The BoC Cuts Interest Rates…Again

by Ryan Lewenza, CFA, CMT, Private Client Strategist, Raymond James

• In last week’s publication we highlighted the slowdown in the Canadian economy due in large part to the weakness in commodities. This very concern prompted the Bank of Canada (BoC) to lower the benchmark overnight rate again by 25 bps to 0.5%, following January’s surprise interest rate cut.

• The steep decline in oil prices continues to weigh on our economy. Previously, the BoC believed that the impact of lower oil prces would be front-end loaded, with the economy bouncing back in Q2/15. As economic data for the second quarter continued to disappoint, it became clear that the economy was not recovering in line with their expectations, and that more was needed to be done to combat the impact of lower oil prices.

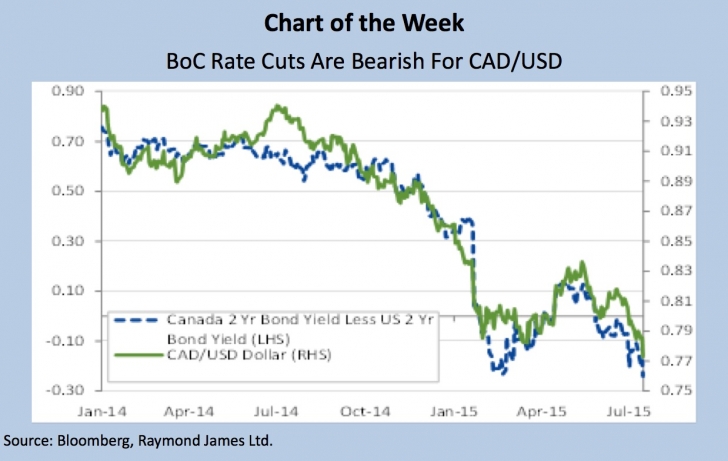

• The implications of the rate cut are: 1) the Canadian dollar declined by over a penny to $0.7744/USD ($1.2913/CAD) following the announcement. We believe that the Bank of Canada is targeting exchange rates on the Canadian dollar, attempting to drive it lower to help our exports sector. With our expectations for a widening divergence in monetary policies between Canada and the US, we believe the CAD will continue to decline; 2) Canadian benchmark bond yields declined in recent days, as the bond market began to price in the prospect of a rate cut. We believe the Canadian bond market will outperform the US bond market as the US Federal Reserve looks to hike rates later this year; 3) the housing market could get a boost from this rate cut, however the impact is likely to be muted as the Canadian banks did not follow through with a commensurate decline in prime lending rates; and 4) with the average Canadian consumer already maxed out with household debt to income at a record 166% we believe the appetite for further credit is limited.

Read/Download the complete report below:

Copyright © Raymond James