Photographs by William Green

by Michael O'Brien, via The Observer

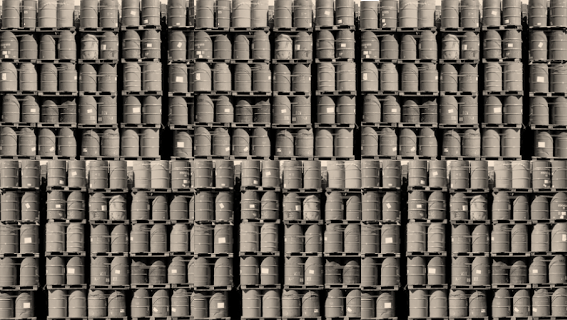

As an undergraduate at Wharton in the 1960s, Howard Marks stumbled upon one of the guiding principles of his life — the Buddhist concept of mujo. In his Japanese studies course, mujo was defined as “the turning of the wheel of the law.” Marks explains: “Change is inevitable. The only constant is impermanence…. We have to accommodate to the fact that the wheel turns and the environment changes.” This constant flux applies not only to human lives but economies and markets. “It’s very helpful to view the world as behaving cyclically and oscillating rather than going in a straight line. Everything is cyclical.”

“You can’t control the environment,” Marks adds. So the key is to recognize how it’s changing, accept it, and respond as wisely as possible. “The screwiest thing you can do is to think you’re a Master of the Universe. We’re all just little cogs, and the universe will go on without us. We have to fit into it and adapt to it.” For example, at the time of our interview in late 2014, he sees scant investment opportunity and excessive complacency: “What bigger mistake could there be than to think you can safely get high returns in a low-return world?” Investors should adjust by assuming less risk and lowering their expectations. He cites a favorite quote from Peter Bernstein: “The market’s not a very accommodating machine; it won’t provide high returns just because you need them.”

Returns in areas such as distressed debt and junk bonds have brought Marks a fortune that Forbes estimates at $2 billion.

This kind of rational, clear-headed analysis has served Marks well. Since he co-founded Oaktree Capital Management in 1995, it’s grown into an alternative investment behemoth with more than $90 billion under management. Its stellar returns in areas such as distressed debt and junk bonds have brought Marks a fortune that Forbes estimates at $2 billion. His New York apartment cost $52.5 million. As Oaktree’s Chairman, Marks oversees its investment strategy and reigns as its philosopher king. His memos to investors have earned a devoted following, as has his classic book, The Most Important Thing: Uncommon Sense for the Thoughtful Investor. One fan, Warren Buffett, wrote: “When I see memos from Howard Marks in my mail, they’re the first thing I open and read. I always learn something, and that goes double for his book.”

Sitting opposite Marks in his corner office on the 34th floor of a Manhattan skyscraper, you sense that you’re in the presence of a most superior machine. His manner is polite and pleasant, but there’s an intellectual intensity and precision in everything he says. He’s a gifted moneymaker, but he’s primarily an original thinker who relishes expressing ideas that others haven’t considered.

A turning point in his intellectual life came when he learned about the efficient market hypothesis as a graduate student at the University of Chicago. This sparked a “moment of enlightenment” — a capitalistic version of Zen satori. It’s tough to find bargains in a widely-followed market, he learned, so he should focus on less efficient niches where hard work and skill were more likely to pay off. In 1978, he launched a fund at Citibank that invested in junk bonds at a time when most investment firms thought them too risky to own — a “powerful bias” that produced marvelous inefficiencies. Likewise, in 1988, he and his longtime business partner, Bruce Karsh, created a distressed debt fund at TCW, profiting from the perception that it was “disreputable” to buy the debt of bankrupt companies.

Marks has a talent for gauging crowd psychology and adopting what David Swensen once dubbed “uncomfortably idiosyncratic” positions. Marks turned cautious well before the credit crisis exploded in 2008, recognizing that too many reckless deals were getting done. Then, when Lehman Brothers collapsed, he wrote a memo explaining his assumption that this wasn’t “the end of the financial system” but “just another cycle to take advantage of.” As he wryly put it, “Most of the time, the end of the world doesn’t happen.” Oaktree invested about $500 million a week as the market crashed — and made a fortune as it revived.

Marks says he doesn’t find it stressful to go against the crowd: “To be the person who steps onto the exchange floor in 1929 and says, ‘I buy,’ you have to be unemotional.” When I ask the twice-married investor if this lack of emotion drove his wives crazy, he replies: “Yeah, especially my first wife. I think I’ve done a better job with it more recently.”

Marks says he doesn’t find it stressful to go against the crowd: “To be the person who steps onto the exchange floor in 1929 and says, ‘I buy,’ you have to be unemotional.” When I ask the twice-married investor if this lack of emotion drove his wives crazy, he replies: “Yeah, especially my first wife. I think I’ve done a better job with it more recently.”

For all his success, Marks is wary of hubris and talks repeatedly of the need for humility. While acknowledging the importance of intelligence, diligence and perseverance, he believes luck has played an equally crucial role in his life. He attended the University of Chicago only because Harvard rejected him. He would have worked at Lehman, but the partner assigned to inform him that he was being hired had a hangover and failed to call him. He even regards his birth in 1946 as a middle-class American baby boomer with a high I.Q. as evidence of his demographic and genetic good fortune. “I’m a big believer in randomness,” he says. “I walk around with this incredible feeling that I’m a lucky guy.”

Excerpted from The Great Minds of Investing, a new book featuring profiles by William Green and photographs by Michael O’Brien. Available on Amazon.com.

Read more at http://observer.com/2015/06/howard-marks-the-uncomfortably-idiosyncratic-billionaire/#ixzz3eAZOVHhF

Follow us: @newyorkobserver on Twitter | newyorkobserver on Facebook