Breadth Thrust, What's Next?

by Tiho Brkan, The Short Side of Long

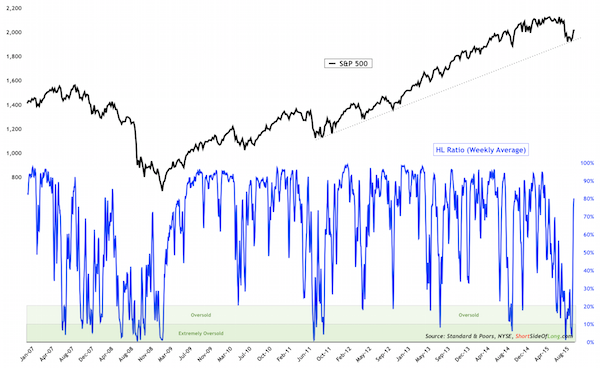

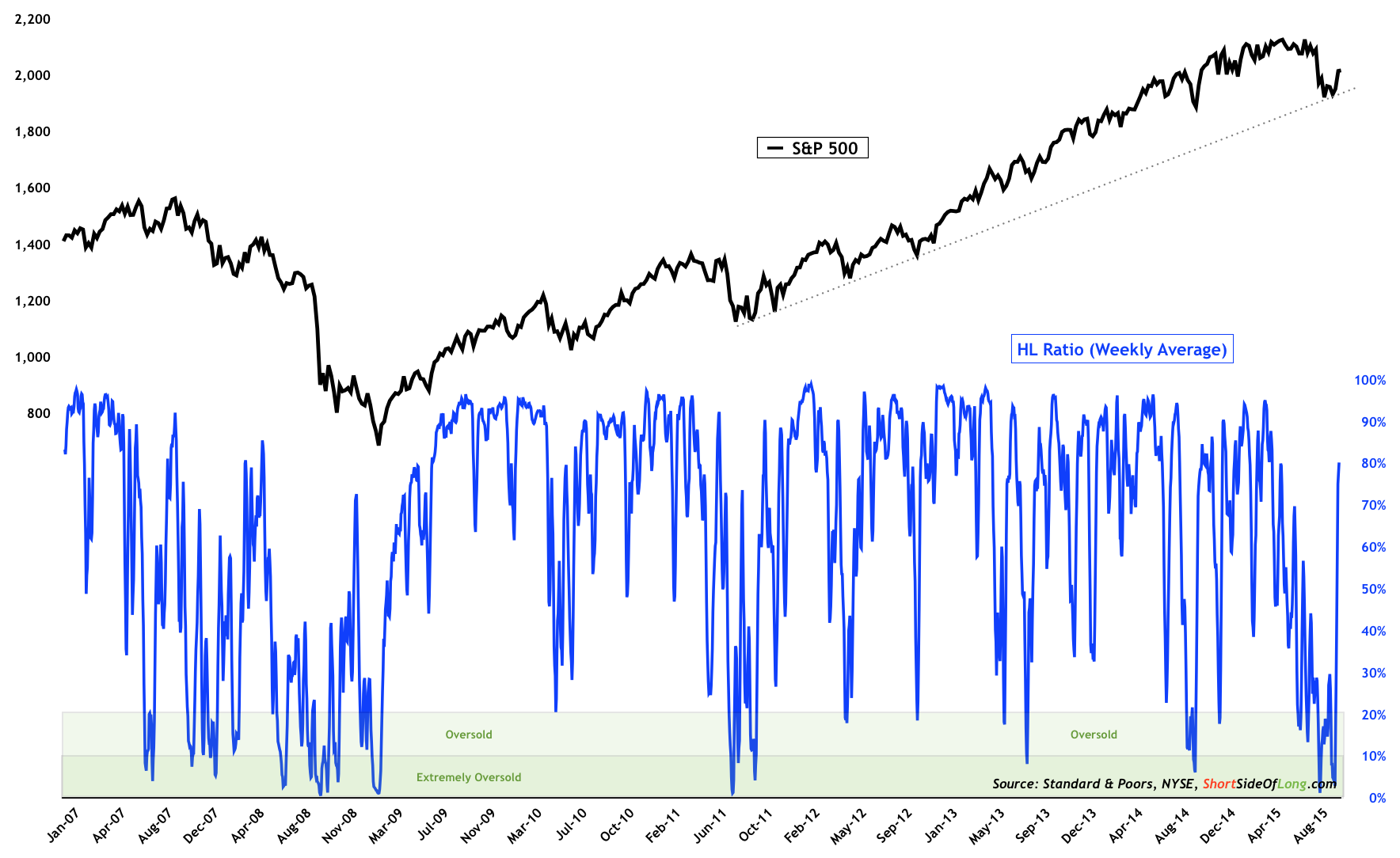

Once again 52 week new highs are dominating market internals

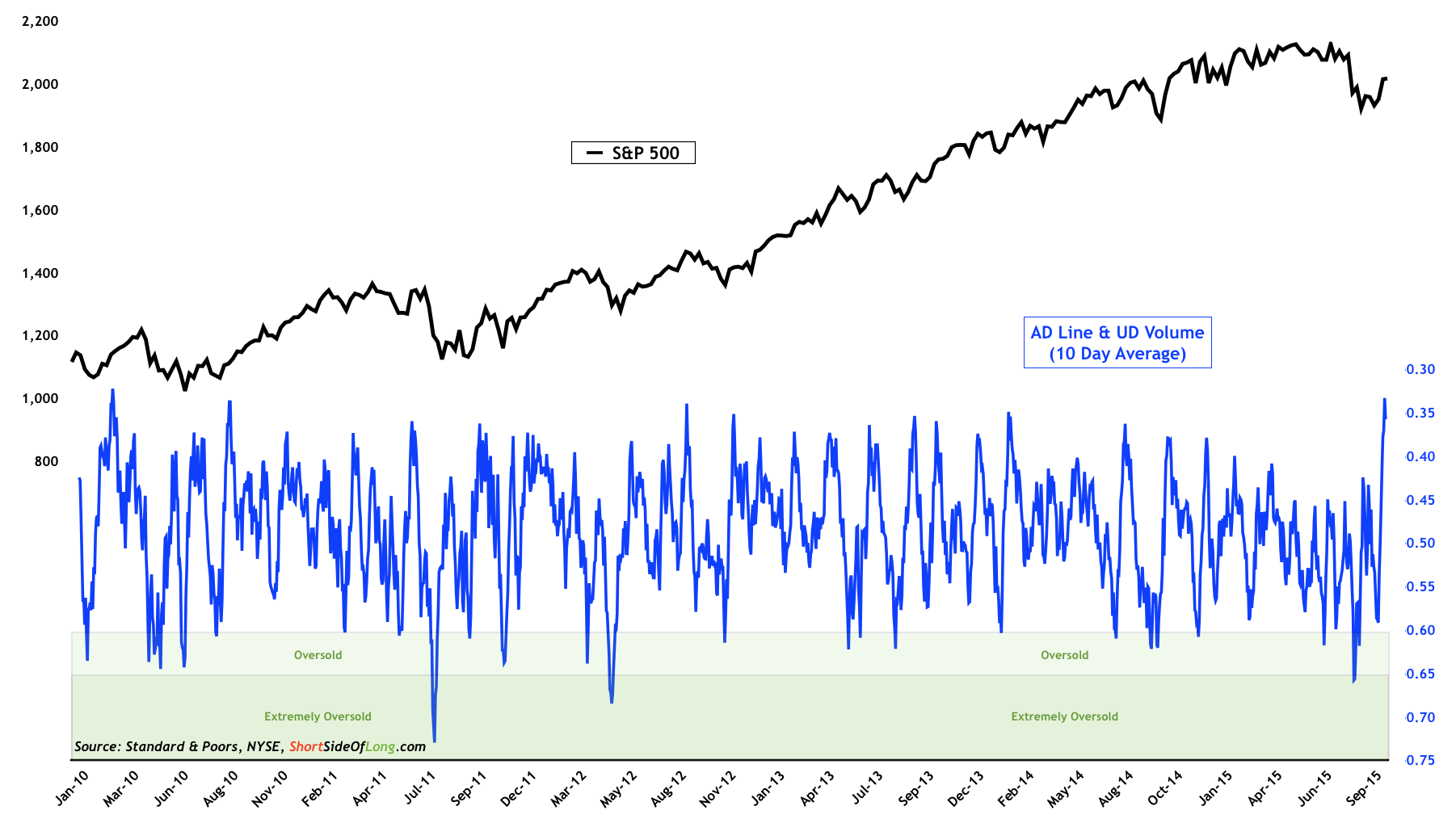

Before yesterdays stock market pullback, US indices such as Dow Jones Industrials were up 9 out of the last 10 trading days. Such a powerful rally usually occurs after sharp drops into panic capitulations or near the end of an uptrend as markets turn parabolic. After a mini-crash we saw in August and further weakness in September, the current rally is coming out of extreme oversold technical levels. Many market participants are describing the sharp rise as a bullish breadth thrust (see the chart above and below), however this breadth signal hasn’t been perfect throughout history.

So where is the stock market heading after the recent breadth thrust?

Stock rally out of recent lows has seen large number of up issues

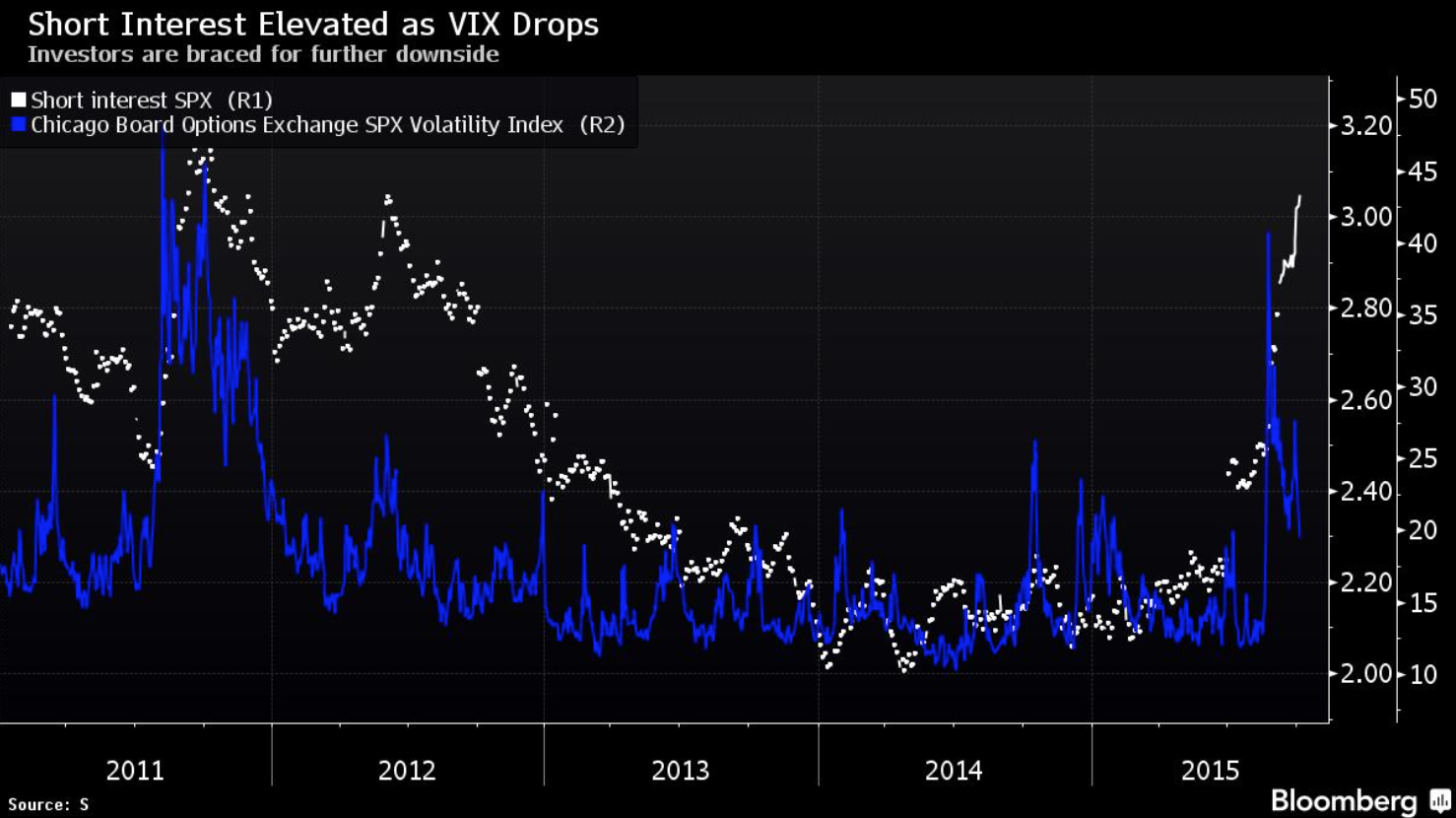

Bears would argue that the current rally is only a dead cat bounce, before we make a lower low. For the downtrend to resume, we would have to see a continual rises in both volatility and short interest. On the other hand, bulls would argue that the volatility spike already marked a major washout, as it has done so historically. High short interest level will be the fuel that feeds the fire, as shorts are forced to cover, pushing stocks higher in coming weeks and months ahead.

Which camp do you sit in?

During the correction short interest spiked, which is now fuelling the rally