by David Merkel, The Aleph Blog

A few days ago, I was trying to buy a little bit of a defense company that I own for myself and clients. It was relatively inexpensive, and had fallen out of favor. Now, it’s not the most liquid beastie on the US market, so I put in an order to buy 2000 shares, while showing 100 shares, offering to buy at the current bid of $25.50 while allowing purchases at up to $25.57, while the ask was at $25.65. I then shifted away from my trading application, and went to do other work.

After an hour, I went back to my trading screen, and saw that 1200 shares had executed between $25.50 and 25.57, but now the price was much higher, and by the end of the day, higher still. It is even higher now.

At the time, I took a look, and lo and behold: I got the bottom tick — the lowest price on that stock ever (for now). I also noted that I had almost all of the volume when it went down to the low price. But 1200 shares is small compared to the total trading in the name, and $30,000 is also a small amount of money. I concluded that it was a happy accident that I got the bottom tick.

I’ve had the same experience working at a hedge fund. I would occasionally get the bottom tick when buying, or the top tick when selling, and most of the time I ended up saying that it had to happen to someone — it was us that day. That said, the total amount of volume was almost always low near the top or bottom, so getting that versus a trade nearby was not worth that much.

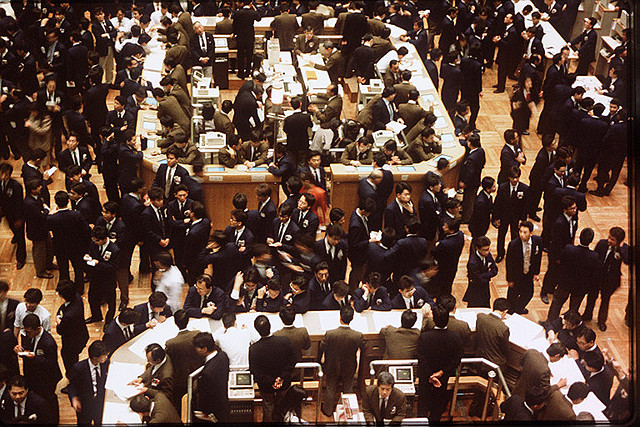

To have a lot of volume near a top or bottom, you need two or more determined and anxious traders with large capacity to trade, a need for speed, and opposite opinions. That happens sometimes, but in experience, not that often. Near a peak, you would need a buyer anxious to buy a lot more NOW. Near a trough, a seller wanting to sell it all NOW.

Most of the time, large institutional investors are cautious, and try to minimize their impact on market prices — being too aggressive will likely give them a worse result than being patient. The exception would be someone who thinks he knows a lot more than the market, but feels that edge will erode soon, and therefore has to do the trade in full NOW.

That doesn’t happen often. Practically, that means to not be so picky about levels in buying and selling. If you are getting the trade off and there is decent volume at a price near where you want to do the trade, do the trade, and don’t worry much about the small amount of profit that you might be giving up. Better to focus on ideas that you think have long term potential for profit, than to waste time trying to squeeze the last bit of profit out of a trade where incremental returns will be minuscule.

Copyright © The Aleph Blog