by Mawer Investment Management, via The Art of Boring Blog

The morning began like any other Thursday. Headphones in and music blasting, I traced the same route that I take every day to work. I was operating on autopilot and when I got to the intersection, I hardly noticed all the other pedestrians standing at the corner—a peculiar sight given that it was their right-of-way. Nevertheless, I proceeded into the intersection undaunted … and was hit by a gust of wind and flashes of red and white. The ambulance that the pedestrians had heard, but I had failed to notice, zoomed by and narrowly missed me by about two feet.

My potentially grim and ironic run-in with an ambulance happened three weeks ago. This event was an example of a low-cost lesson: an important learning imparted without great cost. And it made me reflect on how we approach these lessons in investing. Low-cost lessons are gifts from the gods of probability. Given that many lessons in life are learned through pain, low-cost lessons are opportunities to grow without enduring significant hardship. In my case, I narrowly avoided severe injury (or worse) without much more than a brief scare.

Unfortunately, most people often move on from these moments without internalizing the lessons. Instead of embracing these events as catalysts for change, we tend to simply acknowledge how lucky we were and then promptly forget they happened. In this way, we habitually miss chances to make much-needed changes in our careers, health, relationships and finances; leaving the lessons to be learned only under more painful circumstances. And this type of behaviour happens all the time in investing.

For example, imagine that you’ve been concerned with recent events in Greece and China. To avoid the pain of potential losses, you decide to take your money off the table, i.e., you decide to try your hand at market timing even though you “know” that this is a largely unsuccessful strategy. But just as you are about to put in your sell trades, you get distracted by a big presentation at work and put your portfolio aside until the next week. And low and behold! Miraculously, by the next week, events have shifted, sentiment has turned and the market is up. You avoided an ill-fated trade and smile, self-satisfied, at your brilliant luck.

Clearly, this would be an example of a low-cost lesson: in this situation, you would learn (without cost) that market timing is a bad idea. And while this scenario is hypothetical, our team hears about similar situations all the time. These “near-misses” are way more common than we think. We all have moments when we made a bad decision but got lucky. The question is not whether we will have near-misses, but how we react to them when we do.

Unfortunately, many investors never learn from their low-cost lessons. One reason for this is that investors rarely realize a lesson is being taught, or feel the need to evaluate their past decisions, when outcomes are good.

Moreover, even when they do recognize the errors in their ways, how often do they do something about it? It is not enough to acknowledge a near-miss; we have to go one step further and evaluate whether our decision-making process or habits need to change too. It’s not enough to say seatbelts are important; we need to also drive with them on. Making adjustments to our processes or behaviour is what prevents us from repeating the same mistakes in the future—likely with more dire consequences.

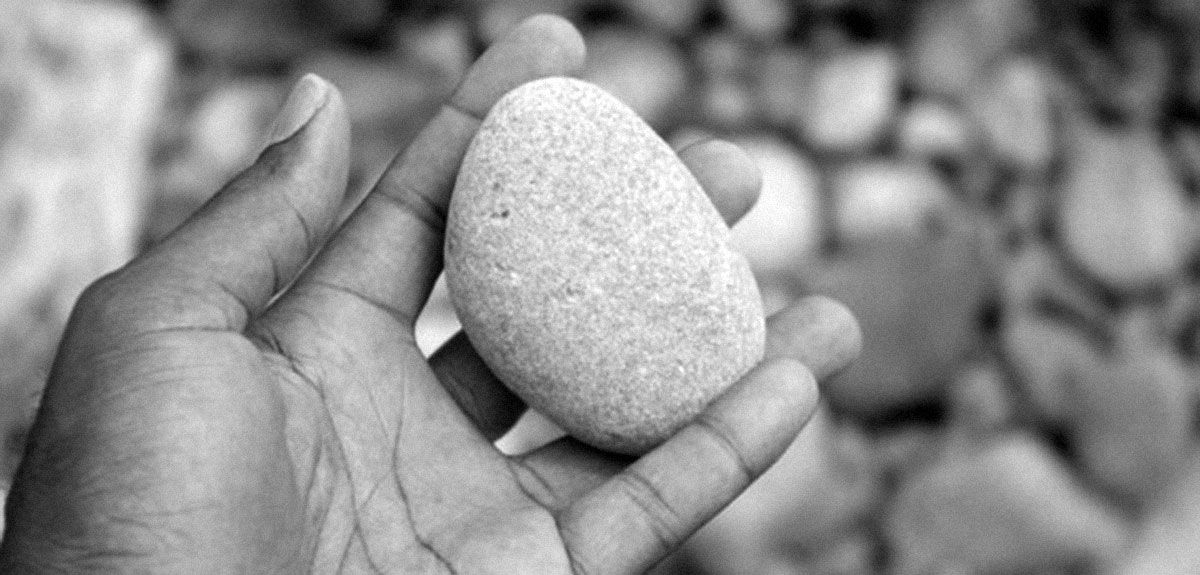

As it happened, I told a colleague about my near-miss. Her response was that I had been thrown a pebble. She explained further that life keeps throwing stones (lessons) at us until we learn the lessons it wants to teach. First, it throws a pebble. Then, it throws a stone. Finally, if we still haven’t learned our lesson… it throws a boulder. My colleague was saying that life threw me a pebble that day when I missed the ambulance… and not to take that for granted.

Let’s resolve to run with the pebbles we’re thrown.

This post was originally published at Mawer Investment Management