by William Smead, Smead Capital Management

The longer we are in the investment business, the more skeptical we become about the investment crowd’s ability to identify which innovative companies are truly disrupting competing companies. Last week (August 7th of 2015) a sharp correction occurred in the prices of television and other media stocks, seemingly based on concerns that Netflix and other internet-based streaming services would “kill” the TV business. As long-duration common stock pickers who hold media securities, we got to thinking about long-term changes in media. We wondered if the Buggles were right when they debuted on MTV in 1981 proclaiming that “Video Killed the Radio Star.”

From a security selection process standpoint, can you predict ahead of time which innovations permanently damage existing moats? Are companies like Netflix and Amazon going to wipe out the formats which preceded them and completely ruin the competitive position of formerly profitable businesses? How do common stocks, which the crowd deems “out of favor,” perform compared to the companies which appear to have the brightest futures?

We look to the Buggles, whose prescient lyrics offer some evidence on this common theme:

I heard you on my wireless back in ’52

Lyin’ awake intent on tuning in on you

If I was young it didn’t stop you coming through

Oh-a-oh

In 1952, when they heard a song on the wireless, television was becoming the hot new technology. Radio was all the rage in the 1920s, 1930s and 1940s. By the 1950s, however, radio-related stocks were severely threatened as Texaco and Colgate sponsored variety Television shows with hosts like Milton Berle, Dean Martin and Jerry Lewis.

The problem with theorizing that video would kill the radio star is exposed in the following line in the song:

In my mind and in my car

We can’t rewind, we’ve gone too far

Those who were bearish on the radio business forgot that you can’t watch TV in your car and it is hard in many other venues to watch anything. Instead, in the 1980s, 1990s and 2000’s you listened. Radio continued to be “in my mind and in my car.”

Recently, Sirius, Pandora and other competitors have invaded the space of advertising-based radio stations. Those who assumed the death of the radio business in 1981, as MTV got incredibly popular, ended up missing out on additional decades of profitability. The next phase of competition threatened the TV business itself.

Pictures came and broke your heart

So put all the blame on VCR

In the mid-1980s, the VCR and cable access became available. This appeared to threaten the advertising-based franchise of the TV networks like CBS and NBC. After all, who likes to watch commercials and who doesn’t like a large and growing choice of what to watch? These forces legitimately weakened the moat of the TV networks. The three main broadcast networks had a blessed oligopoly for about three decades. Even at today’s lowered prices, CBS has a $24 billion stock market capitalization and it had more than doubled its earnings from 2005 to 2013.

Now Netflix comes and investors are afraid that they are going to take over the entire TV entertainment industry. Here is how Charlie Ergen, the CEO of Dish Network, described the situation to Wall Street Journal writer, Joe Flint, in an August 6th piece called “Cord Cutting Weighs on Pay TV:

“ ‘Netflix is the most powerful content aggregator in the world today and there’s nobody that’s even close,’ Dish Chief Executive Charlie Ergen said Wednesday on the company’s earnings call. He said kids are ‘happy to watch SpongeBob from 2007 and that’s just as fresh to them as SpongeBob from 2015. So the world has changed.’ ”

The Buggles had that covered too:

They took the credit for your second symphony

Rewritten by machine on new technology

And now I understand the supernova scene

Today, 20-35 years old Americans represent our largest population group and are the first generation to be entirely internet savvy. It only makes sense that investors would favor technology “rewritten by machine on new technology” over content creation and traditional choices. They see themselves as part of the “supernova scene.”

In an over-generalized way, having millions of un-married twenty-somethings is a dream for the Netflix, Amazons, Apples and Facebooks of the world. Folks between 22 and 35 years old predominately live in historically over-priced apartments, spend money on restaurants (Chipotle, Shake Shack, Panera Bread), drink craft beer, pay for cell service/internet access and watch a limited amount of TV via Netflix to save money.

Every generation’s modus operandi leads them to think that they won’t do what the prior generations did. Don’t worry, The Buggles covered that as well:

Oh-a-oh

I met your children

Oh-a-oh

What did you tell them

Once the millennials marry and have kids—once we get to meet “your children”—it should be amazing how the millennial spending patterns will change and formerly unattractive activities become mainstream to them. When you marry, have kids and buy a house, life changes dramatically. Our guess is that the average millennial couple will have Netflix, cable, a DVR, watch local TV news, read locally-written news/commentary and access a great deal of it on their wireless devices. Remember, the radio stations and TV networks lost market share along the way, but enjoyed a doubling of the population from the end of World War II to today.

Regardless of which distribution method is used, entertaining content is always what allows most media companies to survive and prosper. I recently asked the CFO of then Gannett and now Tegna, Victoria Harker, what they needed to do to succeed in the next ten to twenty years. Her answer was, “We need to create great content!” Mr. Flint’s Wall Journal Street article quoted Nomura Securities on the subject:

“ ‘What the market is saying is that these are uncertain times because we are transitioning from one form of distribution to another,’ said Nomura Securities analyst Anthony DiClemente. But over the long term, he said, media companies that create the best content will remain ‘providers of a scarce resource,’ and therefore will maintain their place of value in the ecosystem.”

We think DiClemente hits the nail on the head. It’s less about the distribution and more about content creation. This matters because most investors seem much more concerned with distribution, as evidenced by the P/E multiples of the “supernova” media companies.

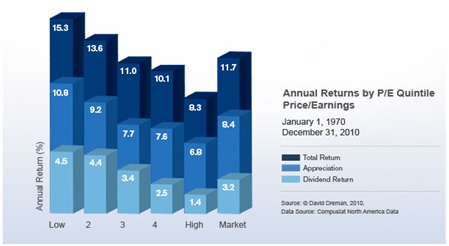

The historical studies like the one below shows that video isn’t likely to kill the radio star; instead it shows that cheap stocks outperform average and expensive ones. The lowest P/E stocks on the left had the highest average appreciation and the high P/E ones the lowest. Plus the dividends were significantly higher among “out of favor” low P/E stocks. As we like to say, valuation matters dearly!

In conclusion, sometimes the new technology does kill a business. Automobiles did kill horse-drawn buggies by replacing them between 1905 and 1925. Electronic photography did to the camera and film business what autos did to oats and hay.

While we think The Buggles’ proclamation made for great content, we don’t think their prediction played out in a way that was helpful to long-duration common stock investors. Based on P/E ratios, there might be more money made betting on millennial adoption of some of the traditional ways of life and technologies than there is paying nosebleed multiples for Netflix. As contrarians, we find this compelling.

Two events in the last year highlight the staying power of premium content provided by traditional television distribution. First, CBS secured the rights to Thursday Night Football from the NFL Network, and saw the audience numbers soar in the 2014 NFL season. Second, the first Republican debate for the 2016 Presidential election cycle drew the second largest audience in the history of cable television.

Historical statistics and human observation would argue that after the recent stock price weakness, cable access, network television and their local affiliates are attractively priced and are subject to low expectations. They also provide content that they control and remains highly valued by millions of customers. Maybe the aging of the millennials and the blossoming of families will grow their customer base in the next five years.

Warm Regards,

The information contained in this missive represents SCM’s opinions, and should not be construed as personalized or individualized investment advice. Past performance is no guarantee of future results. It should not be assumed that investing in any securities mentioned above will or will not be profitable. A list of all recommendations made by Smead Capital Management within the past twelve month period is available upon request.

This Missive and others are available at smeadcap.com

Copyright © Smead Capital Management