There are No Hacks in the Market

by Eddy Elfenbein, Crossing Wall Street

When I was in college, my friends often came up with crazy “can’t miss” business ideas. One week, they were going to sell imported leather goods. Another week, they were going to scalp concert tickets. They always knew somebody who knew somebody who probably knew somebody else.

It didn’t take long for me to realize that these business ideas rarely involved much work on their part. Instead, it was a transaction that exploited some apparently unfilled gap in the market. Not surprisingly, these business ideas never worked out. The lesson is that there’s no way to hack the economy.

I thought of that as I read Josh Brown’s recent post “Computers are the new Dumb Money.” This past week an unhappy one for computerized trading. Josh relayed the story of hearing a quant saying he “could write a program that crushes the market in my sleep.” Yeah, sure. A $20 trillion can be so easily hacked.

To be sure, there are patterns that emerge which can be exploited for some time. Then it stops and the computers are never told when. As Josh said, “The problem with computers is that they can’t be programmed with humility.”

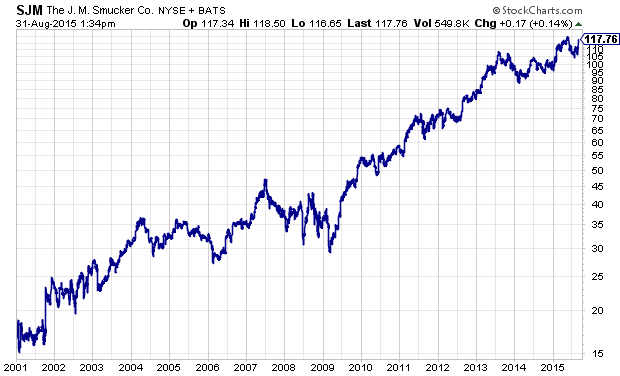

This is also why I tell investors to steer clear of stock screeners, or any over-systemized investing approach. They may work, and they’ll keep on working—until they don’t. It’s a very reassuring thought that very hedge funds have beaten Smuckers (SJM), the jelly people.

I take back what I said before; there really are ways to hack the economy. For example, hard work. A college student came wake up early on a Saturday and mow someone’s lawn. They can do a good job and get referrals. Pretty soon, the student can make some decent spending money.

In the stock market, there are hacks as well. For example, value investing. Time after time, academic studies have shown that it works, and in markets all around the world. For all the evidence, you’d think more people would pay attention. Instead, they’re buying BABA for a quick buck. It’s about to pop. I heard it from someone who heard it from someone….

Copyright © Crossing Wall Street