressure on wages and hurt margins. To an extent, margins are mean reverting, so they tend to head back to their long-term average after periods of strength such as we have experienced. Interest rates have bottomed, perhaps suggesting that borrowing costs may be poised to move higher.

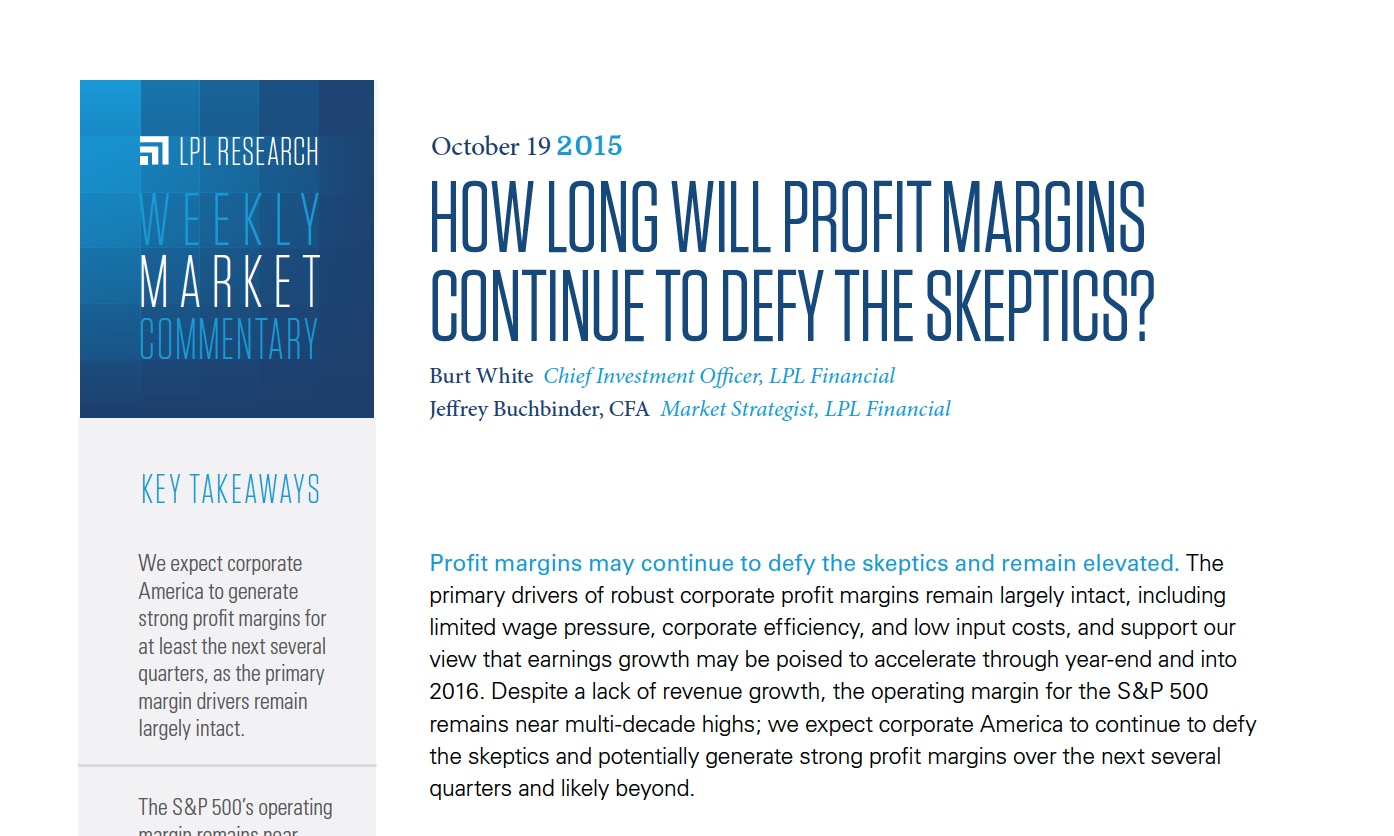

Yet, despite all of these reasonable arguments for margins to contract, the S&P 500’s operating margin remains near multi-decade highs [Figure 1]. We see little reason to expect much, if any, margin contraction for at least the next several quarters. We expect strong profitability to support earnings growth acceleration in late 2015 and early 2016 and provide a favorable backdrop for the stock market.

We have seen some margin contraction from multi-decade highs in recent quarters due to the energy sector downturn. Although the sector is only about 10% of the S&P 500’s profits, the near halving of the sector’s operating margins over the past year to below 7%, also shown in Figure 1, has been felt in overall profit margins (and also in earnings per share [EPS], with a 7% estimated impact to S&P 500 EPS estimates for the third quarter of 2015). Margins have held up quite well considering the energy sector’s impact on revenue and margins.

MARGIN DRIVERS

When we break down the components of profit margins, we can see that most of the drivers of recent margin expansion remain intact. Here is a breakdown by category.

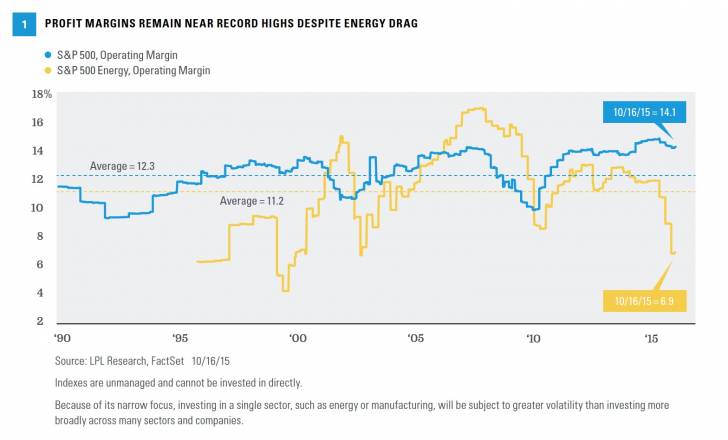

Limited wage pressure. By far the biggest component of corporate costs, the cost of labor (wages and salaries) has picked up a bit in recent years but remains well contained at around 2% growth annually, as measured by the Employment Cost Index from the Bureau of Labor Statistics [Figure 2]. This pace of wage growth is below the long-term average of over 3% during the past 30-plus years, supporting margins. The economy has produced five years of fairly steady job gains and an unemployment rate that is poised to drop below 5%, historically the Federal Reserve’s (Fed) threshold for full employment; yet wages are rising slowly, except for some small pockets of strength in industries having a difficult time attracting workers with the right skills.

Why are wages rising so gradually? For one, companies still seem to lack confidence in the business cycle. There is also still some slack in the labor market that may not be captured by traditional statistics. Technology and automation have removed some of the leverage employees have to demand higher compensation. There are other reasons, but the bottom line is we do not expect wages to accelerate meaningfully from the recent pace until well into 2016, if not later.

Corporate efficiency. Companies have been doing a tremendous job controlling costs, supporting margins. Sales, general, and administrative costs (SG&A) for the S&P 500 in aggregate have, on average, increased 4.4% annually during the 2010s, compared to 6.9% in the 2000s and 7.0% during the 1990s. More widespread use of technology and automation to improve efficiency is part of the story. Offshoring, where business functions are being relocated to lower cost geographies outside the United States, is another part. The gradual improvement (rather than euphoria) in corporate confidence following the 2008 – 09 financial crisis is another piece of the margin puzzle. The lack of revenue growth has forced companies’ hands and led them to try to squeeze more earnings growth out of a revenue base that has grown more slowly in recent years. A corporate merger boom has enabled cost synergies — 2015 may break the record for dollar value of mergers and acquisitions set in 2007 at $4.29 trillion, according to data provider Dealogic.

Cost cuts are not pleasant, but this cost discipline is having the effect of propping up margins, a trend that may continue through the end of the business cycle, even if it were several years down the road.

Input costs. Although a smaller portion of corporate costs, input costs have been falling for several years as commodity prices have fallen, benefiting the cost of goods sold (COGS), and therefore, margins. The Bloomberg Commodity Index is down 14% year to date, and 15% and 9% annualized over the past three and five years, respectively. While commodity prices broadly have shown signs of bottoming, we believe a large, sustained increase is unlikely to begin in the near term in the face of China uncertainty and a potentially stronger U.S. dollar.

“Below the line.” The aforementioned factors explain most of the margin story, but factors “below the line” are at work here too. Operating margin represents earnings before interest and taxes relative to revenue, or EBIT margin. But earnings after interest and taxes — which translate into the bottom line (or net margin) — and EPS are also getting support from low interest expense and lower taxes. Lower interest rates have reduced borrowing costs, a benefit that will continue because corporations have extended their debt maturities. Tax obligations have been on the decline as globalization has pushed more revenue out to lower tax jurisdictions around the world.

BUYBACK BOOST

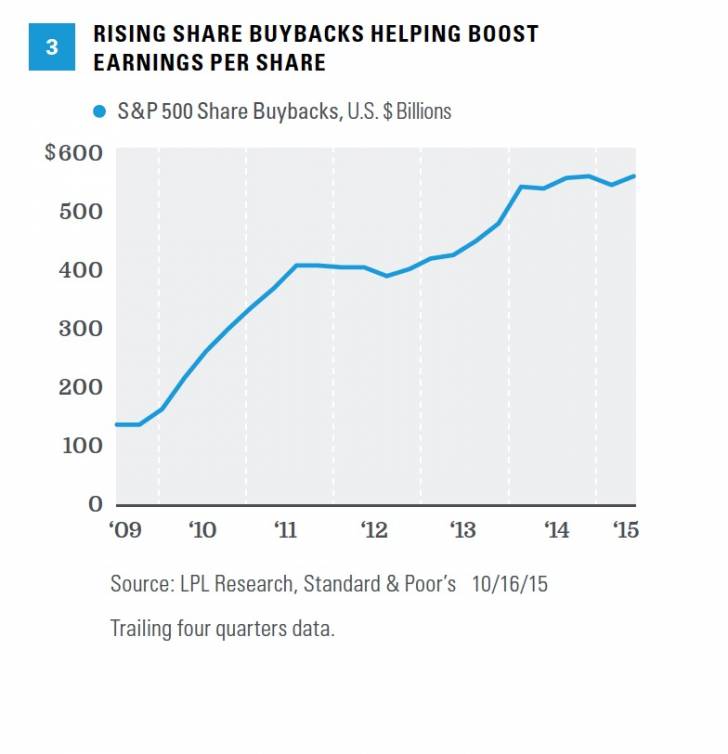

Although a capital allocation decision and not a margin driver, share buybacks are supporting EPS by reducing share counts and represent another way many companies are generating some EPS growth on weak revenue. According to Standard & Poor’s data, S&P 500 EPS got a boost of 3% over the past year from buybacks alone. Although the pace of buybacks is beginning to slow and capital expenditures may be poised to take a greater share of companies’ cash flow, the S&P 500 is on pace to challenge the record level of buybacks set in 2007 of $589 billion [Figure 3]. All of these factors have enabled corporate America to squeeze earnings gains from weak revenue performance in recent years.

CONCLUSION

We expect corporate America to continue to defy the skeptics and potentially generate strong profit margins for at least the next several quarters and likely beyond, as the primary drivers of strong margins remain largely intact. Despite a lack of revenue growth, thanks to limited wage pressure, strong cost control efforts, and falling input costs, the S&P 500’s operating margin remains near multi-decade highs. We expect strong profitability to support earnings growth acceleration in late 2015 and early 2016 and provide a favorable backdrop for the stock market. n

IMPORTANT DISCLOSURES

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which investment(s) may be appropriate for you, consult your financial advisor prior to investing. All performance referenced is historical and is no guarantee of future results.

The economic forecasts set forth in the presentation may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Investing in stock includes numerous specific risks including: the fluctuation of dividend, loss of principal, and potential liquidity of the investment in a falling market.

All indexes are unmanaged and cannot be invested into directly.

Because of its narrow focus, specialty sector investing, such as healthcare, financials, or energy, will be subject to greater volatility than investing more broadly across many sectors and companies.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not ensure against

market risk.

Commodity-linked investments may be more volatile and less liquid than the underlying instruments or measures, and their value may be affected by the performance of the overall commodities baskets as well as weather, geopolitical events, and regulatory developments.

INDEX DESCRIPTIONS

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The Bloomberg Commodity Index is calculated on an excess return basis and composed of futures contracts on 22 physical commodities. It reflects the return of underlying commodity futures price movements.

Read/Download the complete report below: