Overdue correction, not a new bear market

Asset Allocation Q2 2015 Update

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

• After a thorough review of our existing asset allocation framework, Raymond James Ltd.’s (RJL) asset allocation committee has decided to make a number of changes to our framework and investor profiles. The objective of these changes is to make our asset allocation framework easier to understand and follow. These changes include: 1) the RJL asset allocation committee name will change from the Investment Policy Committee to the Investment Advisory Strategy Group (IASG); 2) the IASG has been expanded to include new members; 3) we are introducing new Strategic (i.e. long-term) asset allocation mixes for each investor profile; 4) we are removing Alternatives as a separate asset class and returning to the basics with cash, bonds and equities as our three asset classes; 5) we are changing the names of our Income & Capital Preservation and Global Equity investor profiles to Capital Preservation and Aggressive Growth; and 6) we are adjusting our asset class ranges for each profile.

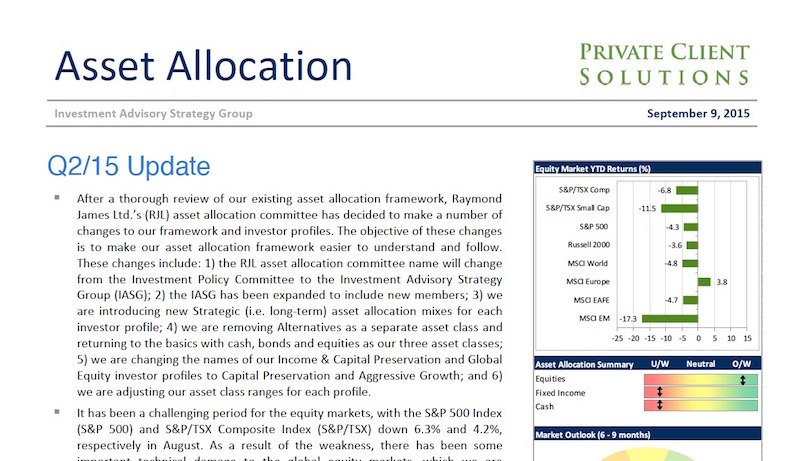

• It has been a challenging period for the equity markets, with the S&P 500 Index (S&P 500) and S&P/TSX Composite Index (S&P/TSX) down 6.3% and 4.2%, respectively in August. As a result of the weakness, there has been some important technical damage to the global equity markets, which we are monitoring closely. Our base case view remains that the equity markets are experiencing an overdue correction, rather than the start of a new bear market. Given this view, we are maintaining our overweight recommendation of equities. However, should we see further weakness and important technical levels being broken, we will likely re-evaluate our bullish stance.

• We are making a number of changes to our investor profiles, with the Capital Preservation and Conservative profiles seeing the most significant changes. Previously, we recommended significant holdings of cash for these profiles given the focus on income and capital preservation for these profiles. However, with cash (91-day T-bills as our cash proxy) yielding so little as a result of near record low interest rates, we have decided to significantly lower our cash exposure, and reallocate those proceeds into bonds and equities.

• See pages 4-5 for a detailed breakdown of our asset allocation changes.

Read/Download the complete report below:

Copyright © Raymond James