Over the decades I have collected lists of rules, guidelines, steps, etc. written by various individuals for various reasons. Most of them were created by folks after they had spent decades in the business and were sharing some things they not only learned over that time, but also strongly believed. My friend Lance Roberts did something similar to this on his blog a few months ago and I thought it was a great idea. These tidbits contain valuable insights and there is some repetition among the contributors. Gerald Loeb’s two books are must reads – I read them about 35 years ago. I’m sure there are many other great lists that can be found on the internet; just be sure to learn about who created the list and if they actually traded with real money or not. Click on the books for a link to either StockCharts.com’s Store or Amazon.

Enjoy!

Market Wisdom from Gerald Loeb

1. The most important single factor in shaping security markets is public psychology.

2. To make money in the stock market you either have to be ahead of the crowd or very sure they are going in the same direction for some time to come.

3. Accepting losses is the most important single investment device to insure safety of capital.

4. The difference between the investor who year in and year out procures for himself a final net profit, and the one who is usually in the red, is not entirely a question of superior selection of stocks or superior timing. Rather, it is also a case of knowing how to capitalize successes and curtail failures.

5. One useful fact to remember is that the most important indications are made in the early stages of a broad market move. Nine times out of ten the leaders of an advance are the stocks that make new highs ahead of the averages.

6. There is a saying, "A picture is worth a thousand words." One might paraphrase this by saying a profit is worth more than endless alibis or explanations. . . prices and trends are really the best and simplest "indicators" you can find.

7. Profits can be made safely only when the opportunity is available and not just because they happen to be desired or needed.

8. Willingness and ability to hold funds in cash while awaiting real opportunities is a key to success in the battle for investment survival.

9. In addition to many other contributing factors of inflation or deflation, a very great factor is the psychological. The fact that people think prices are going to advance or decline very much contributes to their movement, and the very momentum of the trend itself tends to perpetuate itself.

10. Most people, especially investors, try to get a certain percentage return, and actually secure a minus yield when properly calculated over the years. Speculators risk less and have a better chance of getting something, in my opinion.

11. I feel all relevant factors, important and otherwise, are registered in the market's behavior, and, in addition, the action of the market itself can be expected under most circumstances to stimulate buying or selling in a manner consistent enough to allow reasonably accurate forecasting of news in advance of its actual occurrence.

12. You don't need analysts in a bull market, and you don't want them in a bear market.

Jesse Livermore's Trading Rules

Note: Reminiscences was not written by Livermore, but believed to be about Livermore.

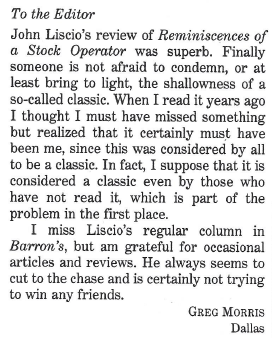

Personally, I did not care for the book, and often think it is popular because people want to be part of the supposedly wise crowd. Above is the note I penned decades ago (late 80s, early 90s??) to Barron's Mailbag after a review of the book appeared in Barron's. However, the book has been updated and annotated by Jon Markman and is much improved (last book on the right).

1. Nothing new ever occurs in the business of speculating or investing in securities and commodities.

2. Money cannot consistently be made trading every day or every week during the year.

3. Don't trust your own opinion and back your judgment until the action of the market itself confirms your opinion.

4. Markets are never wrong – opinions often are.

5. The real money made in speculating has been in commitments showing in profit right from the start.

6. As long as a stock is acting right, and the market is right, do not be in a hurry to take profits.

7. One should never permit speculative ventures to run into investments.

8. The money lost by speculation alone is small compared with the gigantic sums lost by so-called investors who have let their investments ride.

9. Never buy a stock because it has had a big decline from its previous high.

10. Never sell a stock because it seems high-priced.

11. I become a buyer as soon as a stock makes a new high on its movement after having had a normal reaction.

12. Never average losses.

13. The human side of every person is the greatest enemy of the average investor or speculator.

14. Wishful thinking must be banished.

15. Big movements take time to develop.

16. It is not good to be too curious about all the reasons behind price movements.

17. It is much easier to watch a few than many.

18. If you cannot make money out of the leading active issues, you are not going to make money out of the stock market as a whole.

19. The leaders of today may not be the leaders of two years from now.

20. Do not become completely bearish or bullish on the whole market because one stock in some particular group has plainly reversed its course from the general trend.

21. Few people ever make money on tips. Beware of inside information. If there was easy money lying around, no one would be forcing it into your pocket.

Bernard Baruch's 10 Investing Rules

Note: James Grant wrote the book on the right about Baruch.

1. Don't speculate unless you can make it a full-time job.

2. Beware of barbers, beauticians, and waiters — of anyone — bringing gifts of "inside" information or "tips."

3. Before you buy a security, find out everything you can about the company, its management and competitors, its earnings and possibilities for growth.

4. Don't try to buy at the bottom and sell at the top. This can't be done — except by liars.

5. Learn how to take your losses quickly and cleanly. Don't expect to be right all the time. If you have made a mistake, cut your losses as quickly as possible.

6. Don't buy too many different securities. Better have only a few investments which can be watched.

7. Make a periodic reappraisal of all your investments to see whether changing developments have altered their prospects.

8. Study your tax position to know when you can sell to greatest advantage.

9. Always keep a good part of your capital in a cash reserve. Never invest all your funds.

10. Don't try to be a jack of all investments. Stick to the field you know best.

Arthur Huprich's Market Truisms and Axioms

Note: Huprich is Chief Market Technician at Day Hagan Asset Management

1. Commandment #1: "Thou Shall Not Trade Against the Trend."

2. Portfolios heavy with underperforming stocks rarely outperform the stock market!

3. There is nothing new on Wall Street. There can't be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again, mostly due to human nature.

4. Sell when you can, not when you have to.

5. Bulls make money, bears make money, and "pigs" get slaughtered.

6. We can't control the stock market. The very best we can do is to try to understand what the stock market is trying to tell us.

7. Understanding mass psychology is just as important as understanding fundamentals and economics.

8. Learn to take losses quickly, don't expect to be right all the time, and learn from your mistakes.

9. Don't think you can consistently buy at the bottom or sell at the top. This can rarely be consistently done.

10. When trading, remain objective. Don't have a preconceived idea or prejudice. Said another way, "the great names in trading all have the same trait: An ability to shift on a dime when the shifting time comes."

11. Any dead fish can go with the flow. Yet, it takes a strong fish to swim against the flow. In other words, what seems "hard" at the time is usually, over time, right.

12. Even the best looking chart can fall apart for no apparent reason. Thus, never fall in love with a position but instead remain vigilant in managing risk and expectations. Use volume as a confirming guidepost.

13. When trading, if a stock doesn't perform as expected within a short time period, either close it out or tighten your stop-loss point.

14. As long as a stock is acting right and the market is "in-gear," don't be in a hurry to take a profit on the whole positions. Scale out instead.

15. Never let a profitable trade turn into a loss, and never let an initial trading position turn into a long-term one because it is at a loss.

16. Don't buy a stock simply because it has had a big decline from its high and is now a "better value;" wait for the market to recognize "value" first.

17. Don't average trading losses, meaning don't put "good" money after "bad." Adding to a losing position will lead to ruin. Ask the Nobel Laureates of Long-Term Capital Management.

18. Human emotion is a big enemy of the average investor and trader. Be patient and unemotional. There are periods where traders don't need to trade.

19. Wishful thinking can be detrimental to your financial wealth.

20. Don't make investment or trading decisions based on tips. Tips are something you leave for good service.

21. Where there is smoke, there is fire, or there is never just one cockroach: In other words, bad news is usually not a one-time event, more usually follows.

22. Realize that a loss in the stock market is part of the investment process. The key is not letting it turn into a big one as this could devastate a portfolio.

23. Said another way, "It's not the ones that you sell that keep going up that matter. It's the one that you don't sell that keeps going down that does."

24. Your odds of success improve when you buy stocks when the technical pattern confirms the fundamental opinion.

25. As many participants have come to realize from 1999 to 2010, during which the S&P 500 has made no upside progress, you can lose money even in the "best companies" if your timing is wrong. Yet, if the technical pattern dictates, you can make money on a short-term basis even in stocks that have a "mixed" fundamental opinion.

26. To the best of your ability, try to keep your priorities in line. Don't let the "greed factor" that Wall Street can generate outweigh other just as important areas of your life. Balance the physical, mental, spiritual, relational, and financial needs of life.

27. Technical analysis is a windsock, not a crystal ball. It is a skill that improves with experience and study. Always be a student, there is always someone smarter than you!

Note: I think the windsock comment should be credited to Carl Swenlin.

James Montier (GMO)

Note: I have stated often (maybe too often) that everyone should buy the “little book” and read it once a year. It is available at StockCharts.com’s Store. Click on the book for the link.

Risk isn’t a number and it isn’t volatility, it’s the permanent impairment of capital. Note: Seriously, how many times have I said that in these articles?

Volatility creates the opportunity.

Leverage cannot turn a bad investment into a good one, but it can turn a good one bad.

Leverage limits staying power.

Often financial innovation is often just leverage in thinly veiled disguise.

James Montier's Seven Immutable Laws of Investing

1. Always insist on a margin of safety

2. This time is never different

3. Be patient and wait for the fat pitch

4. Be contrarian

5. Risk is the permanent loss of capital, never a number

6. Be leery of leverage

7. Never invest in something you don't understand

Ed Seykota’s Trading Tribe Essentials

- Ride Your Winners

- Cut Your Losses

- Manage Your Risk

- Use Stops

- Stick to the System

- File the News

For those who missed it, here is Ed’s Whipsaw Song: Click Here

Robert Farrell’s Ten Rules for Investing

Note: Farrell was the Chief Technical Analyst for Merrill Lynch for decades and was on Wall Street Week many times in the 1970s and 1980s.

1. Markets tend to return to the mean over time.

2. Excesses in one direction will lead to an opposite excess in the other direction.

3. There are no new eras -- excesses are never permanent.

4. Exponential rapidly rising or falling markets usually go further than you think, but they do not correct by going sideways.

5. The public buys the most at the top and the least at the bottom.

6. Fear and greed are stronger than long-term resolve.

7. Markets are strongest when they are broad and weakest when they narrow to a handful of blue-chip names.

8. Bear markets have three stages -- sharp down, reflexive rebound and a drawn-out fundamental downtrend.

9. When all the experts and forecasts agree -- something else is going to happen.

10. Bull markets are more fun than bear markets.

Greg Morris’ Rules

Note: The Market Breadth Indicators book is the one I am revising and putting all of the indicators into StockCharts.com’s Symbol Catalog. Hopefully it will be done near the beginning of next year.

1. Turn off the TV and stop surfing the Internet for advice (stop the noise).

2. Develop a simple process, one that you can explain to anyone (mine is trend following).

3. Create a security selection process based upon momentum.

4. Devise a simple set of prudent and reasonable rules and guidelines.

5. Follow your process with discipline; without it, you will fail.

6. If you do not have the discipline to do this, seek professional help from someone who does.

7. Do not be upset with yourself if you do not have the discipline at times; be proud of yourself for recognizing it.

8. Do not confuse luck with skill.

9. Listen and learn from the market – it is always right.

10. Read this list often (this is what you say when you only have 9 rules).

I believe if you have read all these rules and those lists found elsewhere that you will find a common thread in them – discipline, simplicity, process.

Trade with Wisdom,

Greg Morris