by Michael Batnick, The Irrelevant Investor

With interest rates near all-time lows, the future viability of a classic 60/40 portfolio is something people are starting to think about. With the benefit of a massive bond bull market, is a sixty forty portfolio merely a product of recency bias? Will investors counting on this type of portfolio be sorely disappointed with returns going forward?

Cullen Roche shared some of his thoughts:

“60/40 strikes me as particularly interesting at this time because it’s benefited tremendously from the greatest bull market in the history of bonds. After all, the bond aggregate has generated 7.4% returns in the last 35 years with a standard deviation of just 5.5. That’s relative to the stock market which generated 10.4% returns with a standard deviation of 18. It’s no wonder that 60/40 looks so good in backtests.”

Cullen makes some valid points and the back tested results of a 60/40 portfolio do look very good indeed. With fed fund rates topping out at just over 19% in 1981, interest rates were given a huge runway to fall, lifting bond prices for longer than many people thought possible. Now after six years of zero rates and possibly a return to normalcy, it makes good sense for investors to think about how this might affect their investment plan.

The Barclays Aggregate Bond Index (the forty percent) was created in 1976 so to bring in more data I reconstructed a 60/40 portfolio going back to 1926. I used CRSP (1-10) to represent the sixty percent in equities and for the bond piece, I used one-month T-Bills, five-year notes, long-term corporate bonds and long-term government bonds (3%, 5%, 12%, 20%). From 1976-today, this portfolio was had a correlation with the 60/40 portfolio of .985. Not perfect but good enough.

As we already know, the returns since 1976 have been very good for investors. Looking at rolling ten-year periods, the average return was 10.59%. I then looked at 1926-today. The average rolling ten-year return was 8.82%, not too shabby. Then finally, I excluded the returns from the great bond bull market to see what “normal” returns might look like. From 1926-1980, the average ten-year rolling return from a 60/40 portfolio was 7.10%, also not so terrible.

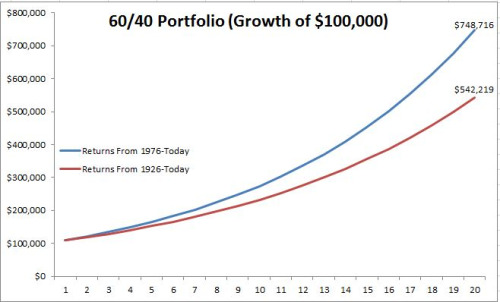

Being that 90% of bond returns come from their starting yield, and knowing that current yields are so low, reigning in one’s expectations probably isn’t a bad idea. In fact, that’s never a bad idea. After all- and this is far from an exact science- the 1.7% difference between 1926-today and 1976-today might sound trivial, but it can have large impacts on the growth of your portfolio. Look what the difference of 1.7% does to a portfolio after twenty years.

The unfortunate reality is that this data doesn’t even go back a hundred years. Furthermore, in the 89 years that we do have, the United States has been one of the best places in the world to invest. Who can say if that will be the case over the next hundred years? That being said, the data is what it is and I do think there is some merit to looking at it, especially if your focus is on how wide the variations in returns are. A 60/40 portfolio returned less than 3% in five percent of the rolling ten-year periods since 1926. There were five separate ten-year periods where returns were less than 1%! Anything is possible and expecting above average or even average returns can set yourself up for massive disappointment and a potential shortfall when retirement rolls around.

So what should investors do? A few options:

1) Try and find a way to generate higher returns.

2) Find someone who tells you they can generate higher returns (definitely don’t do this)

3) Factor in more conservative returns when planning for retirement.

4) Spend less/save more.

5) Diversify, “there are other worlds than these”.

If we can help with your investments, feel free to reach out.

Copyright © The Irrelevant Investor