Sold in May, ______ in October

by Cam Hui, Humble Student of the Markets

Trend Model signal summary

Trend Model signal: Risk-off

Trading model: Bullish

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

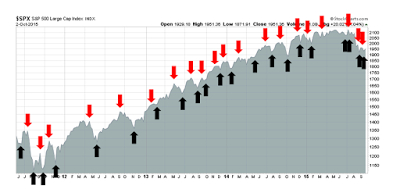

My inner trader uses the trading model component of the Trend Model seeks to answer the question, "Is the trend getting better (bullish) or worse (bearish)?" The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below.

Update schedule: I generally update Trend Model readings on my blog on weekends and tweet any changes during the week at @humblestudent.

Karmic re-balancing?

I have been saying for the past few weeks that while the technical picture for the stock market looked shaky, the macro and fundamental outlooks appeared constructive and that's why I remained constructive on stock prices (see Why this is not the start of a bear market). Now we are seeing a reversal of those trends, perhaps in a Cosmic Karmic re-balancing sort of way. The technical indicators are improving, but we are seeing signs of macro and fundamental deterioration.

While I am still believe that equity prices are likely to be higher by year-end, this change may mean that there may be some more near-term weakness ahead. Weakness in macro and fundamental factors can be triggers for slow, but big money, institutional investors to de-risk.

Let`s go to the numbers.

Macro disappointments

Last week saw a couple of disappointments in big headline macro releases for the US economy. It wasn't that the big miss in the Employment Report that was disturbing, but the ISM Manufacturing number came in below expectations as well.

The Citigroup Economic Surprise Index, which measures whether high frequency economic releases are beating or missing expectations, tell the story well. US macro have begun to deteriorate relative to expectations. This may presage a period of near-term softness in the US economy.

Indeed, the Atlanta Fed "nowcast" of GDP growth has been tanking as well. GDPNow fell to 0.9% last week, which is well below the consensus forecast.

Mid-cycle pause?

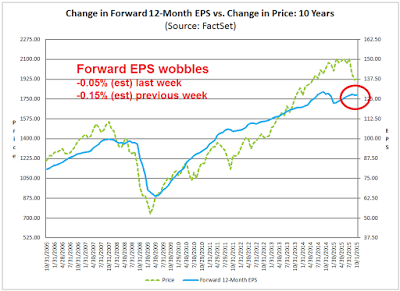

Last week, I highlighted a downtick in forward EPS estimates, which I viewed as a cautionary sign but could have been just a blip in the data. The latest update from John Butters of Factset shows that forward EPS fell again for another week (annotations in red are mine).

The combination of weakening macro and a deterioration in Street EPS expectations can be red flags for institutional investors, the big but slow money in the market. Ed Yardeni found that forward EPS to be correlated with coincidental economic indicators. This may signal a period of greater cautiousness among the big money players as we await developments from Earnings Season.

I remain optimistic on the US economy. The excellent summary provided by New Deal democrat of high frequency economic releases puts the current macro and fundamentals into context, as he dissects macro releases into long leading, short leading and coincidental indicators. Long indicators remain relatively strong, but short leading indicators and coincidental indicators are mixed:

Among long leading indicators, interest rates for corporate bonds and treasuries remained neutral. Mortgage rates, and purchase and refinance mortgage applications are positives. Real estate loans are positive. Money supply is positive.

Among short leading indicators, the interest rate spread between corporates and treasuries remains quite negative, as is the US$. Positives included jobless claims, oil and gas prices, and gas usage. Commodities remain a big global negative. Temporary staffing is negative for the 20th week in a row, and more intensely so for the 2nd straight week.

Among coincident indicators, steel production, shipping, rail transport ex-intermodal, the TED spread and LIBOR all are negative. Tax withholding and consumer spending are now uniformly positive if weakly so.

Slicing and dicing differently, he concluded that the global economy is weak while the American consumer remains strong, which is consistent with his call a few months ago for a weak industrial recession:

We continue to have a stark bifurcation. Consumer-related indicators - mortgages, oil and gas, jobless claims, and consumer spending - all remain positive. But those portions of the US economy most exposed to global forces, including the US$, commodities, and industrial production and transportation, are all firmly negative. Employment on net is still a positive, though more weakly so. Housing and cars, those two most leading sectors of the US economy remain positive (with a post-recession record for motor vehicle sales last month), and thus so do I.

In other words, this is shaping up to be a mid-cycle pause in growth. On the other hand, the current patch of softness in the data may be reflective of that bifurcation.

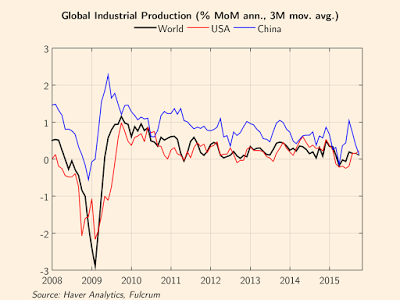

Gavyn Davies analyzed the slowdown in global industrial activity and found that there are signs for optimism (emphasis added):

This month we introduce a new feature that examines the growth of the global industrial sector, with the latest month (September in this case) being estimated from our “nowcast” models. The full set of graphs for all the major EM and DM economies is attached here for reference.

Although the industrial sector is typically around 20-30 per cent of GDP, it is more volatile than the rest of the economy, and it therefore accounts for a large part of the quarterly swings in global activity. Furthermore, the marked weakness of manufacturing in the middle of 2015 raised serious concerns about global recession risks. It therefore offers a good cross-check for our nowcast estimates for overall economic activity.

The most interesting feature of these industrial production figures this month is that the growth rate has now bounced to a monthly rate of 0.2 per cent, up from zero in 2015 Q2. While many commentators have been worrying about industrial growth in China, the main contributor to recent fluctuations in global industrial growth has been the US, where the collapse in the energy sector, and inventory shedding in the manufacturing sector, have had a marked effect. As these negative impacts on growth have faded, the global industrial sector has bounced back a little, which is reassuring.

In other words, there is no need to panic. Neither the world nor the US is rolling over into recession. My inner investor remains constructive on the longer term fundamental outlook and he continues to buy stocks on weakness.

An improving technical outlook

The biggest surprise to me was how the stock market reacted to the big miss in the Employment Report. The numbers looked terrible on all dimensions, from the headline number to participation rate. The fact that stocks rallied in the face of bad news is an indication of a washed-out market.

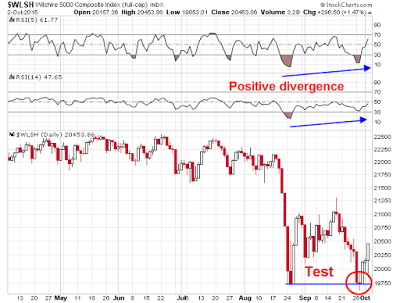

The technical signs were there. The SPX fell last week and appeared to be nearing a test of the panic lows of August, though those support levels were never reached. We saw positive divergence in RSI(5) and RSI(14) at the time of the near-test of the lows - which is a bullish sign.

The broader Wiltshire 5000 Index did test the August lows last week and the same positive RSI divergences were observed.

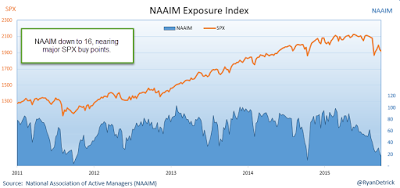

I would also mention that sentiment models remain at a crowded short, which is contrarian bullish. The latest reading comes from NAAIM (via Ryan Detrick):

At the same time, Barron's reports that insiders are still buying stocks hand over fist:

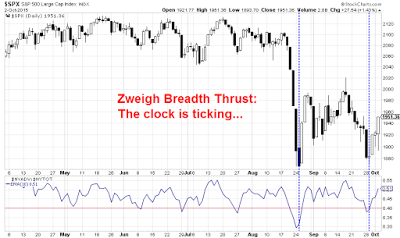

Another tantalizing clue came in the form of a setup for a Zweig Breadth Thrust. I highlighted the possibility of a ZBT in late August but that setup failed (see A rare but possible bull market signal), I would note that while a ZBT would confirm a bullish reversal, stock prices can rise without one, as they did during the 2011 bottom.

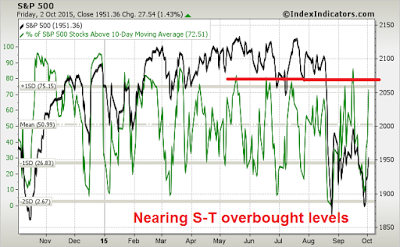

Will the Breadth Thrust succeed and signal a new upleg? That's the challenge the bulls face next week and they only have a mere ten days to complete the task. This chart from IndexIndicators show that short-term breadth is nearing overbought levels on a 1-3 day time frame. Will we see a pause and pullback as institutions get cautious, or will momentum carry the day and signal a ZBT?

My inner trader is sitting this one out for now. He got faked out/stopped out of his long position on Friday on the Employment Report sell-off early in the day. He has gone to cash and he is waiting a few days to see how the market resolves this short-term tension between the bulls and bears.

My inner investor is asking, "Regardless of what happens next week, if you sold in May and went away, what should you be doing in October?"

If you found this post to be valuable, please help me make a decision future of Humble Student of the Markets by completing a simple two question survey if you haven't done so ahead. More details here. I will be announcing a decision either Thursday or Friday.

Copyright © Cam Hui, Humble Student of the Markets