Are credit market signaling more pain for stocks?

by Fil Zucchi, Seeitmarket.com

I have been offering a fair amount of color on the twists and turns of corporate credit and credit derivatives, and their impact on stocks via my Twitter handle (@FZucchi). The skinny is that credit and stocks are behaving in a manner almost identical to the swoon of summer 2011.

And, if that parallel holds, stocks – and credit markets to a lesser degree – are in for more pain, perhaps even as much as an additional 10% downside from current prices.

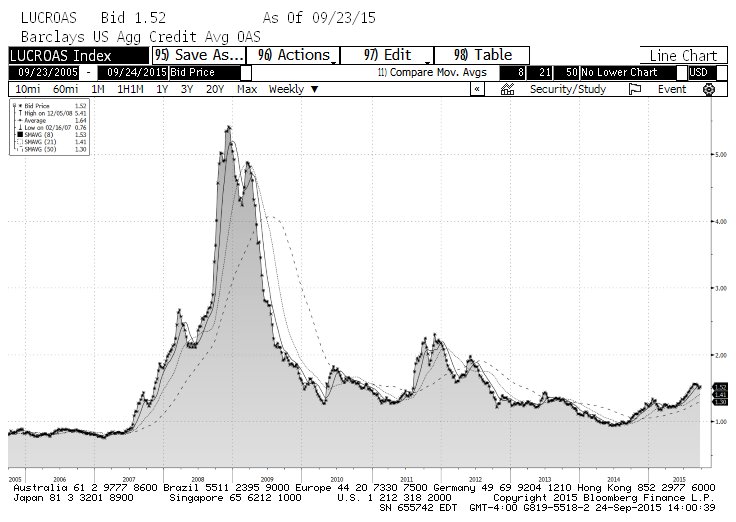

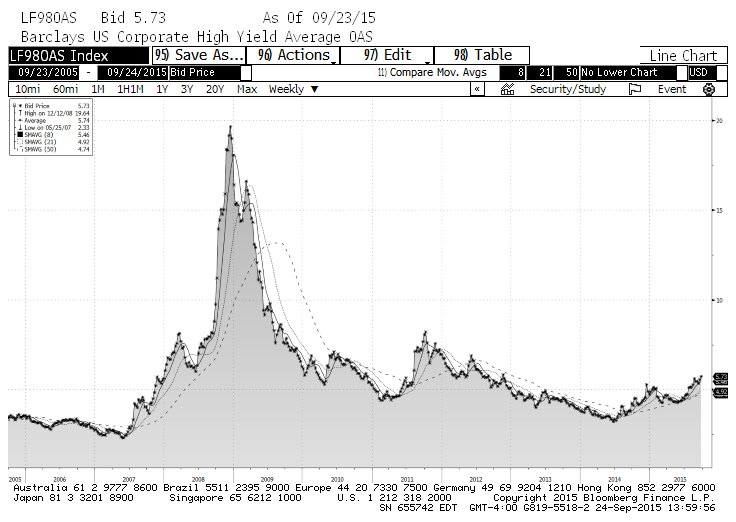

However, the purpose of this note is not to be the purveyor of doom and gloom; rather, the opposite. Below are charts of the key tells I use to gauge the stress in the credit markets. The charts encompass the ’07-’09 crisis as well as the ’11 scare.

As you can readily tell, while credit is “agitated” these days, in the big picture the widening of spreads is well within the range of the random ups and downs we should expect from the credit markets, and markets as a whole.

For further reassurance, consider also the current tone of corporate bonds issuance. SO far this year the corporate bond market has absorbed: about $1.3 trillion of new bonds, versus $731B and $975B for the same time periods in 2008 and 2011. In my humble opinion, there is no substitute for the importance of the cash bond market when trying to determine the level of systemic financial risk, and that market right now is in great shape.

Are you thinking “what about the widening spreads?” I’ll offer that corporate bonds are not in great shape “despite” widening spreads, but partly “because” of widening spreads. Bond funds can only be happy to collect some extra yields considering what they have had to shop for during the last six years.

With that said, I will raise a yellow flag: I have often tweeted that there’s little if anything out there that could derail the corporate bond market right now. There’s simply way too much money looking for a place to land (preferably a place with better yields) and too much fresh money flowing into the coffers of bond buyers week after weeks and month after month. Greece, the commodities crash, Russia, the middle-east, none of these problems are likely to cause more than some scary drops which are ultimately absorbed by the cash on the sidelines.

The one exception would be a financial accident in China. There’s little doubt in my mind that the China miracle will end with the mother-of-all-collapses, but for now the amount of money that the Chinese government can throw at the problems (north of $20T by some estimates) should be enough to let them drag along. But precisely because of the size, and the lack of transparency around everything-China, accidents can happen.

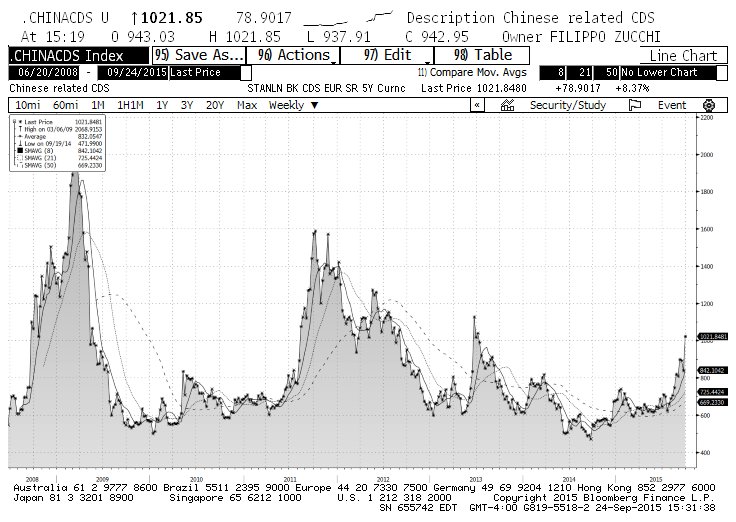

As an early warning system, I put together an index of Credit Default Swaps that should be very sensitive to nascent credit problems in the Far-East.

The components are very volatile so watching it day-to-day is probably not that useful. But the trend and the levels seen during past times of global financial stress are very important.

As you can see on the chart below, these CDS are in no way at crisis levels, but they are not trending in the right direction. Should the widening continue, it may start spilling into our markets in a much more meaningful way than what we have seen so far.

Good luck and good trading!

Copyright © Fil Zucchi

Twitter: @FZucchi

Any opinions expressed herein are solely those of the author, and do not in any way represent the views or opinions of any other person or entity.