The Trend is Your Friend, Except at the End

by Adam Grimes

Let’s talk about endings today. If we can better understand the patterns that often occur when trends end, we are better equipped to manage risk, place stops, and, in general, to trade those trends. Crude oil provides a good example of a dangerous ending in a specific kind of trend.

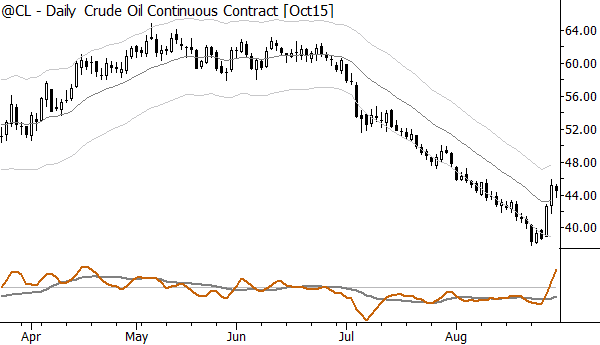

A few weeks ago, I wrote about the trending pattern in crude oil, which I called a “slide along the bands” trend. This is basically a low-volatility trend, and we can identify it when price goes to one band 0r channel–it doesn’t really matter whether you use Bollinger bands, Keltner channels, or some other similar tool–and stays there while the market “slides” in the direction of the trend. This type of trend doesn’t have a lot of the normal pullbacks and retracements that most trends do, and it can be incredibly powerful. Here’s a current chart of crude oil futures:

It’s easy to miss a trend like this because the market may look very dull and boring, but this specific, low volatility trend can go much further than anyone thinks possible. Identifying this pattern early allowed me to catch the recent downtrend, even though I thought, in early summer, that crude oil might be putting in a long term bottom. The grinding trend pattern can roll over many obstacles that set up against the trend.

This trend also provides a good example of what happens when everyone is on one side of the trade. In some ways, this pattern quantifies the classic one-sided trade; trading activity and volume dry up as volatility (measured by standard deviation of returns) craters. These trends are a powder keg, and they tend to end in one way: with sharp, volatile counter-trend pops.

Now, call this a “short covering rally” or whatever you will, but the point is we knew, weeks in advance, that this trend was not likely to end politely. We knew that even a minor bounce against the trend was likely to lead to a multi-day pop. So, how do you use this information? Well, the art of stop placement (and, for discretionary traders, there is maybe more art in this aspect of trading than in any other) depends on understanding expectations. There are times we need to be far from the market; in reality, there are many times we need to be far–it’s a mistake to think you can use tight stops and I think it’s one reason many traders fail. However, there are also times that our stops should be close; if we know that a fairly minor move against the trend is likely to lead to a nasty move against the trend, why not put our stops close enough that we are among the first out?

This is the lesson: learn to identify these “slide along the bands” trends, which are rare but powerful. Try to get on board, but don’t plan to do so via retracements, because those retracements can be nasty. If you are in a trend like this, first, congrats, but, second, play defense. Use tight stops, perhaps even tightening them after each bar. This is not a time to endure much pain against the trend–this is a time to lock in profits.

One of the principles of trading is to identify those points when the crowd might be right, to stand with the crowd while they are right, and to try to be among the first out when the crowd turns. It’s a nice plan, but very hard to execute. If you can identify this (rather rare) type of trend and use the correct stops with perfect discipline, you’ve found trader psychology encoded in the patterns of the market, and this often points the way to winning trades and substantial profits.

Copyright © Adam Grimes