Negative momentum weighs on all the major asset classes

by James Picerno, Capital Spectator

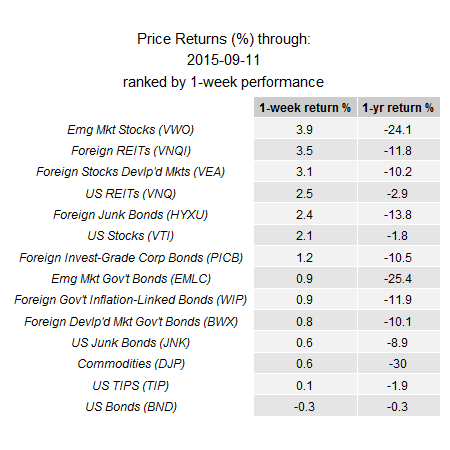

Emerging-market stocks have been getting hammered this year, but last week offered some relief. The Vanguard FTSE Emerging Markets ETF (VWO) jumped 3.9% for the week through Sep 11, delivering the best weekly performance for our standard set of proxies for monitoring the major asset classes. Is it time to jump back into this battered-and-bruised corner of global equities? Probably not.

The negative momentum that’s currently weighing on all the major asset classes remains a potent force and there are few signs that the bearish tide has run its course. Although last week’s gains in some markets suggest otherwise, it’s not yet obvious that the latest uptick marks a bullish turning point that’s worthy of a full-throated risk-on allocation.

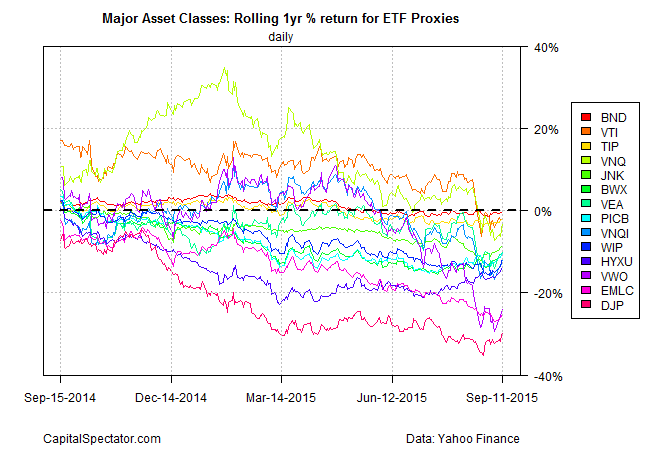

One reason for remaining catious: for first time since the 2008-2009 financial crisis and Great Recession we have the following worrisome trend hobbling all the ETF proxies for the major asset classes: negative year-over-year returns. That’s a formidable force. Beyond nibbling on the edges for speculative purposes, strategic-minded investors may want to wait for more encouraging signs before redeploying capital into risky assets in a meaningful way.

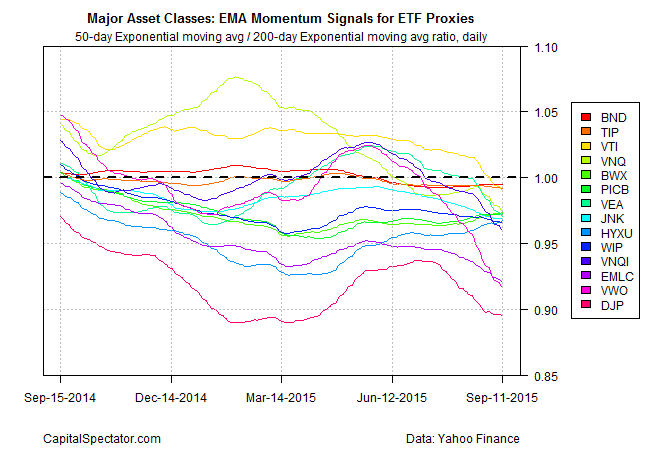

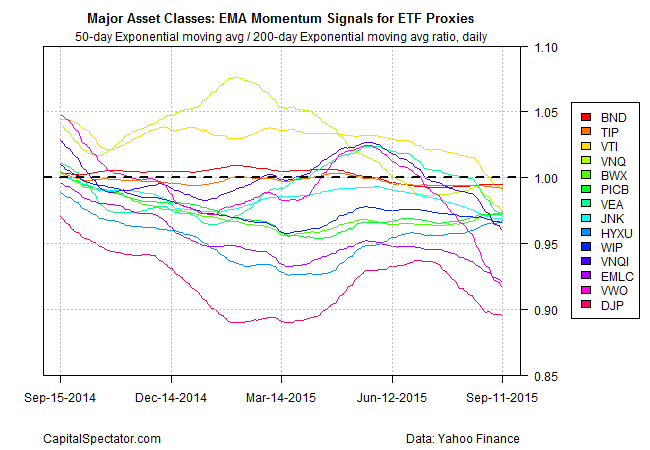

What will the tell-tale signs be that an impending rebound is close at hand (or already underway)? Minds will differ, in part because there’s a long list of possibilities. Meantime, there’s always the practical obstacle of uncertainty, which ensures that most of us never buy exactly at the bottom (or sell at the precise top). Par for the course. In any case, you might start a search for clues of a bottom by considering how a set of exponential moving averages (EMA) compare—the 50-day/200-day EMA ratio, for instance. But here too the trend still looks treacherous: all the proxy ETFs are trending lower by this metric–an unusually dark cloud that we haven’t seen in some time. Unless you’re practiced at the art of catching falling knives, the current climate still looks unusually hazardous.

Strategic opportunity is out there somewhere and it will come a-knockin’ at some point. But in the current climate it’s still early to go hunting for bulls with so many bears running around. The caveat was relevant last month and it’s not obvious that the broad trend has changed for the better four weeks on.