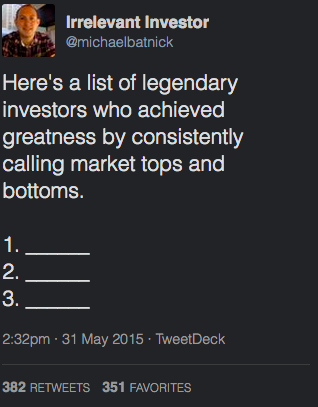

While the message in the tweet below clearly resonated with a lot of people, there are a few who were less than enamored with it. These naysayers were quick to remind me of the existence of Druckenmiller, Soros or Paul Tudor Jones.

PTJ said “I believe the very best money is made at the market turns. Everyone says you get killed trying to pick tops and bottoms and you make all your money by playing the trend in the middle. Well for twelve years I have been missing the meat in the middle but I have made a lot of money at tops and bottoms.”

Fine, let’s take him at face value and assume that he actually did build an empire by calling tops and bottoms. And let’s assume that Druck and Soros did the same. That’s three people! Three! When something is 99.99999% true, I don’t think a caveat is necessary.

There is another person (outside the world of money management) that people often point to as having a pretty good eye for spotting irrational behavior is Bob Shiller. Shiller is a giant in the field, winning a Nobel Prize for his work. However, I wonder how seriously he takes his own advice. I could be wrong but I’m gonna go out on a limb and say he does not make radical changes to his portfolio (assuming he manages it) in an effort to avoid major tops. While Professor Shiller does deserve credit for identifying the euphoric behavior of the tech and credit bubbles, he was so early that this insight would have been fairly useless to investors.

On Masters in Business, Barry had a terrific conversation with Richard Thaler, professor at the University of Chicago and the father of behavioral economics.

They were chatting about bubbles. Do they exist, can people call them in real time, etc. Here is some of the conversation (emphasis mine).

Ritholtz: “Bob (Shiller) has had a pretty good run”

Thaler: “No, no, no. Look Bob is my buddy for twenty-five years. He was warning…when did he give the speech to Alan Greenspan? 1996. Four years early..by 1998 his hair was on fire…

Ritholtz: “Well he was pretty dead on with the housing”…

Thaler: Uhhh again, ya know again, he started warning that housing prices are looking pretty scary, especially in places like Vegas and Scottsdale, but they kept going up for a couple more years. So Gene’s (Fama) right that calling tops and bottoms, there’s nobody who’s good at that.

There’s nobody who’s good at that, yet so many people spend far too much time worrying about market tops. I have no way of proving this but I’d bet there are a lot of people that have been on the sidelines for months and years now, waiting for a better entry point. I’m not saying that entries and exits don’t affect your long-term investing results, of course they do. Unfortunately, the reality is that you’ll never know in advance when the optimal time comes. Will the highest twenty-year returns be achieved by those starting today, next year, in three years?

In Ben Carlson’s excellent new book, he talks a lot about this. “If you bought at the top of the Market in September 1929 and held on until 1960, your return would have been 7.8 percent per year. If you had the nerve- or capital left- to buy in June 1932, after the 85 percent plunge in stocks and held on until 1960, you would have earned 15.9 percent per year.”

So while going all in at the bottom would have delivered phenomenal returns, buying at the worst top of all-time wasn’t exactly crippling. In fact, for me personally, I would be thrilled to receive an 865% return over the next thirty years.

Most people have a multi-decade investment horizon. I’m not saying that you have to set it and forget it, but I am saying that you can and should forget about joining Paul Tudor Jones in the pantheon of great market timers. The good news is that your ability to call tops and bottoms has absolutely nothing to do with you being a successful investor. In fact, the less of this you do, the more successful you’re likely to be.

Follow me on Twitter