by James Picerno, Capital Spectator

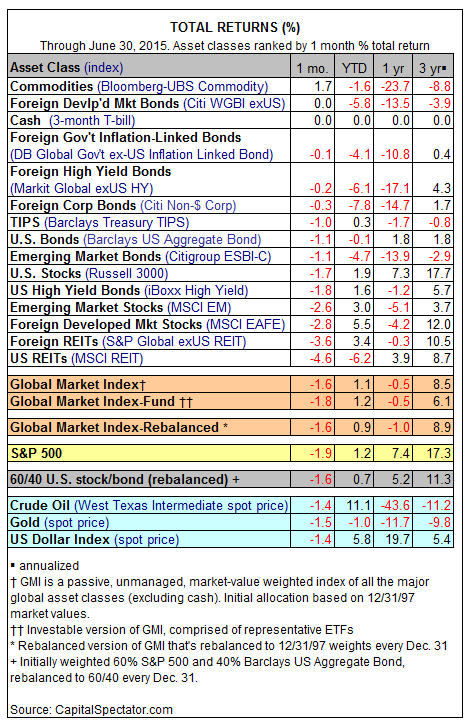

The markets staggered to the year’s midpoint with a thud, with most of the major asset classes suffering losses in June. The exception: broadly defined commodities (Bloomberg Commodity Index), which posted a modest 1.7% gain last month. The rest of the field was either flat or (in most cases) in the red. The big loser: US real estate investment trusts (REITs), which shed a hefty 4.6% in June, based on the MSCI REIT Index, leaving this measure of securitized real estate off by more than 6% so far in 2015.

The creeping incidence of losses in recent history continues to take a toll on the Global Market Index (GMI), an unmanaged benchmark that holds all the major asset classes in market-value weights. GMI slumped a hefty 1.6% last month, paring its year-to-date gain to a thin 1.1%. US stocks (Russell 3000) were also clipped in June, suffering a 1.7% setback, which translates to a mild 1.9% rise for the first half of the year.

Are the weak returns for GMI a surprise? No, not really. The Capital Spectator’s monthly risk premia forecasts (see June’s update, for instance) have been quite soft lately—dramatically so relative to the stellar results in recent years. Although GMI’s 3-year, 5- and 10-year annualized trailing returns are still quite lofty relative to the expected performance, the crowd is inclined to squeeze the gap these days.

Copyright © Capital Spectator