Trend Model signal summary

Trend Model signal: Risk-off

Trading model: Bearish (downgrade)

by Cam Hui, Humble Student of the Markets

The Trend Model is an asset allocation model which applies trend following principles based on the inputs of global stock and commodity price. In essence, it seeks to answer the question, "Is the trend in the global economy expansion (bullish) or contraction (bearish)?"

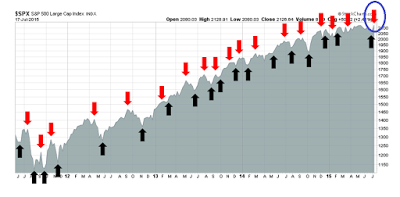

My inner trader uses the trading model component of the Trend Model seeks to answer the question, "Is the trend getting better (bullish) or worse (bearish)?" The history of actual out-of-sample (not backtested) signals of the trading model are shown by the arrows in the chart below. In addition, I have a trading account which uses the signals of the Trend Model. The last report card of that account can be found here.

Update schedule: I generally update Trend Model readings on my blog on weekends and tweet any changes during the week at @humblestudent.

After the euphoria, what next?

The trading model turned bullish last week, but I warned that the "trading model 'buy' signal flashed this week may turn out to be very short-lived, depending on how the market action develops" (see Back to our regular programming (of 2011)). Indeed, the SP 500 advanced 3.9% from an oversold oh-no-Greece-oh-no-China-the-world-is-going-to-end extreme to an overbought buy-buy-buy-Greece-and-China-are-solved reading in the space of seven trading days.

At these levels, it would be very difficult to get bullish in the short term and, indeed, the intermediate term picture has deteriorated rapidly for several reasons:

- Greece isn't fixed

- Neither are problems in China

- US fundamentals have turned a little wobbly

- Market internals look terrible

Greece’s public debt has become highly unsustainable. This is due to the easing of policies during the last year, with the recent deterioration in the domestic macroeconomic and financial environment because of the closure of the banking system adding significantly to the adverse dynamics. The financing need through end-2018 is now estimated at Euro 85 billion and debt is expected to peak at close to 200 percent of GDP in the next two years, provided that there is an early agreement on a program. Greece’s debt can now only be made sustainable through debt relief measures that go far beyond what Europe has been willing to consider so far.

According to IMF staff projections, the eurozone will either have to cough up a lot more than they ever expected to rescue Greece, or give them interest-free loans for the next 30 years.

The long-term problem of Greece in the eurozone can be summarized by Dany Bahar and Michael Kransdorff at the Brookings Institute, where they studied the competitiveness of Greek exports and productivity and concluded (emphasis added):

Greece’s productive know-how corresponds to a much lower GDP per capita, far below that of its peers, even after years of economic contraction. It effectively has an export basket with similar sophistication to that of Tunisia supporting a lifestyle like Sweden.

Conclusion: The good news is already in the market on Greece. There will be more drama and ups and downs of negotiations in the next few months. Expect the perception of Grexit to rise again.

China: Don't look at the stock market!

The gyrations of the Chinese stock market is mesmerizing, but I have urged readers to avoid paying attention to that market as it is not truly reflective of China's economy. Pay attention to the more important matter, which is the fact that Chinese economic growth is slowing.

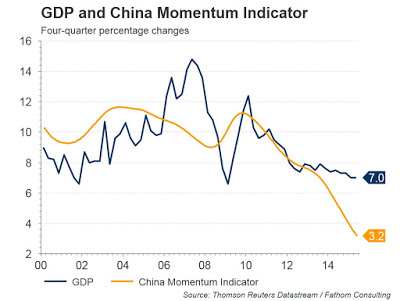

Last week, China report that its 2Q GDP growth came in at 7.0% and the report was greeted with disbelief. As an example of the many skeptical reports, Fathom Consulting estimated that its own growth estimate was closer to 3%, instead of the official 7%:

With its usual efficiency, China’s National Bureau of Statistics released its 2015 Q2 growth estimate earlier this week. Reportedly, GDP rose by 7.0% in the four quarters to Q2. We remain sceptical about the accuracy of China’s GDP data, and the speed with which they are compiled. Our own measure of economic activity — the China Momentum Indicator — suggests the current pace of growth is nearer 3.0%.

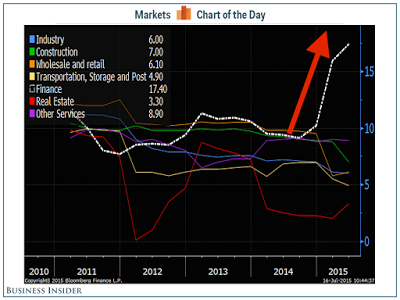

Who actually believes that 7.0% figure? To be sure, there were some "special effects" in that GDP growth report (via Business Insider):

Bloomberg's chief Asia economist Tom Orlik points out that the recent boom in the Chinese stock market boosted the financial sector, and caused it to grow at more than twice the growth rate of the whole economy.

The sector may have added a whopping 0.5 percentage point to the GDP print, according to Orlik.

As I have pointed out before, China has been a major engine of global growth and slowing growth will impact many of her trading partners. Here is William Pesek:

Singapore is the closest thing Asia has to an economic barometer. Its highly open, trade-reliant economy usually signals when trouble is approaching the global stage. And at the moment, Singapore is flashing clear warning signs.

The city-state's gross domestic product plunged 4.6 percent last quarter, a downturn almost certainly triggered by China. Singapore's plight may mark a dangerous inflection point not just for Asia, but for the entire global economy.

After the 2008 global crisis, China's 9-percent-plus growth picked up the slack from a West licking its financial wounds. But as Asia's biggest economy cools, officials from Seoul to Brasilia are finding themselves without a reliable growth engine. Uneven recoveries in the U.S. and Europe have already slowed the exports that power most Asian economies, including Japan. China's downturn could now throw Asian manufacturing into reverse.

The combination of slowing Chinese growth and Fed rate increase later this year could prove to be very bad news for many emerging market economies, such as South Africa and Brazil, as well as Asia. This is a key risk that does not appear to be fully discounted by the market.

US fundamentals looking shaky

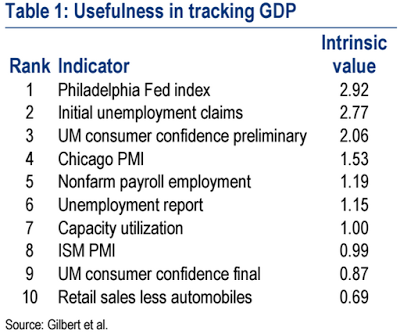

In the US, the economy seems to be stuck in second gear and starting to show signs of deceleration. The BoAML economist pointed to a study of the usefulness of economic indicators, based on their timeliness, revision noise and the relation to fundamentals (via Business Insider).

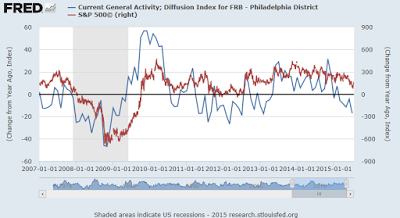

The top two indicators on that list is showing signs of slowdown. Here is a chart of the Philly Fed Index, whose YoY rate of change appears to be fairly well correlated equity returns - and the index is showing signs of deceleration.

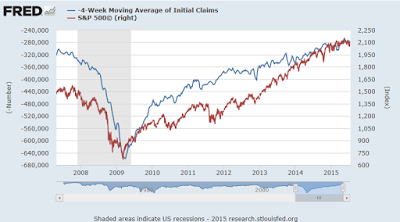

The second most important indicator, initial claims, is flashing signs that employment growth may be hitting its speed limit. (also see this analysis from New Deal democrat where he lays out the case that hiring is hitting a mid-cycle pause). Last week was the first week in four that initial unemployment claims have beaten expectations. As a reminder, this chart shows the high level of correlation between initial claims (in blue, inverted scale) and stock prices (in red).

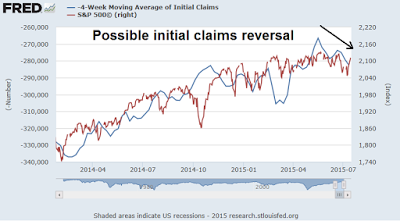

Here is a close-up of the above chart, which shows the worrisome uptrend trend in initial claims (recall the initial claims inverted scale where down=up).

The bottom line is changes in growth outlook impact sales and earnings, which drive stock prices. 2Q earnings season is just getting under way and results are coming in a tad below expectations. The latest report from John Butters of Factset shows that both the earnings and revenue beat rates are slightly below historical averages. More importantly, forward EPS estimates have begun to tick down again, which is worrisome as the direction of forward EPS estimates have been highly correlated with stock prices (chart annotations are mine).

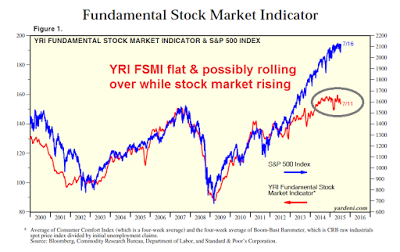

Ed Yardeni provided some confirmation of the fundamental weakness. The YRI Fundamental Stock Market Indicator, which is described as a coincidental indicator of stock market strength, has been flat in the past few weeks and may be rolling over, even as stock prices have risen (annotations are mine).

All of these possible negative macro and fundamental are highly preliminary, but they do serve as an advance warning of incipient weakness. As changes occur at the margin, further deterioration in macro and fundamental factors have the potential to depress stock prices.

Market internals are awful

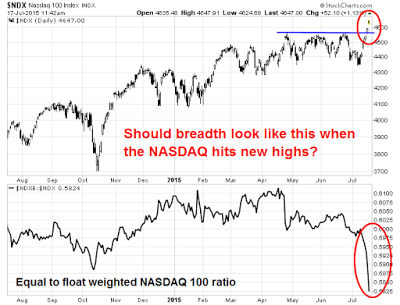

The technical picture of the US stock market is frankly awful. Even as the major indices advanced last week, I saw widespread instances of glaring negative divergences. On Friday, I tweeted the following chart of the negative breadth divergence in the NASDAQ 100:

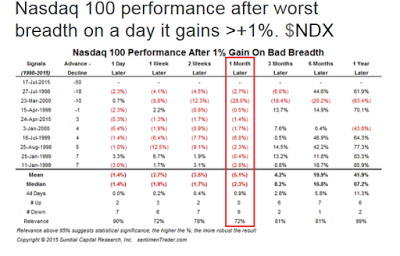

Jason Goepfert pointed out that the huge Friday NASDAQ advance was achieved on negative breadth, which has negative historical implications.

The SPX breadth picture wasn't much better. Even as the index advanced to test the old highs, the equal-weighted index dramatically underperformed the float weighted index, bullish percentage remained in a downtrend and the same could be said of SPX above their 200 dma. All of these are key indicators of non-confirmation of market strength.

In addition, credit market risk appetite was not improving. As the chart below shows, the relative price performance of junk bonds against Treasuries is showing a pattern of lower lows and lower highs even as stock prices rallied.

Sentiment models are mixed. Retail investor sentiment is pointing a crowded long. Mark Hulbert was at the San Francisco Money Show and he was disturbed by the number of greedy investors that he found there:

Here’s another straw in the wind that we’re close to a stock market top: Greed sells, while fear does not.

I draw this worrisome conclusion from this week’s San Francisco Money Show, where hundreds of investment gurus are giving workshops and seminars to thousands of investors. I count on the fingers of one hand the presentations dedicated to managing risk and how to avoid losses.

In contrast, there were numerous workshops catering to greed, with advisers enticing investors with the prospect of triple- and even quadruple-digit returns.

This is a worrisome situation, according to contrarians, because at market tops greed completely replaces fear as investors’ primary concern. (Disclosure: I am also speaking at the Money Show, focusing on a contrarian analysis of prevailing market sentiment.)

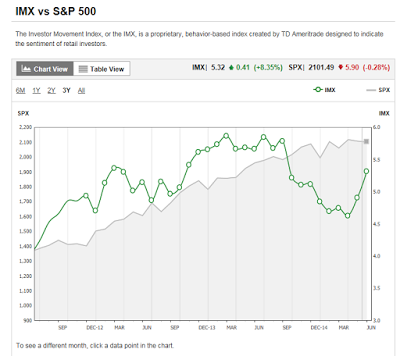

The latest TD-Ameritrade IMX index, which is a measure of TD-Ameritrade client activity, confirms rising individual investor bullishness as it showed that they have been buying stocks hand over fist:

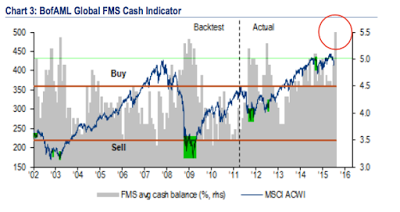

There was some excitement when the latest BoAML Fund Manager Survey showed a high cash level, which is contrarian bullish. However, Urban Carmel pointed out that an examination of manager sector weighting showed them to be overweight high-beta sectors and underweight defensive sectors. So call that result a wash.

Silver linings

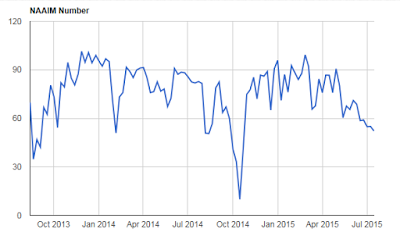

Despite these negatives, I could find a few silver linings in the dark cloud from other sentiment indicators. The latest survey of NAAIM managers, which consists of RIAs who mainly manage retail money, shows that their equity exposure is falling hard, which is contrarian bullish.

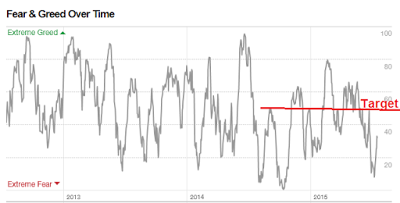

Despite the flaws in its construction, the CNN Money Fear and Greed Index is still showing a bearish reading. Stock prices may not be ready to stage a major retreat until this index gets back to at least a neutral level.

I interpret these readings as the market being overbought, but not sentiment models need to return to a more neutral condition before a sustainable drop can be seen.

The week ahead: More choppiness

Last week ended with SPY, the SP 500 ETF, rallying on falling volume and ended the week testing a key resistance level, RSI at either overbought levels or at resistance and VIX trading at a keys support.

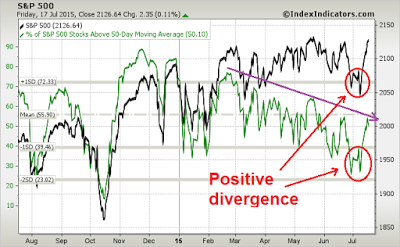

In the meantime, this chart from IndexIndicators shows that the market has screamed upwards and moved from an oversold to an overbought condition in a very brief period. Moreover, the tick down of the last couple of days in the net 20-day highs-lows is also indicative of the breadth deterioration that have I pointed out.

Notwithstanding the breadth divergences, which may not matter over a one-week time frame, these conditions are worrisome. The most obvious conclusion that I can draw is the market is likely to decline and retrace its gains in the week ahead. Even if you were bullish and believed that the market is likely to break out to new all-time-highs, it would be difficult to be buying here with so many overbought readings across the board.

This chart of the % of stocks above the 50 dma may outline a possible possible scenario that resolves the excessively fear readings in the Fear and Greed and other sentiment indicators.We see the deterioration even as the market advanced (purple line). A pullback and rally could see bullish sentiment improve, but see the mirror image of the positive divergence seen about a week ago (in red circles) of the indicator as the SPX grinds up again to test the highs again. If a pullback does emerge, then the bulls' first key test is holding the 50 dma at the about 2100 level.

Bottom line: Expect a near-term bearish bias early in the week but further market volatility in the days ahead. My inner trader took profits on his long positions last Wednesday and took a preliminary short position in the markets Thursday. He is staying flexible and waiting to see how the market reacts in the days ahead before taking on further commitments.

My inner investors remains calm and he has some dry powder so that he can pick up stocks at lower levels. There is minimal risk of a recession on the horizon and therefore a major bear market is highly unlikely.

Disclosure: Long SPXU

Copyright © Humble Student of the Markets