Liquidnet CEO Sees Stock Picker's Market Amid Turmoil

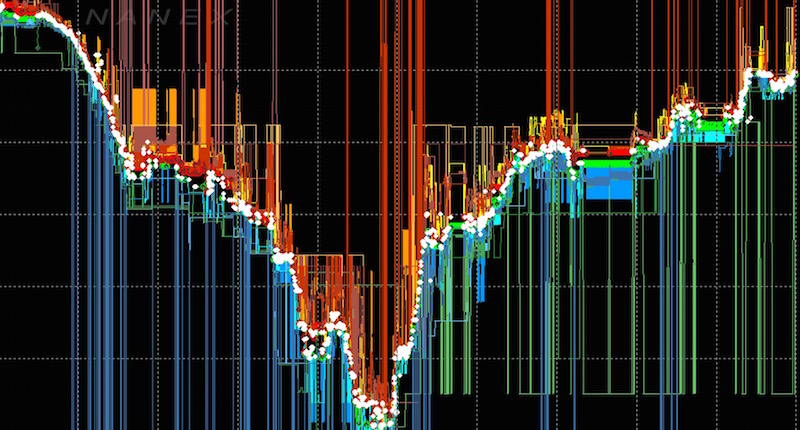

Volatile Markets are HFTs Playground

August 27, 2015 - Seth Merrin, founder and chief executive officer of Liquidnet Holdings Inc., the HFT-free peer-to-peer trading network which protects 800 of the largest asset managers from predatory trading algorithms, talks about the U.S. stock market, volatility and investor sentiment. Its during volatile trading sessions, when investors are reacting badly, HFTs make a lot of money, exacerbating markets. He speaks with Erik Schatzker on Bloomberg Television's "Market Makers." (Source: Bloomberg)

Smaller investors are getting a raw deal, from exchanges that allow HFTs to co-locate their servers, so they can front-run latency within the system. Liquidnet via its dark pools allows its members, some the largest asset management firms in the world to trade amongst themselves and provide each other liquidity, away from the gaze of the supercomputers.

Back in April, Seth Merrin, chief executive officer of Liquidnet Holdings Inc., talked to Bloomberg about the structure of Liquidnet's dark pool and high-frequency trading. He spoke with Erik Schatzker and Stephanie Ruhle on Bloomberg Television's "Market Makers." (Source: Bloomberg)

“Mutual funds and pension funds have grown their assets so large during the whole bull market, that they have become a wholesale sector, and for the 90-million Americans that invest with these mutual funds and pension funds.”

“They need a venue where they can trade, in the size, among themselves, safely, and away from predatory traders, like high frequency trading, that move the market against them, ultimately creating a tax on all the returns, for all those people that have invested in mutual funds and pension funds,” says Merrin.

He says IEX, the brain-child of former RBC institutional trader, Brad Katsuyama, the subject of of Michael Lewis’s “Flash Boys”, differs from Liquidnet, in that it “operates within the current market structure framework, and that is a very leaky house.”

Merrin says “IEX is doing a good job of patching a lot of these leaks. The problem is that high frequency traders make so much money, that they’re going to find new areas they can create new leaks in.”

“Liquidnet is a wholesale marketplace, much like every other industry has created, when a wholesale sector has emerged. Its a whole new house, and its a house that is only for these large wholesalers, these institutions to trade, so we don’t allow in, any of these high frequency traders.”

Not all high frequency traders are bad, but there’s a large segment that simply make money at the expense of these large institutions.

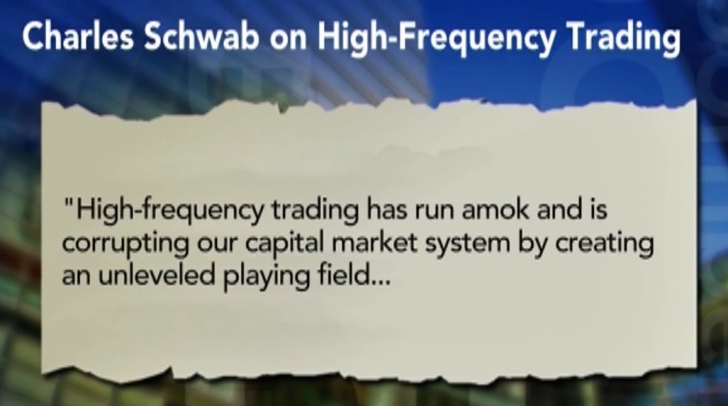

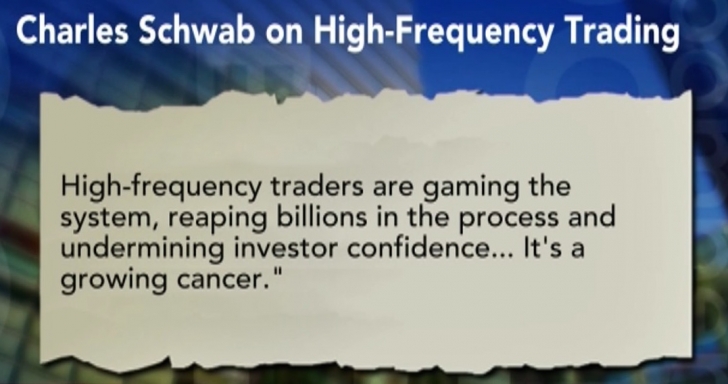

Charles Schwab's thoughts on HFT:

High Frequency Trading is “typical of Wall Street,” Merrin points out, “where very few make a lot of money at the expense of the very many. There is a problem with market structure, and there is a problem with these high frequency traders trading ahead of these institutional orders, knowing that they have a large amount of shares they have to buy in order for them to actually perform.”

“They’re sitting ducks, the institutions, and unfortunately, HFTs are taxing on all of our returns from the institutions that invest our money.”

“Something has to be done. This is an old debate we’re having. Michael Lewis was late to the game, as far as this debate is conerned.”

“I’m glad that its in focus, we have to focus on this. We have to get market sentiment back, we have to get investor confidence back in to our markets.”

“The market is supposed to be there, and Investors should be able to trade shares efficiently without having to be concerned with being front-run or taken advantage of,” says Merrin. The market is there for capital formation, so companies can raise money efficiently, in the public market, and if there’s a segment of those markets that simply take advantage of the inefficiencies of the market, that’s something the regulators and entrepreneurs, like Liquidnet, should try to solve.”

What (real) progress is being made market-side in the stock exchange business?

Adam Sussman, Head of Market Structure and Liquidity Partnerships at Liquidnet, weighs in on how Canada's new stock exchange, Aequitas NEO Exchange, which launched in April 2015, has developed a market speed bump that uniquely exceeds those implemented to date, and protects Canadian investors returns from predatory high frequency traders.

So far, so clear. There are good speed bumps. There are bad speed bumps. Things get more interesting with Aequitas Neo. The Aequitas speed bump is only levied on immediate-or-cancel (IOC) orders sent by firms the Exchange identifies as HFT (High Frequency Traders). Aequitas came up with its idea first and so it’s pretty clear that Alpha was designed to be the exact opposite.

The intent of the Aequitas speed bump is closer to that of the IEX “shoebox.” In fact, one could argue that the Aequitas speed bump is more effective in removing the HFT advantage. Because all orders are slowed down at IEX, the HFT firm can still have some advantage as long as it get its order to the shoebox faster than other market participants. Aequitas only slows down HFT orders. It’s a speed bump that applies only to certain market participants under certain conditions.

Download Adam Sussman's full note from June 24, 2015 here.