How did your smart beta fund do in the current correction?

by Michael Batnick, The Irrelevant Investor

As the revolution in “smart beta” rolls on, what’s important for investors to know is that many of these products are just factor investing in disguise. Run a regression on many of these strategies and what you will find is they are overweight value stocks and small stocks, strategies that have been known and in play for decades.

“After eight years of struggling to outperform the S&P 500, Mike Willis has decided to use the benchmark against itself by equal-weighting all 500 stocks in the index.”

This is the lede from a piece today in InvestmentNews.

Let’s take a closer look at the S&P 500 equal-weight. As the name implies, this gives every stock in the index the same representation; so Apple and its $650 billion market cap has the same influence as Fossil, the $3 billion fashion company. The equal-weight index is not new and is often referred to as another name, the Mid Cap 400.

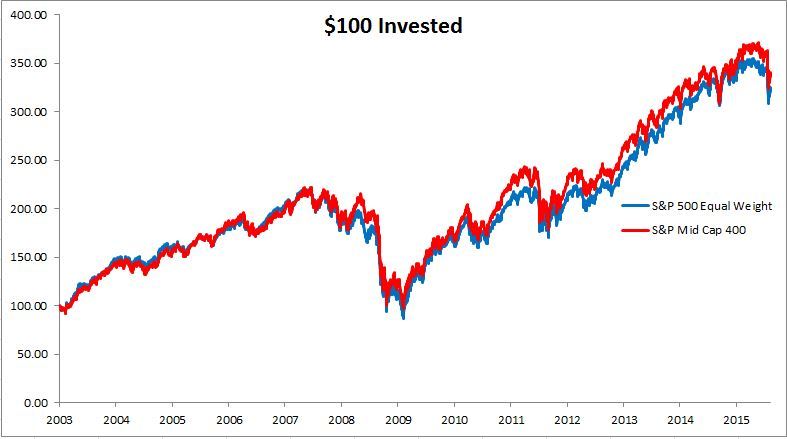

Take a look at the chart below. If you were to invest $100 in both indexes in 2003 (inception of equal-weight), you would be left with $322 in the equal-weight index and $327 in the mid cap index. With a correlation of .97, for all intents and purposes, these products are identical.

There’s nothing inherently wrong with breaking away from traditional cap-weighted indexes. I do however think there are several issues worth mentioning.

1) Many of these products are very similar to small/value strategies with a higher price tag.

2) The name smart-beta can be misleading to the average investor. If you opened your statements last week, you’ll notice that smart nor dumb beta was spared from the recent correction.

3) None of these strategies work all the time. Small and value stocks often go through long periods of under performance. From August 1998 to February 2000, when the Growth Index returned 83%. Strategies with a value tilt would likely have gone into the furnace.

Again, the point is not that there’s anything wrong with slicing indexes differently, just make sure you know what you’re getting. The S&P 500 equal-weight at 30 bps doesn’t sound so bad, but neither does the mid caps at 15.

Copyright © Michael Batnick, The Irrelevant Investor