by Corey Hoffstein, Newfound Research

We’ve waxed philosophical about currencies in the past, but we received a request to add some more color. Off the backdrop of the U.S. dollar hitting a 13-year high against the yen this week, it seemed timely.

Coverage of the new high highlighted an important and unique aspect about investing in currencies: buying one leg of the trade necessarily means selling the other. The high is just as much about U.S. economics as it is Japanese economics.

But a “strong dollar” does not exist in isolation. The dollar can only strengthen against another currency. The best we can get if we want to “invest in the dollar” is to invest in a broad basket of U.S. dollar currency-pairs, helping to diversify the idiosyncratic risks of the other currencies.

The negative aspect to this diversification is that a broad dollar-strengthening cycle requires an argument for the dollar to strengthen against all currencies. Yet 2015 may see that very confluence. Consider the argument for the dollar:

- Against foreign developed: With the Fed contemplating a fall rate hike and zero interest rate policies in full effect around the globe, we can expect to see an inflow of foreign assets buying U.S. Treasuries for their post-hike increased yield profile. To buy Treasuries, foreign investors will first have to buy the dollar. This is the old dollar/yen carry trade but played out on a global scale.

- Against commodity block currencies: Because commodity markets operate in dollars, global commodity producers (e.g. Australia, Norway, Canada) must convert their dollar-based sales back into local currencies to meet their liabilities. This creates constant downward pressure on the dollar and upward pressure on local currencies. However, lower commodity prices and volumes have reduced this pressure.

- Against emerging markets: As rates rise in the U.S., investors will have to re-evaluate as to whether the risk/reward tradeoff remains favorable enough to stay invested in emerging market assets. This is where the recent yen devaluation could be critical – and well worth keeping an eye on – as it could push the fragile Chinese economy into a recession as the competitiveness of China’s products worsens in the global market.

At the very simplest, the dollars strengthens when global demand for (supply of) dollar-based goods increases (decreases) against non-dollar-based based substitutes. Here, we can think of our three goods as “U.S. Treasury yield,” “short commodities,” and “economic risk.”

With broad commodity indices down over 30% in the last year, pressure against the dollar from the commodity block currencies has already been reduced. A sequence of rate hikes in the U.S. could be a tremendous catalyst for further growth in the dollar. Which may, in turn, make a position in the dollar a great hedge against rising rates. Unfortunately, this analysis all comes off the back of a tremendous run in the dollar over the past year. Has the trade run its course? Only if foreign investors have already started converting to U.S. dollars in preparation of grabbing post-hike Treasuries.

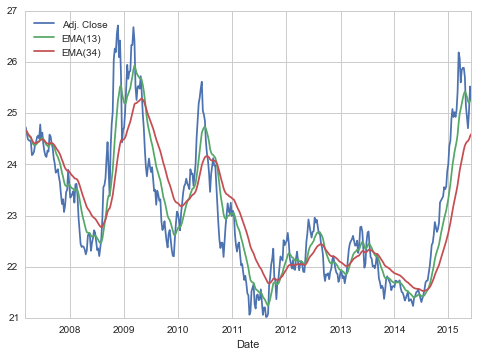

Below we plot the price of the PowerShares DB US Dollar Bullish ETF (UUP). UUP is up just over 5.5% year-to-date and nearly 17% in the past year.

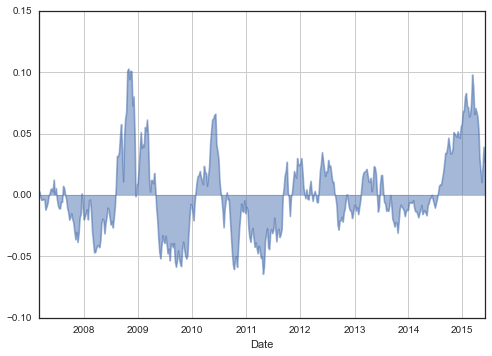

So while the fundamental view may be pro-dollar, timing will be critical for success. As always, we prefer to trade with the trend. We can see that despite the strong recent run, the trend still remains positive (we can see that the 13-week EMA is above the 34-week EMA). On the right we’ve also plotted the %-distance of price from its 34-week EMA, helping us quantify how extended price is from its long-term trend. We can see that despite pushing up against 10% in the heat of the rally, it has since consolidated to more normal levels.

At Newfound we do not make these sorts of trades, nor do our models contain any explicit currency- related positions. Nevertheless, currency fluctuations can play a critical role in dollar-based foreign equity returns and we believe that understanding the current – and potential future – sources of returns is critical for risk management.

With a potential rate hike around the corner, all eyes are on bonds. We think it is worthwhile to consider the second and third degree effects that hike may have on the dollar and dollar-based foreign asset portfolios.

In our Models

Our Tailwinds Growth model rebalanced this week to align with recent accrued changes within our Multi-Asset Income portfolio. Therefore, the majority of the changes happened within the Multi- Asset Income sleeve of the portfolio.

Most significantly, we increased our exposure to bank loans while reducing our exposure to preferreds, mortgage REITs, and corporate bonds. We also eliminated our exposure to corporate bonds and our small exposure to 20+ Year US Treasuries due to waning momentum strength.

Copyright © Corey Hoffstein, Newfound Research