The Market Downturn is Here – Now What?

KEY TAKEAWAYS

• As a bull market matures over the second half of an economic expansion, periods of increased market volatility are likely to become more common.

• Periods of volatility bouts will likely create a more challenging environment for investors, and in the short term, sentiment can control markets as investor sensitivity to certain risks spikes.

• We believe the macroeconomic fundamentals and the dynamism of American corporations are likely to drive further stock market gains.

by Burt White, CIO, LPL Financial

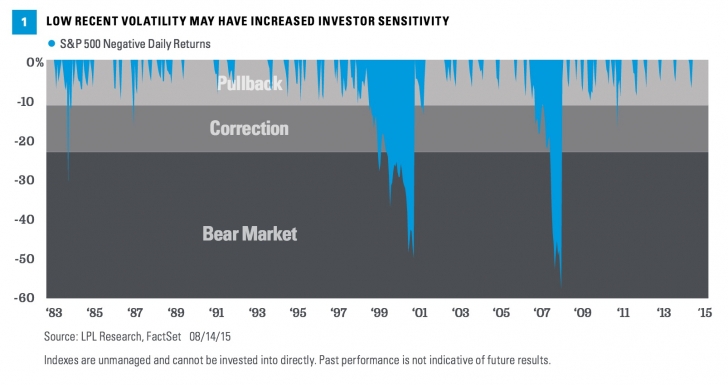

August brings with it the end of summer, but in recent years, bouts of stock market volatility have been common. It is quite normal for stock prices to decline at some point almost every year. Since 1980, the stock market, as measured by the S&P 500 Index, declined into negative territory at some point during the calendar year in every year except four. Furthermore, the average peak to trough decline during any year is 15% even though stocks finish the year higher 70% of the time.

At times like these we need to remind ourselves that market downturns are part of investing. The length of the current bull market, the lack of notable pullbacks, and the length of time without a correction may have increased investor sensitivity to pullbacks. Four years have passed since the last correction (a decline of more than 10%) in August 2011 and two of the four years (mentioned above) without a decline into negative territory were recent: 2012 and 2013. Recent history may have provided a false sense of security.

As we noted in our Outlook 2015: Some Assembly Required, as a bull market matures over the second half of an economic expansion, periods of increased market volatility are likely to become more common.

A combination of worries has led to the latest episode of market turbulence, including:

China fears

Chinese stock market gains were simply unsustainable, as was the yuan’s currency strength. The torrid pace of gains over the first half of 2015 was ripe for a correction. Despite the severity of the correction Chinese equity markets were still in positive territory year to date, as of Friday, August 21, 2015, although more volatility could change that status quickly.

Chinese stock market action is likely to have a limited impact, if any, on the global economy. Only 9% of the Chinese public invests in equities compared to a much higher 55% in the United States. Potential wealth effects, either positive or negative, from equity market changes are therefore much less impactful.

Furthermore, economic linkages with China exist, but are much less significant than the U.S.’s key trading relationships. U.S. trade with Europe and Japan combined is roughly 4 times larger than U.S. trade with China. And U.S. trade with both Canada and Mexico is greater than our trade with China.

Regarding China’s currency, due to its peg to the strong U.S. dollar, the yuan appreciated 11% versus other emerging market currencies, 19% versus the yen, and 10% versus the euro in 2015 prior to the early August devaluation. The relative strength of the Chinese yuan created a strong headwind for China’s export economy. Poor communication from Chinese officials only compounded investors’ fear. Bold attempts to stem the market’s decline earlier this summer had only mixed success and the central bank’s statement announcing the currency change was extremely brief — both factors eroding confidence. Concern over a modest 3% yuan devaluation, in light of a significant multi-year rise, is overdone, in our view. This is just another step in the China’s long history of overtly managing its economy, especially now as it transitions to becoming more consumer-driven.

China is likely to continue with a heavy hand but its next move is likely to be another policy easing move either in the form of another interest rate cut or additional regulatory relief.

Lower oil prices

Oil price declines weigh heavy on the energy industry. However, unlike past years, the decline in oil prices is a function of oversupply, and not weakening demand. Over the second half of 2015, energy companies will have dealt with lower oil prices for a year and profit declines will likely slow, removing a headwind from broader earnings growth — the key driver of stock prices over the long run. Excluding the energy sector, S&P 500 company earnings grew 9% year over year in the second quarter of 2015 and we believe the overall earnings picture will improve over the remainder of 2015.

The Fed’s first rate hike

The possibility of a Federal Reserve (Fed) interest rate increase in September, even if low, has added to investors’ concerns. The Fed is unlikely to be hasty and the release of its July meeting minutes suggested some apprehension over a potential September rate hike. We believe the Fed will take note of global events and hold off from raising interest rates.

Despite ongoing fears, economic data still points to continued U.S. expansion. Robust auto and home sales data, the two largest purchases most consumers will make, argue strongly against a recession. Consumer spending accelerated after a slow start to 2015 and monthly jobs gains have exceeded 200,000 in all but 3 months over the past 18 — one of the most consistent stretches on record. The economic recovery has been gradual by historical comparison, but the silver lining is that the slow pace has not produced the excesses that typically accompany the end of a bull market or economic expansion. It is these excesses, not age, that end bull markets.

Information Void

Unfortunately, there is limited economic data until the August jobs report on September 4, 2015, which suggests the information void that may have sparked panicky selling in recent days may linger. The Kansas City Fed’s annual Jackson Hole Conference, which starts Friday, usually provided insight into monetary policy but Fed Chair Yellen is not attending this year. However, Fed Vice Chair Stanley Fischer will speak on inflation on Saturday, August 29, 2015, and provide clues as to the latest Fed thinking. Fischer is known as a “dove” (someone who favors more accommodative monetary policy), and market friendly comments may add to the ongoing decline in September rate hike expectations.

Nonetheless, as long as earnings continue to grow, pullbacks such as the current one can be opportunities for investors with longer-term horizons. We continue to monitor underlying market conditions for potential financial or economic stress. Bouts of volatility will likely create a more challenging environment for investors and in the short term sentiment can control markets as investor sensitivity to certain risks spike, but we believe that the macroeconomic fundamentals and the dynamism of American corporations are likely to drive further stock market gains.

Weekly Market Commentary 08242015