by Ben Carlson, A Wealth of Common Sense

Some of my writing and ideas here and on other media outlets have been called into question lately by some well-known trend following investors. I’m all about casting a skeptical eye on your own ideas because I think it’s important to be willing to admit your limitations, so I’m all about having a healthy debate. Challenging your own ideas is a huge part of the learning process. I’ll be the first one to admit there are no perfect strategies.

The main point of contention is that trend following is superior to many other forms of investing because it typically has lower drawdowns and lower volatility, therefore it comes with less risk. The problem with focusing on one or two risks within a portfolio is that there are always unintended consequences. Let’s take a look at managed futures to see where the potential risks lie beyond a decrease in drawdowns and volatility.

Managed Futures is a trend following strategy that trades futures contracts both long and short depending on the direction of the markets. The strategies are typically diversified across stocks, bonds, interest rates, commodities and currencies and follow a systematic approach. Also called CTAs (commodity trading advisors), these funds got a ton of attention following the 2008 crash because they were one of the few places to earn positive returns when stock markets around the globe sold off anywhere between 35-55%.

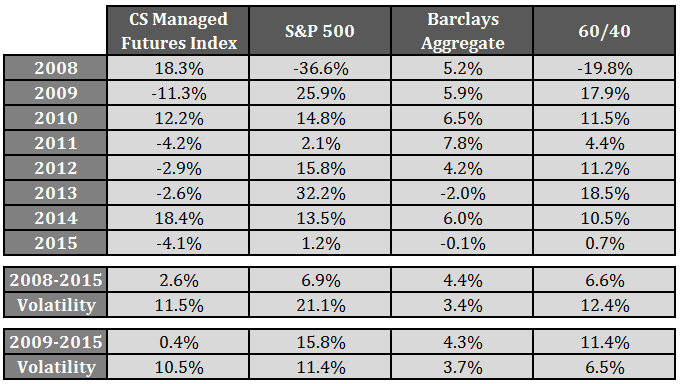

I looked at the Credit Suisse Managed Futures Index going back to 2008 and compared it to the annual returns on stocks, bonds and a 60/40 stock/bond portfolio through June of this year:

You can see why managed futures grew in popularity following the crisis. This particular index outperformed stocks by more than 50% in 2008 and beat a 60/40 portfolio by roughly 40%. Predictably, managed futures mutual funds exploded in AUM from around $200 million in 2007 to almost $2.5 billion by the end of 2009 as investors chased past performance.

Since then many CTAs have had a very difficult time keeping pace with the more traditional strategies. The numbers from 2009 show how tough it’s been for this group to generate competitive returns. It’s worth noting that the Credit Suisse index isn’t representative of all trend following strategies, but it does give you an idea about the struggles the space has endured following the crash.

Despite these numbers, I don’t think it makes sense to completely write off (or pile into) a strategy simply because it’s had a poor (or good) run over the past cycle. This is just one fairly short time frame. I’m all about intellectual honesty when discussing the markets. I don’t believe in disparaging someone else’s strategy just because I don’t invest that way. My motto has always been, ‘do what works for you, as long as it helps you reach your goals and allows you to sleep at night.’

Throughout my career I’ve researched, invested in, or closely tracked every different type of investment strategy imaginable. My conclusion? Value investing works. Momentum investing works. Trend following rules work. Index investing works. Diversified global asset allocation works. And all of them work much better for the majority of investors if they’re able to implement them in a rules-based, systematic way to be able to stay disciplined and follow the strategy over the long-term.

Many things work on paper, but not everything works for everyone in real life. You can’t fit a square peg in a round hole and expect every process to be a perfect fit for every investor. Some people won’t be able to stomach large losses in a stock-heavy portfolio. Others won’t be able to tolerate potentially missing out on huge gains during a booming bull market.

The biggest problem most investors face is that they invest in something like managed futures after they see the impressive results it had in 2008. Then they bail when it falters. Or they change their strategy to a low cost indexed buy and hold approach after seeing how well it’s done since 2009. Once again, many will bail during the inevitable down period.

Another thing I’ve learned in this industry is the importance to admitting that there’s more than one way to be successful in the markets. When I first started out the only thing that made sense to me was value investing. It probably took me far too long to come around to the fact that momentum works as well, but it’s impossible to ignore the facts.

The beauty of being intellectually honest about the different investment approaches is that you can create a portfolio that includes many or all of them if you’d like. I’ve found that this provides something of an emotional hedge from the problems that can come from being all-in on one strategy that you either can’t or won’t stick with. History has even shown that diversifying by strategy can also reduce volatility and increase returns from rebalancing.

Of course, this also means that you’ll always have part of your portfolio that’s lagging. Every strategy has risks. They may come in different forms, but there’s no way to completely insulate yourself from all types of risk if you wish to make money over time. People who tell you otherwise aren’t being intellectually honest with themselves.

Further Reading:

Why Buy and Hold Works

Why Momentum Works

Subscribe to receive email updates and my quarterly newsletter by clicking here.

Follow me on Twitter: @awealthofcs

My new book, A Wealth of Common Sense: Why Simplicity Trumps Complexity in Any Investment Plan, is out now.

Copyright © A Wealth of Common Sense