A seeming paradox: Most stocks underperform the market

by Michael Batnick, The Irrelevant Investor

One of the many seductions of dabbling in the stock market is the potential for lottery winners. Look at the returns these stocks have generated since going public:

Starbucks: ~18,000%

Amazon: ~21,000%

Apple: ~28,000%

Microsoft: ~72,000%

Disney: 128,000%

What many investors don’t know or don’t seem to care about is that for every Apple, there are several thousand companies that have come and gone (to zero). Let’s not even talk about the near impossibility of actually staying on the horse for a multi-thousand percent return.

Alright fine, let’s talk about it.

The hypothetical investor who captured the entire 128,000% return over the last nearly sixty years would have experienced plenty of discomfort along the way. Disney has seen eight separate drawdowns of at least thirty percent. To be clear, what this means is that on eight different occasions, Disney would hit new all-time highs and then fall by at least thirty percent. A few more data points worth mentioning:

1) Disney has been in a 20% drawdown 55% of the time.

2) After gaining 270% in the seven years following its IPO, Disney would decline 80% in under two years.

3) Disney has been in a 50% drawdown 25% of the time.

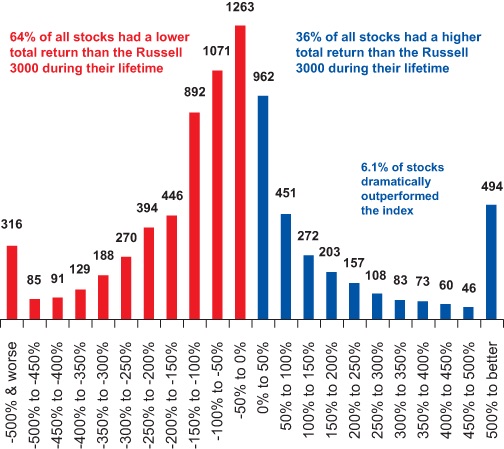

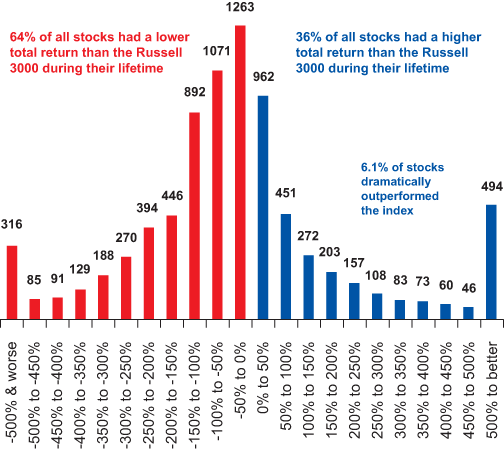

These sobering numbers come from one of the greatest companies of all-time. What does the rest of the stock market look like? A study from J.P. Morgan examines all Russell 3000 stocks from 1980-2014. What they found was that 40% of all stocks suffered a catastrophic loss, which they define as “a decline of 70% or more in the price of a stock from its peak, after which there was little recovery such that the eventual loss from the peak is 60% or more.” J.P. Morgan also found that two-thirds of all stocks underperformed the Russell 3000, while 40% of stocks experienced negative absolute returns.

Adam Smith (really George Goodman) talks about what it takes so be successful in The Money Game:

“If you are a successful game player, it can be a fascinating, consuming, totally absorbing experience, in fact it has to be. If it is not totally absorbing, you are not likely to be among the most successful, because you are competing with those who find it so absorbing.”

It’s hard to comprehend how many people are out there that are totally absorbed by the game. Yesterday the volume on the NYSE was $50,627,642,157. In Howard Marks’s new memo, he says “markets have a number of functions, one of which is to eliminate opportunities for excess returns.” When trillions of dollars worth of stocks are traded every month, you better believe the opportunities for excess returns are limited to a few.

Copyright © Michael Batnick, The Irrelevant Investor