by Michael Batnick, The Irrelevant Investor

“This oscillation is one of the most dependable features of the investment world, and investor psychology seems to spend much more time at the extremes than it does at a happy medium” – Howard Marks

These are not normal times investors are living in. The Fed has held short-term interest rates at zero for six years now, a policy experiment never seen before. This has many investors eager to see what happens if and when this returns to “normal.”

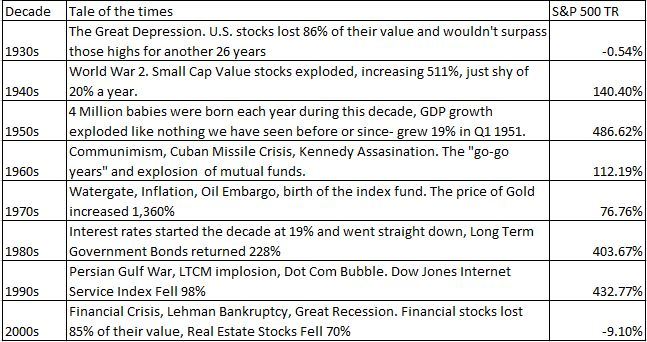

One of the biggest psychological challenges of investing is that there is always something out of the norm. Take a look at the table below which highlights different times investors had to live through and the extreme performances that accompanied them. I wonder at what point would somebody would have described the times as normal.

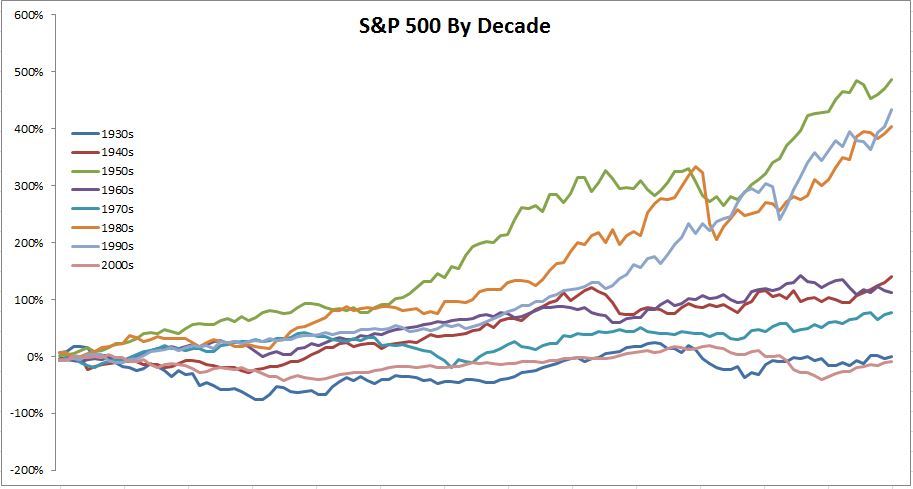

Next, have a look at the chart below, which shows the S&P 500 return by decade. You’ll notice absolutely no pattern.

Understanding how different it always is should be a great reminder why no strategy will work in all market environments. Knowing the limitations to what you are doing- whatever you’re doing- is critical. The ability to stick with your plan during the bad times will determine if you’ll be around for the good ones.

Copyright © The Irrelevant Investor