Corporate Cash and Corporate Balance Sheets

by Jeff Carter, Points and Figures

In the US, there is more cash on corporate balance sheets than ever before. There is more cash inside of banks than ever before. But, if you are a student of accounting you know that if one side of the balance sheet increases, the other side has to increase too.

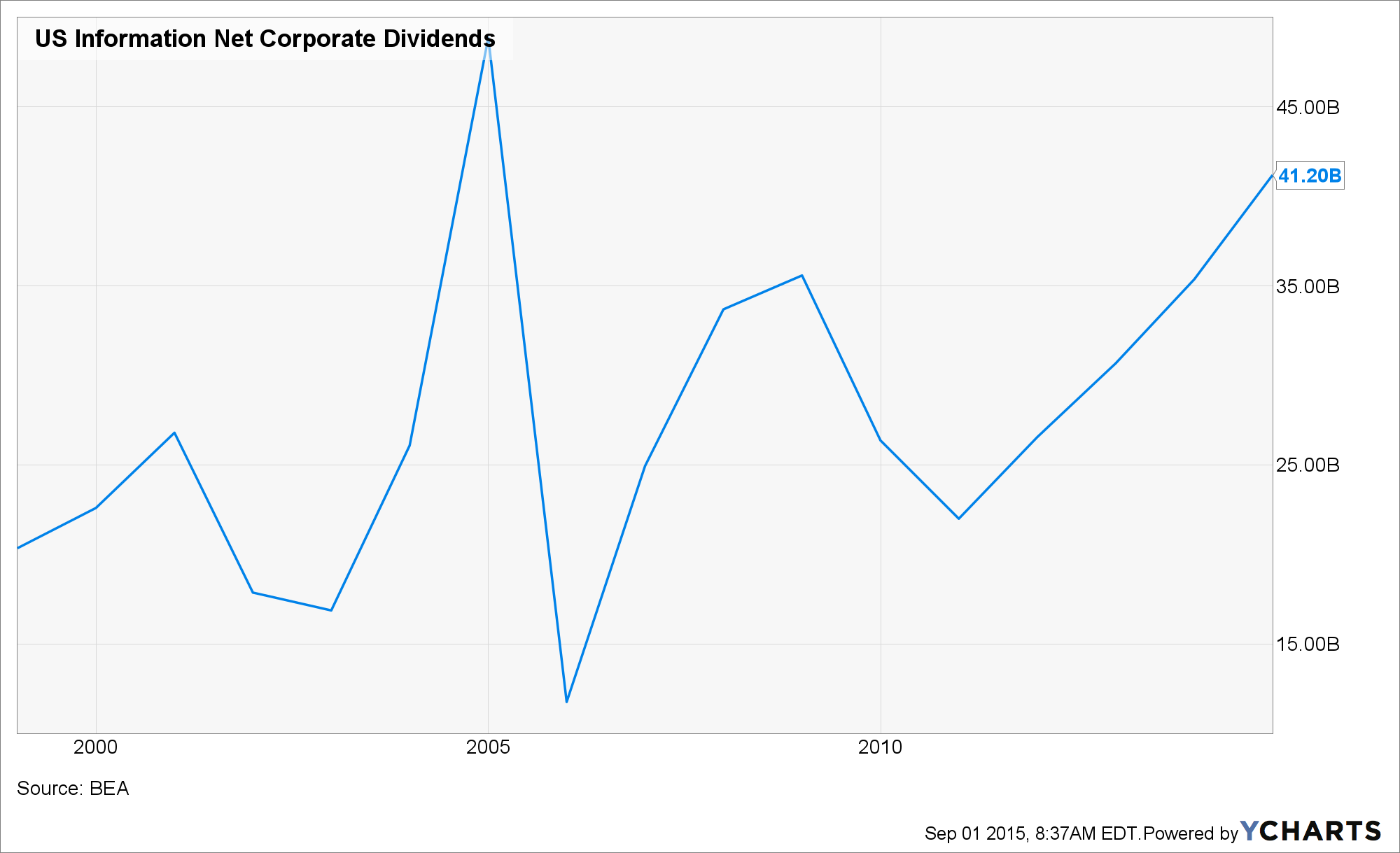

Personally, if we are interested in seeing that cash flow off of corporate balance sheets and into the hands of people, we ought to make taxes on dividends 0%. We should think about taxing buybacks, since they don’t enhance anyone’s real return. Dropping corporate taxes to 15% would also be a good idea. The shareholders are assuming risk to hold the stock. They should be rewarded via appreciation and dividends, not buybacks.

Here is some data on corporate activity.

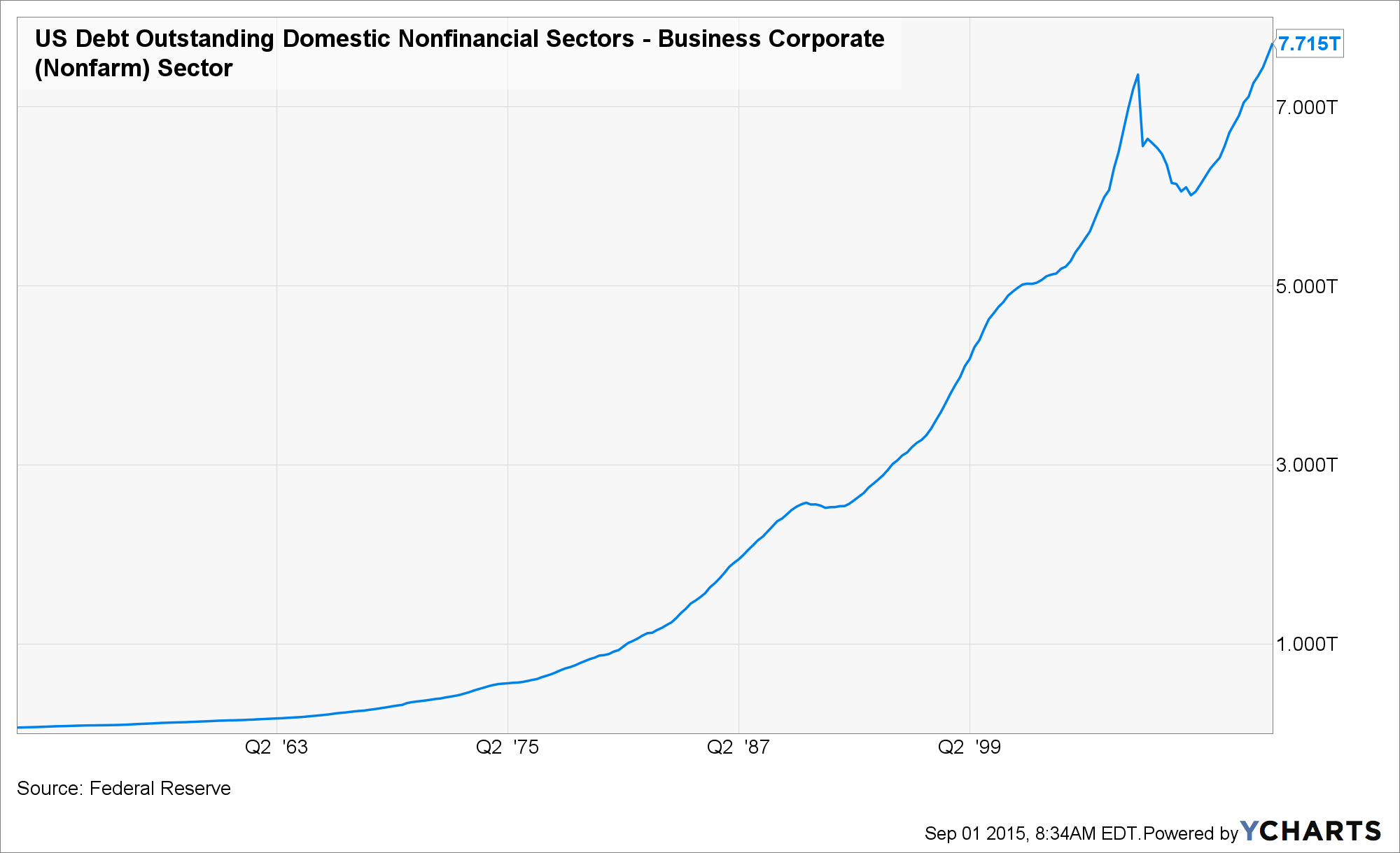

In an up market, shareholders equity goes up in value offsetting and balancing the increase in cash. In the case of US corporations this is partially true, but they have also tagged on debt. Lots of it and lots of it is less than 5 years in duration.

US Debt Outstanding Domestic Nonfinancial Sectors – Business Corporate (Nonfarm) Sector data by YCharts

Most of the debt is short term. It’s financed at near zero interest rates. If they were smart, they didn’t take on debt that they couldn’t pay with free cash flow. Corporations aren’t always so smart. Corporations have also increased dividends.

US Information Net Corporate Dividends data by YCharts

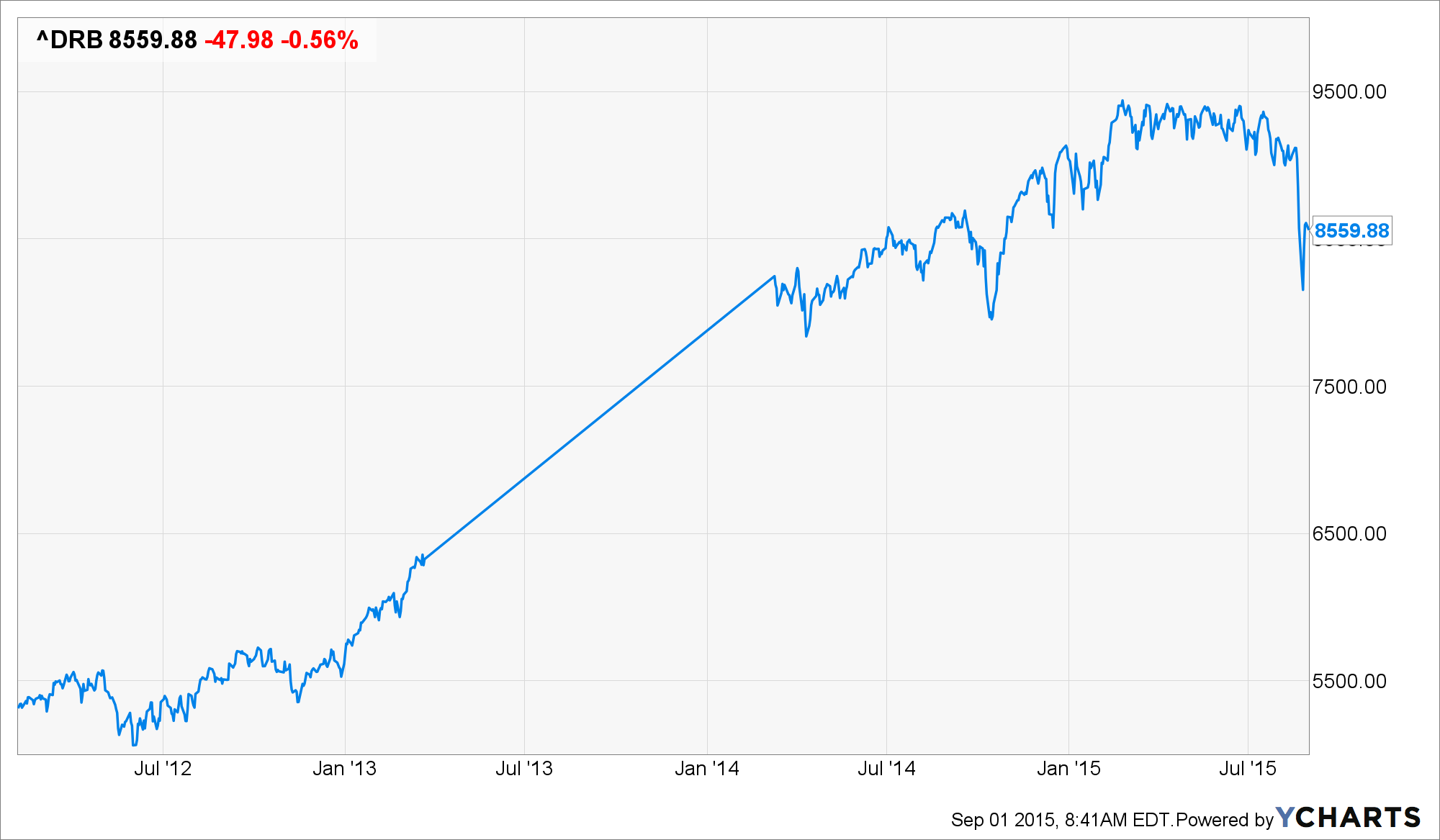

As you may have read, many corporations have bought back stock as well. In the fourth quarter of 2014, aggregate share buybacks amounted to $125.8 billion. That’s year-over-year decrease of 4.4%. Here is an AMEX index of share buybacks. Buybacks help executives get out of options, they don’t help shareholders. That’s why I would tax buybacks, and make dividend taxes 0%.

As the stock market continues to go down, I would not expect corporations to begin buying back stock in greater volume. I’d also look for dividends to remain the same or be cut. They can get scared, just like people. In tough times, corporations sit on their hands. GDP has been totally anemic during this whole “recovery”. The bulls tell me that there is nothing to worry about because corporate earnings are okay. But, I think that can change pretty quickly depending on their business model. A strong dollar and weak China isn’t going to help them.

No doubt, the Fed will use this as an excuse not to raise rates. This will keep the shell game going. Corporatist Republicans in Congress will use this as an excuse not to get rid of the subsidized corporate only EX/IM Bank. Socialist Democrats will call for more government intervention and government programs. None of that will work.

One interesting thing about this break has been the relationship between the S&P and the US Treasury Market. The treasuries don’t bounce in a flight to quality since the Chinese are selling every bid to raise cash. That’s not going to help the US deficit. Debt is a double edged sword.

As I write this, the S&P 500 is down 53 points or 2.72%. The VIX is going to trade over 30.

Economist John Cochrane said, “Financial crises are always and everywhere about debt, especially short term debt. Lending more, encouraging more bank leverage, reducing reserves and margin requirements, means that when the downturn comes a needless wave of runs and defaults follows.”

Buckle your chin strap. Warren Buffett’s metaphorical tide is going out. Let’s see what everyone really looks like.

Copyright © Points and Figures